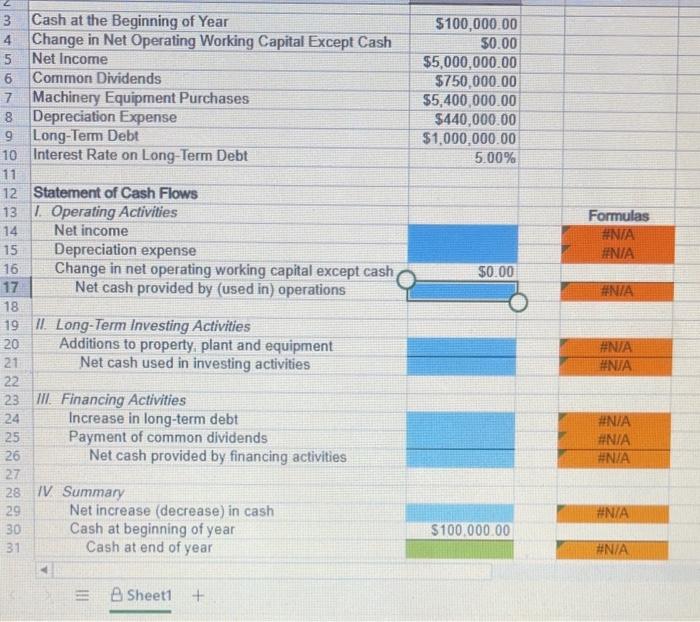

Excel Online Structured Activity: Statement of cash flows You have just been hired as a financial analyst for Barrington Industries. Unfortunately, company headquarters (where all of the firm's records are kept) has been destroyed by fire So, your first job will be to recreate the firm's cash flow statement for the year just ended. The firm had $100,000 in the bank at the end of the prior year, and its working capital acus except cash remained constant during the year. It samed $5 million in net income during the year but maid $750,000 in dividendis to common shareholders. Throughout the year, the firm purchased $5 million of machinery that was needed for a new project. You have just spoken to the firm's accountants and learned that anual depredation expense for the year is $440,000; however the purchase price for the machinery represents addition to property, plant, and equipment before deciation. Finally, you have determined that the only financing done by the firm was to issue long-term det of $1 million at a 5% interest rate. The data has been collected in the Microcul Of below. Open the spreadsheet and perform the required analysis to answer the question below. X Opera what was the firm's end-of-year cash tstance? create the firm's cash flow statement to arrive at your answer write out your answer completely. For example 5 million should be entered a 5.000.000 Fund your answer to the cat dollar, if necessary $100,000.00 $0.00 $5,000,000.00 $750,000.00 55,400,000.00 $440,000.00 $1,000,000.00 5.00% Formulas #N/A #N/A $0.00 3 Cash at the Beginning of Year 4 Change in Net Operating Working Capital Except Cash 5 Net Income 6 Common Dividends 7 Machinery Equipment Purchases 8 Depreciation Expense 9 Long-Term Debt 10 Interest Rate on Long-Term Debt 11 12 Statement of Cash Flows 13 I. Operating Activities 14 Net income 15 Depreciation expense 16 Change in net operating working capital except cash 17 Net cash provided by (used in) operations 18 19 II . Long-Term Investing Activities 20 Additions to property, plant and equipment 21 Net cash used in investing activities 22 23 III Financing Activities 24 Increase in long-term debt 25 Payment of common dividends 26 Net cash provided by financing activities 27 28 IV Summary 29 Net increase (decrease) in cash 30 Cash at beginning of year 31 Cash at end of year #NIA #N/A #N/A #N/A #N/A #N/A #N/A $100,000.00 #N/A Sheet1 +