Answered step by step

Verified Expert Solution

Question

1 Approved Answer

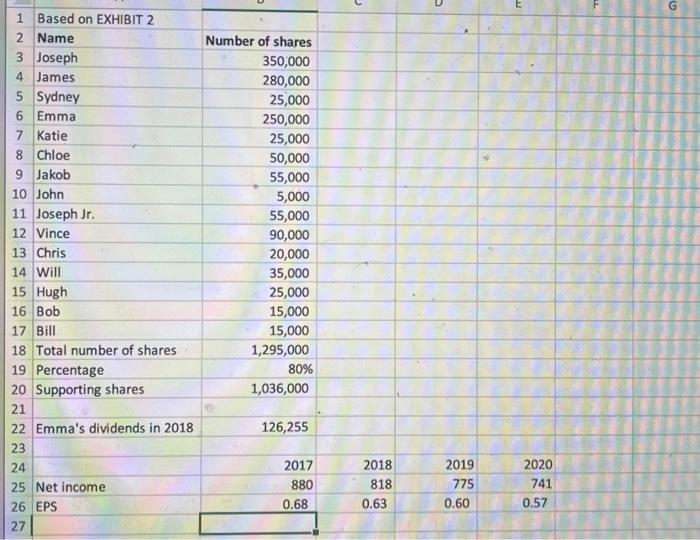

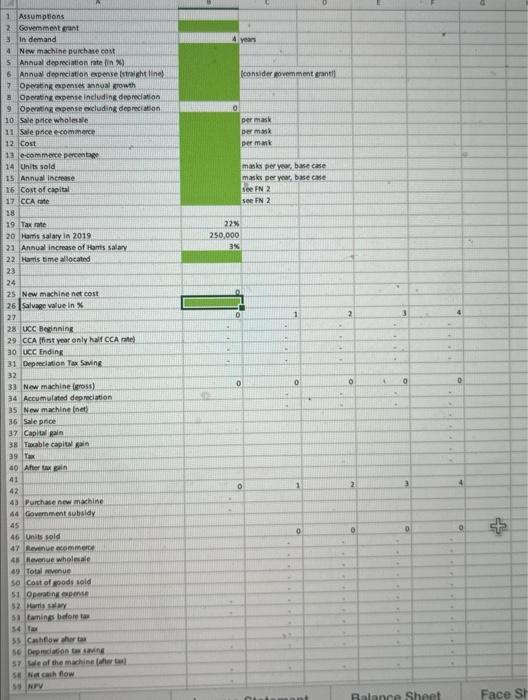

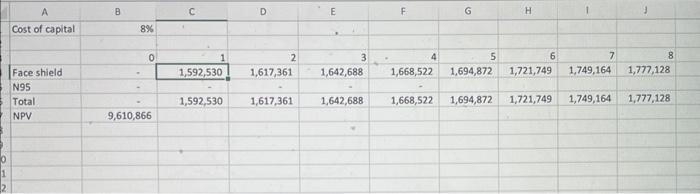

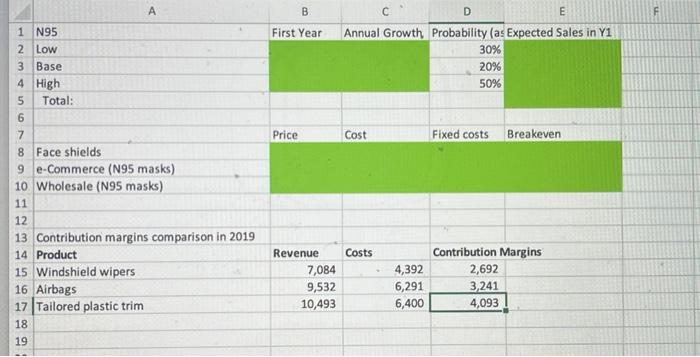

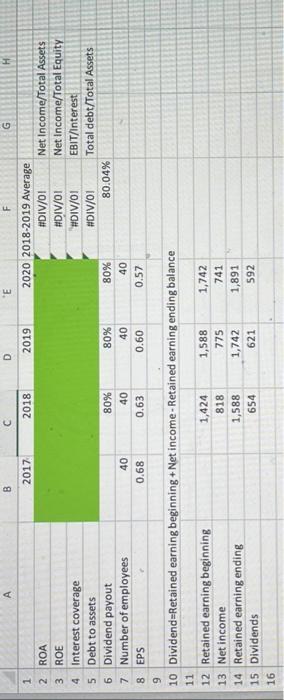

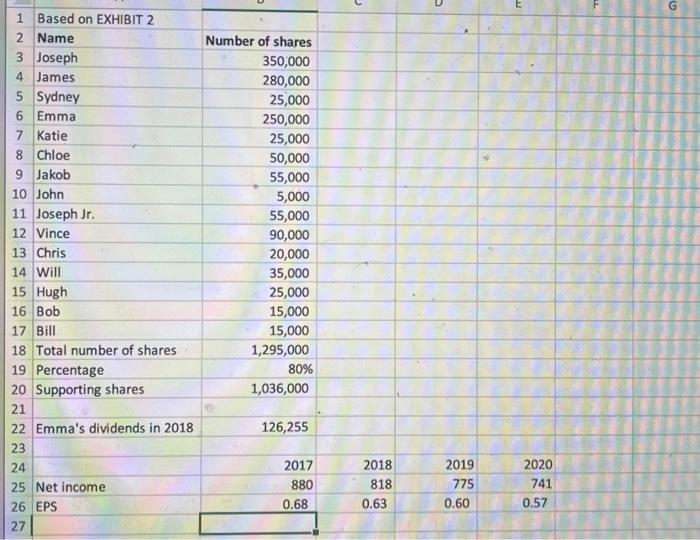

Excel photos have the required information to complete the questions. begin{tabular}{|c|c|c|c|c|c|} hline 1 & Based on EXHIBIT 2 & : & & & hline

Excel photos have the required information to complete the questions.

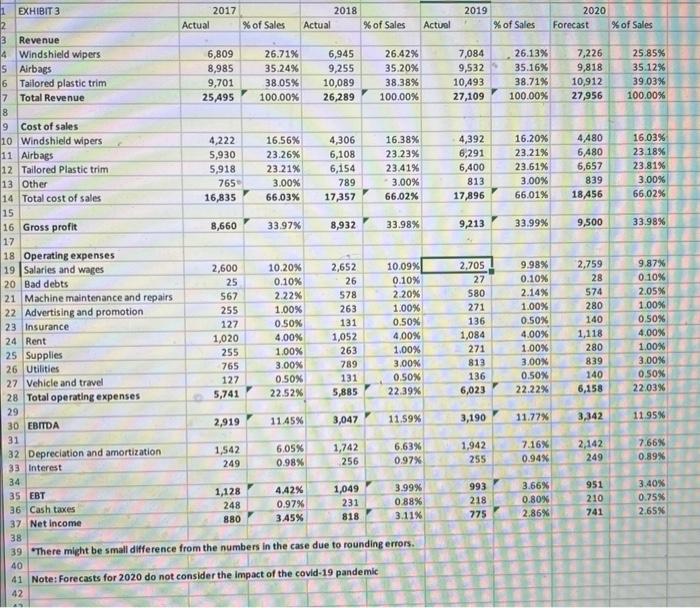

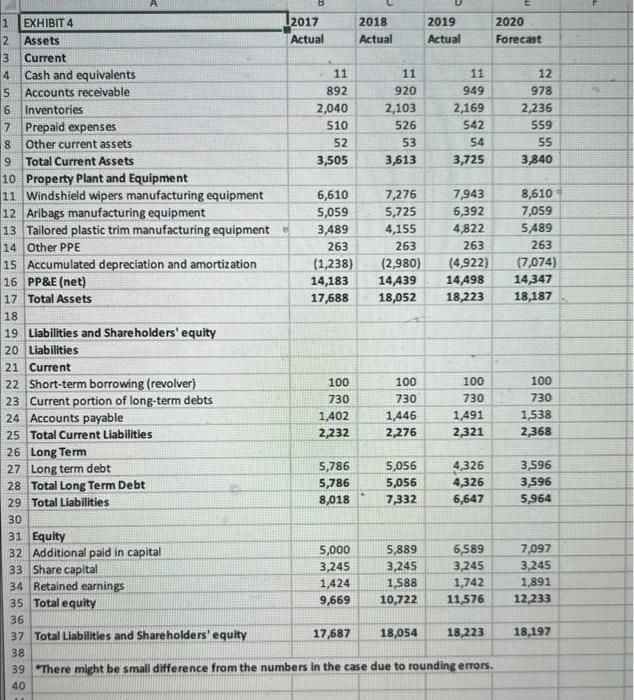

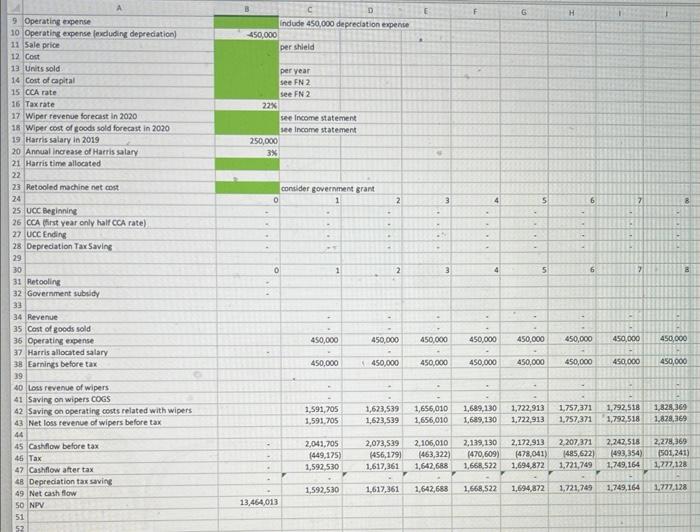

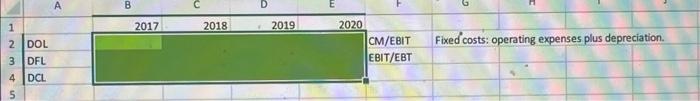

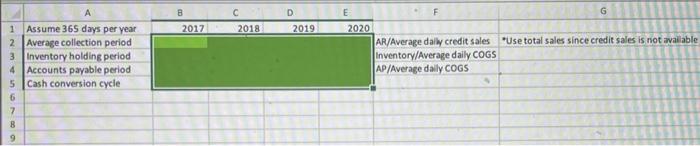

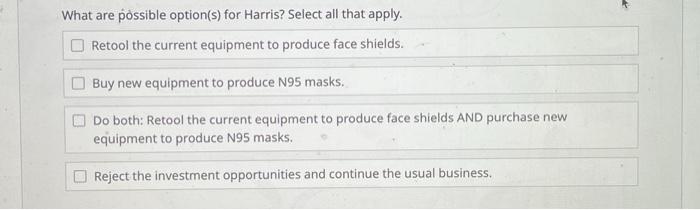

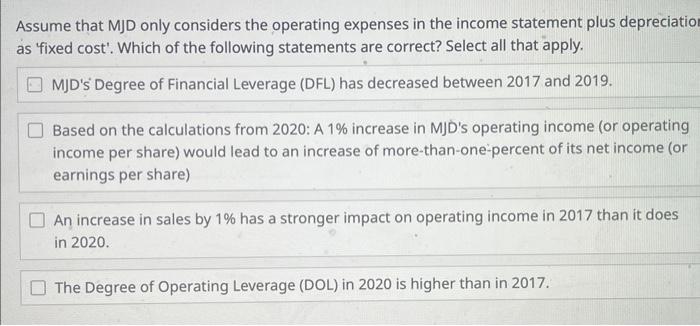

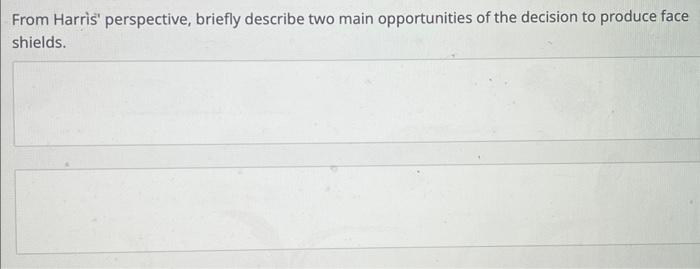

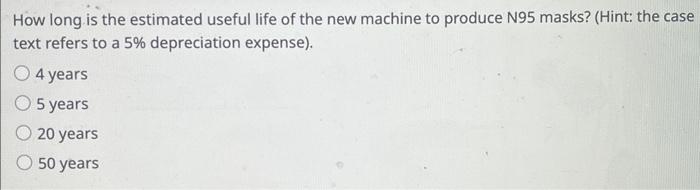

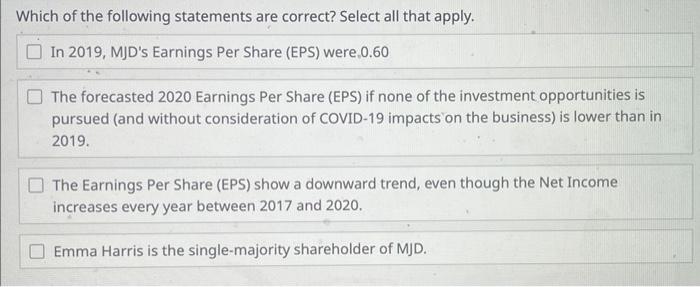

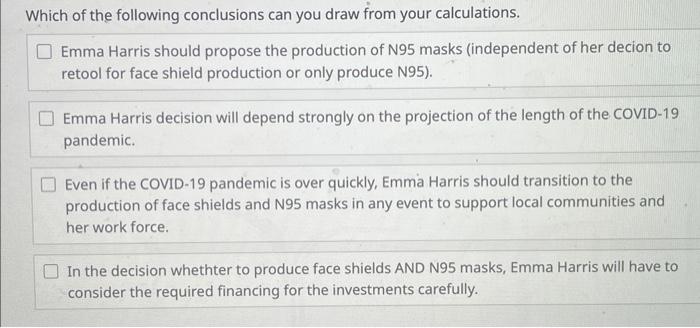

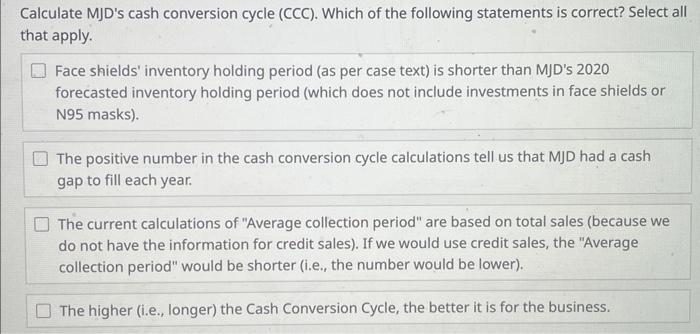

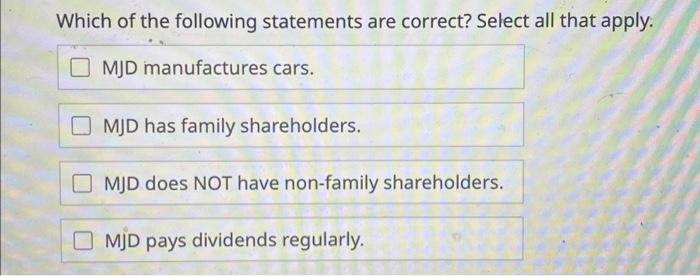

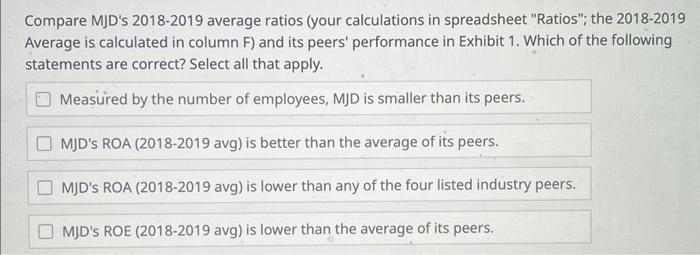

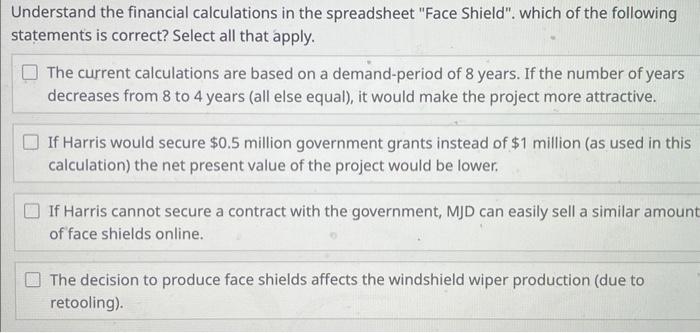

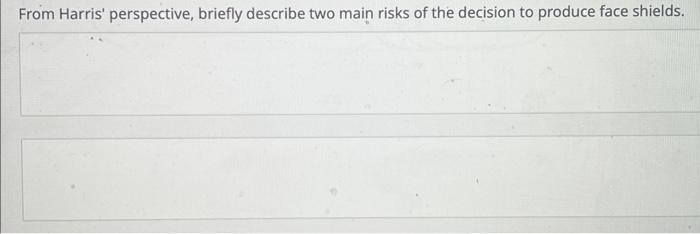

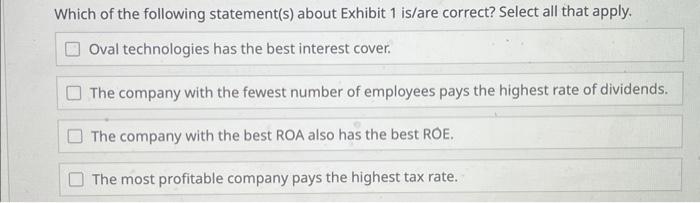

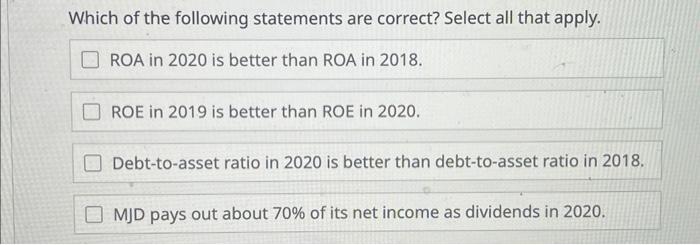

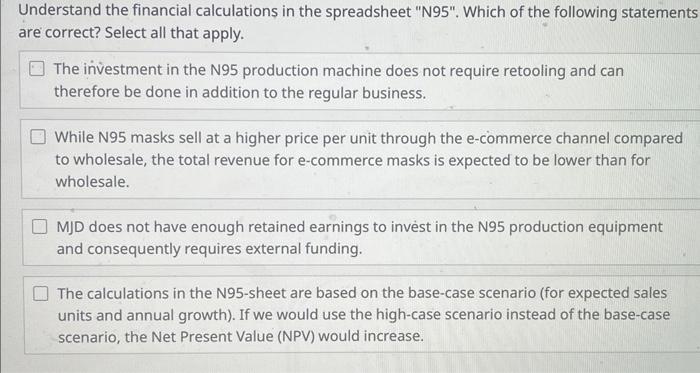

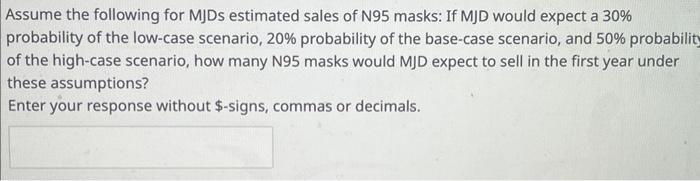

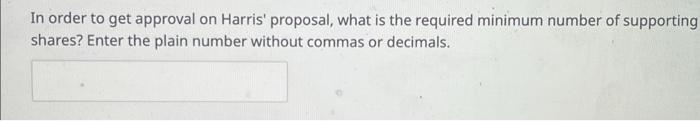

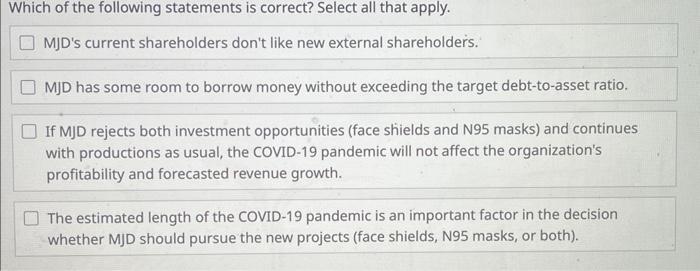

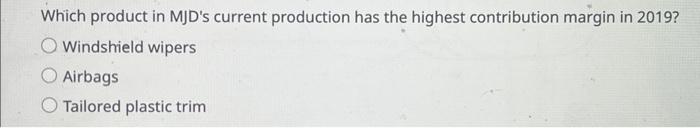

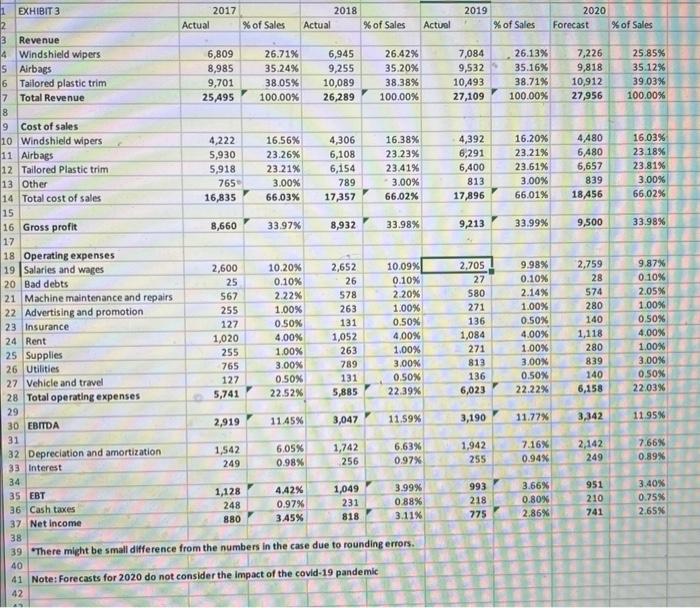

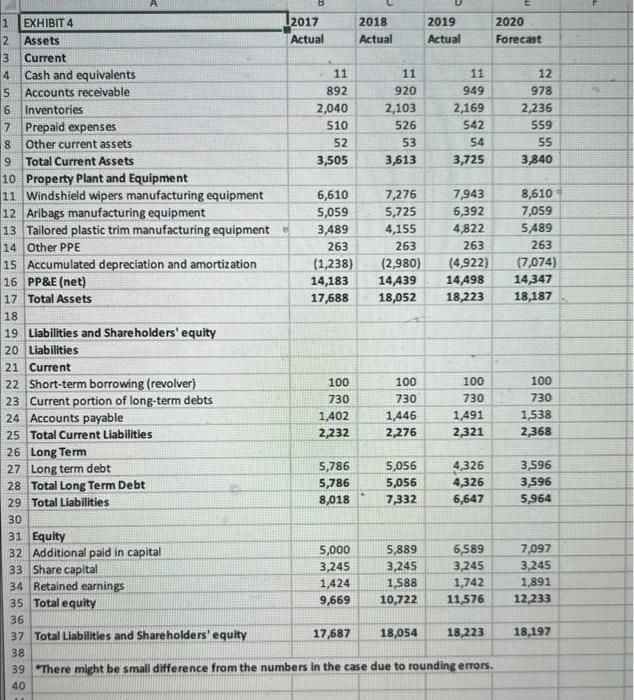

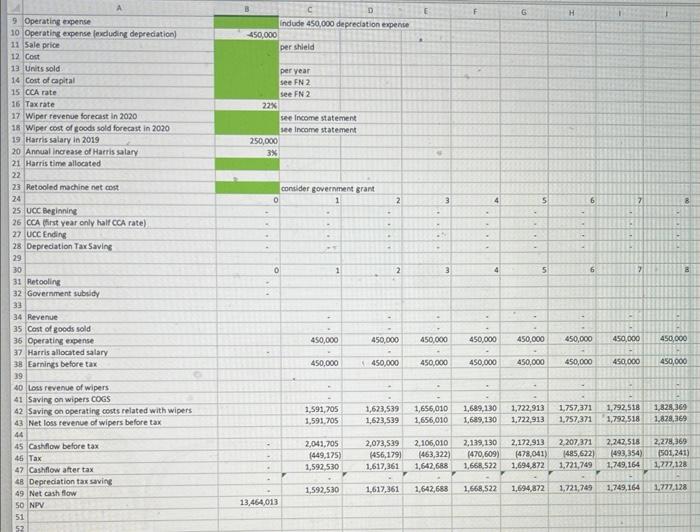

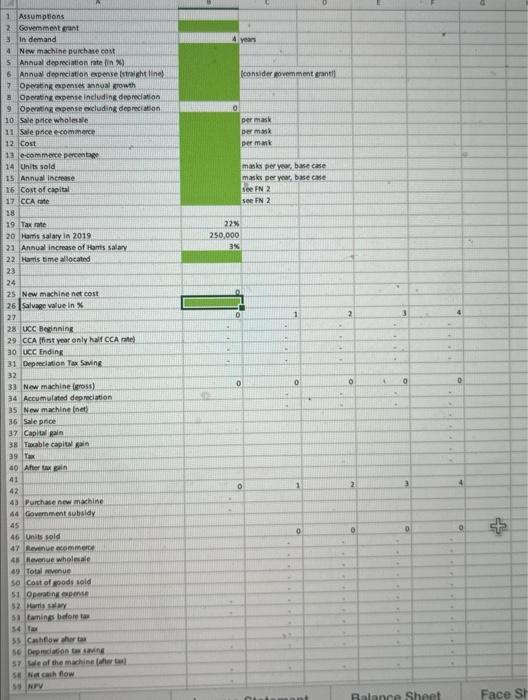

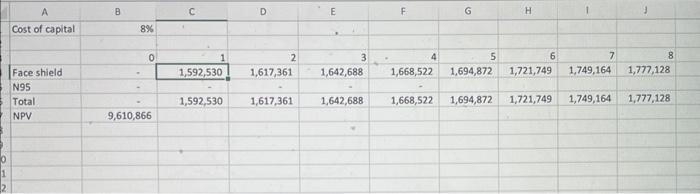

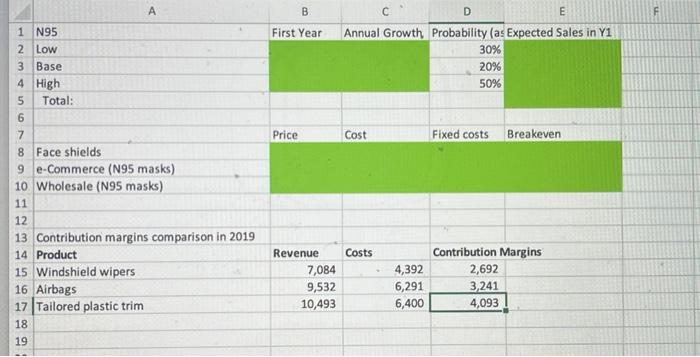

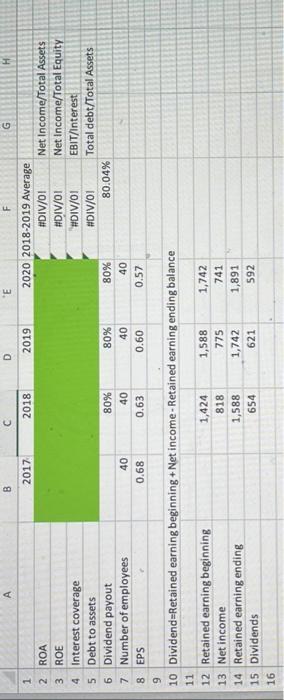

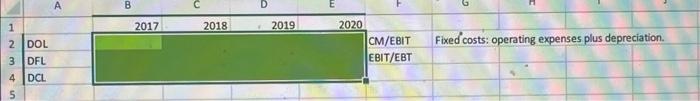

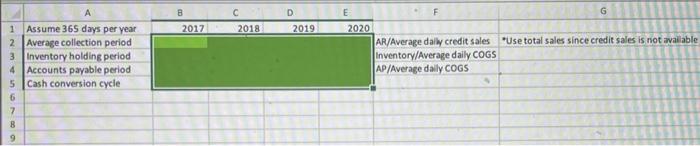

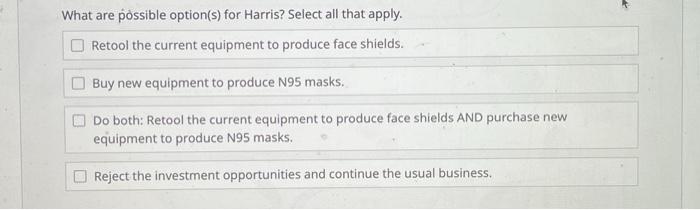

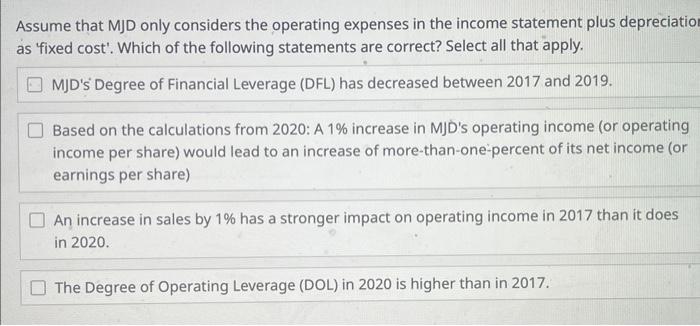

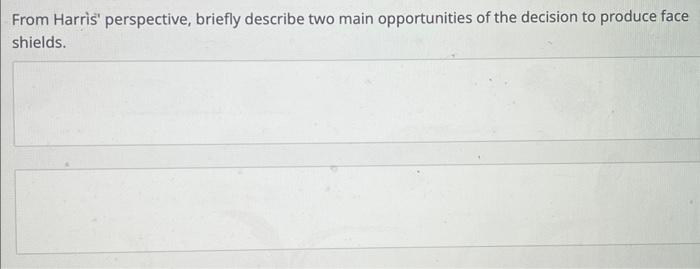

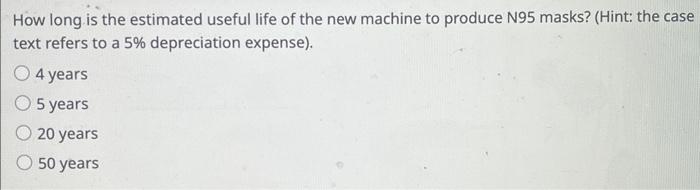

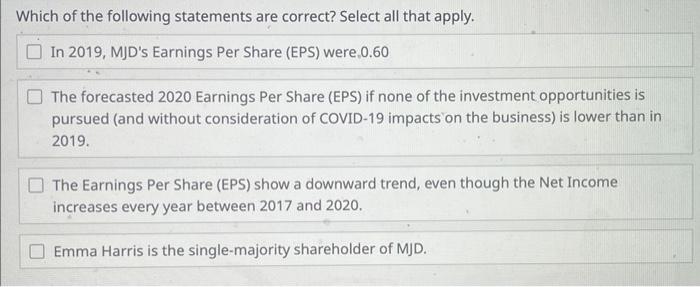

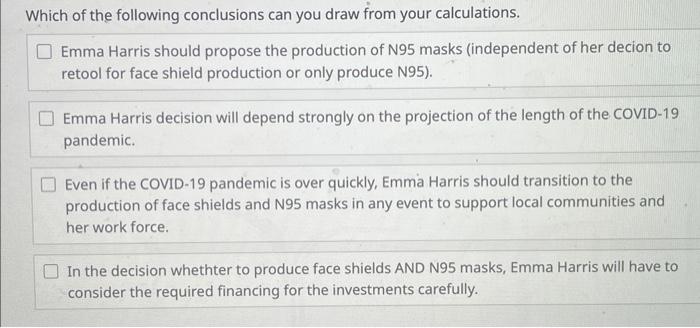

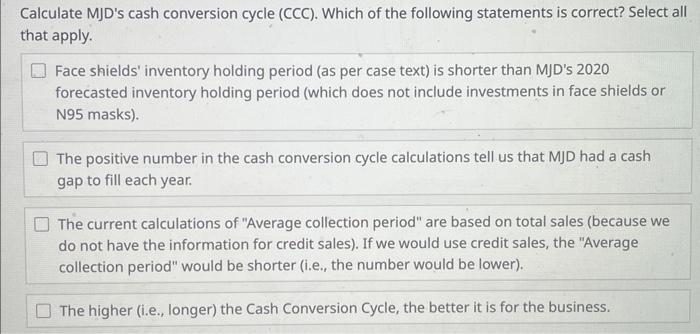

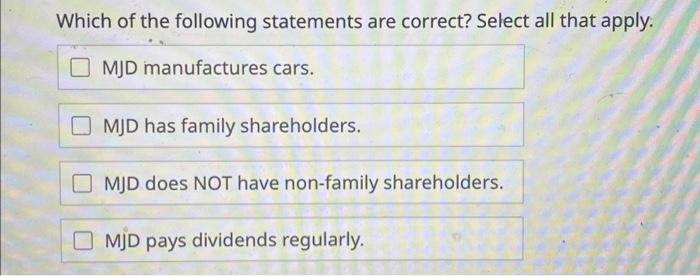

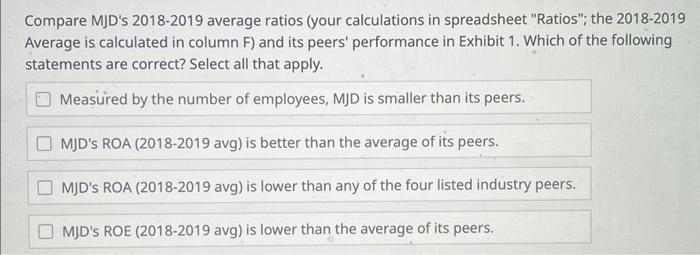

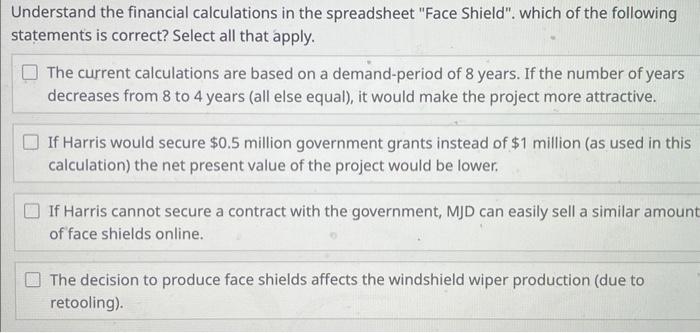

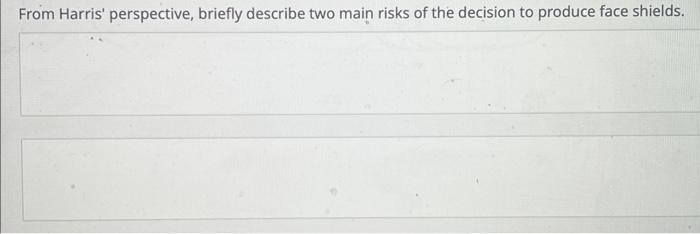

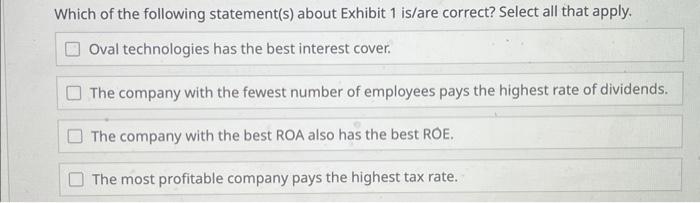

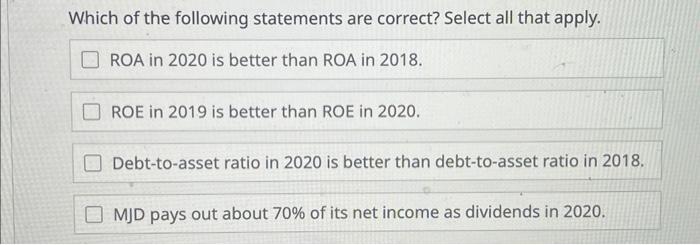

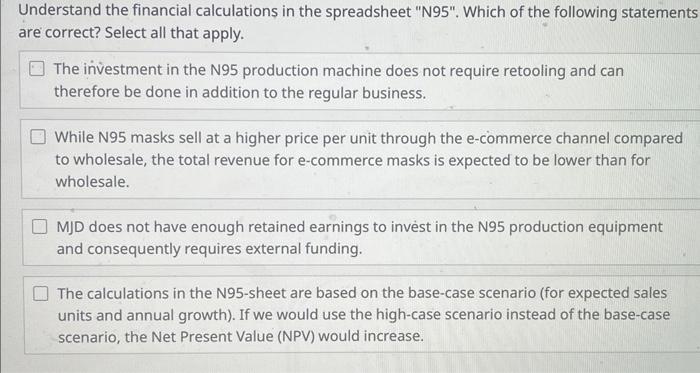

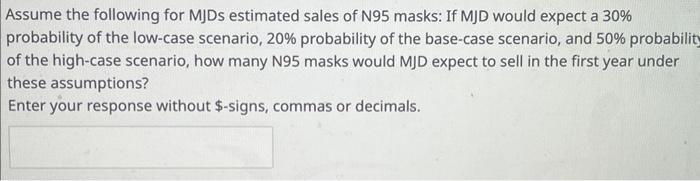

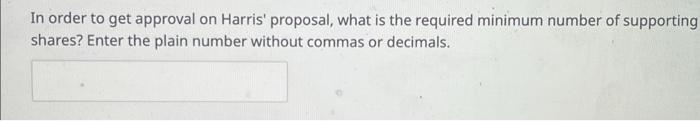

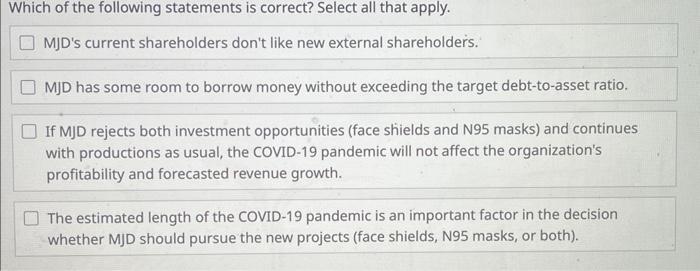

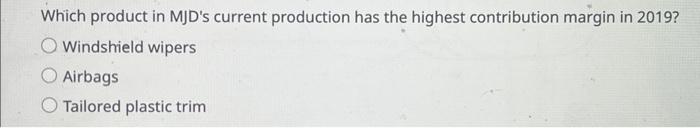

\begin{tabular}{|c|c|c|c|c|c|} \hline 1 & Based on EXHIBIT 2 & : & & & \\ \hline 2 & Name & Number of shares & & & \\ \hline 3 & Joseph & 350,000 & & & . \\ \hline 4 & James & 280,000 & & & \\ \hline 5 & Sydney & 25,000 & & & \\ \hline 6 & Emma & 250,000 & & & \\ \hline 7 & Katie & 25,000 & - & & \\ \hline 8 & Chloe & 50,000 & +1 & & \\ \hline 9 & Jakob & 55,000 & & & \\ \hline 10 & John & 5,000 & & & \\ \hline 11 & Joseph Jr. & 55,000 & - & s. & \\ \hline 12 & Vince & 90,000 & & & \\ \hline 13 & Chris & 20,000 & & & 3 \\ \hline 14 & Will & 35,000 & & & \\ \hline 15 & Hugh & 25,000 & & . & \\ \hline 16 & Bob & 15,000 & & & \\ \hline 17 & Bill & 15,000 & & & \\ \hline 18 & Total number of shares & 1,295,000 & & & \\ \hline 19 & Percentage & 80% & & & 1 \\ \hline 20 & Supporting shares & 1,036,000 & & & \\ \hline 21 & x2 & 0 & & & 2 \\ \hline 22 & Emma's dividends in 2018 & 126,255 & & & \\ \hline 23 & & & & & \\ \hline 24 & -1 & 2017 & 2018 & 2019 & 2020 \\ \hline 25 & Net income & 880 & 818 & 775 & 741 \\ \hline 26 & EPS & 0.68 & 0.63 & 0.60 & 0.57 \\ \hline 27 & & & - & & - \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|} \hline EXHIBIT 4 & 2017 & 2018 & 2019 & 2020 \\ \hline Assets & Actual & Actual & Actual & Forecast \\ \hline Current & & & & \\ \hline Cash and equivalents & 11 & 11 & 11 & 12 \\ \hline Accounts receivable & 892 & 920 & 949. & 978 \\ \hline Inventories & 2,040 & 2,103 & 2,169 & 2,236 \\ \hline Prepaid expenses & 510 & 526 & 542 & 559 \\ \hline Other current assets & 52 & 53 & 54 & 55 \\ \hline Total Current Assets & 3,505 & 3,613 & 3,725 & 3,840 \\ \hline \multicolumn{5}{|l|}{ Property Plant and Equipment } \\ \hline Windshield wipers manufacturing equipment & 6,610 & 7,276 & 7,943 & 8,610 \\ \hline Aribags manufacturing equipment & 5,059 & 5,725 & 6,392 & 7,059 \\ \hline Tailored plastic trim manufacturing equipment & 3,489 & 4,155 & 4,822 & 5,489 \\ \hline Other PPE & 263 & 263 & 263 & 263 \\ \hline Accumulated depreciation and amortization & (1,238) & (2,980) & (4,922) & (7,074) \\ \hline PP\&E (net) & 14,183 & 14,439 & 14,498 & 14,347 \\ \hline Total Assets & 17,688 & 18,052 & 18,223 & 18,187 \\ \hline \multicolumn{5}{|l|}{ Llabilities and Shareholders' equity } \\ \hline \multicolumn{5}{|l|}{ Liabilities } \\ \hline \multicolumn{5}{|l|}{ Current } \\ \hline Short-term borrowing (revolver) & 100 & 100 & 100 & 100 \\ \hline Current portion of long-term debts & 730 & 730 & 730 & 730 \\ \hline Accounts payable & 1,402 & 1,446 & 1,491 & 1,538 \\ \hline Total Current Liabilities & 2,232 & 2,276 & 2,321 & 2,368 \\ \hline \multicolumn{5}{|l|}{ Long Term } \\ \hline Long term debt & 5,786 & 5,056 & 4,326 & 3,596 \\ \hline Total Long Term Debt & 5,786 & 5,056 & 4,326 & 3,596 \\ \hline Total Liabilities & 8,018 & 7,332 & 6,647 & 5,964 \\ \hline & & & & \\ \hline \multicolumn{5}{|l|}{ Equity } \\ \hline Additional paid in capital & 5,000 & 5,889 & 6,589 & 7,097 \\ \hline Share capital & 3,245 & 3,245 & 3,245 & 3,245 \\ \hline Retained earnings & 1,424 & 1,588 & 1,742 & 1,891 \\ \hline Total equity & 9,669 & 10,722 & 11,576 & 12,233 \\ \hline Total Liabilities and Shareholders' equity & 17,687 & 18,054 & 18,223 & 18,197 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|} \hline & A & B & c & D & E: & F & G. & H & 1 & 1 \\ \hline 9 & Operating expense & & Indude 450,000 de & epreclation expente & & & & & & \\ \hline 10 & Operating expense (exduding depreciation) & 450,000 & & 71 & & & & & & \\ \hline 11 & Sale price & & per shield & 7 & & & & & & \\ \hline 12 & cost & & 18 & II. & & & sin & & & \\ \hline 13 & Units sold. & & per year & H & & & & & & \\ \hline 14 & Cost of copital & & see FN 2 & 8 & & & & & & \\ \hline 15 & CCA rate. & & see FN 2 & & & & & & & \\ \hline 16 & Taxrate & 22x & & & & & & & & \\ \hline 17 & Wiper revenue forecast in 2020 & & see income statem & nent & & & 4 & & & \\ \hline 18 & Wiper cost of soods sold forecast in 2020 & & see income statem & nent & & & & & & \\ \hline 19 & Harris salary in 2019 & 250,000 & & & & & & & & \\ \hline 20 & Annual increase of Harris salary & 3*. & & & s. & & action & & & \\ \hline 21 & Harris time allocated & & & & 40 & & & & & \\ \hline 22 & & 2 & & . & & & & & & \\ \hline 23 & Retooled machine net cost. & & contider governme & ent grant & & & & & & \\ \hline 24 & & 0 & 1 & 2 & 3 & 4 & 5 & 6. & 7 & 8 \\ \hline 25 & ucc Beginnine: & - & & & . & . & =. & - & - & F. \\ \hline 26 & CCA (first year only half cCA rate) & & - & - & . & & & . & (.) & t. \\ \hline 27 & ucc Ending & & * & & & . & . & \% & f & 8 \\ \hline 28 & Deprediation Tar Savine & - & & & & - & - & & H & f. \\ \hline 29 & & & & & 7 & & & - & & \\ \hline 30 & & 0 & 1 & 2 & 3 & 4 & 5 & 6 & 7 & B \\ \hline 31 & Retooling: & E & & & & & & 7 & 7 & \\ \hline 32 & Government subuldy & - & & DII. & (16) & 3 & & 111 & 1 & \\ \hline 33 & - & E & - & 48 & +3 & 3 & & 17 & Hit & ffi \\ \hline 34 & Revenue & - & - & - & & . & . & & & t) \\ \hline 35 & Cost of goods sold & & - & - & . & & 4 & & & (i) \\ \hline 36 & Operating expense. & & 450,000 & 450,000 & 450,000 & 450,000 & 450,000 & 450,000 & 450,000 & 450,000 \\ \hline 37 & Harris allocated salary & - & = & - & - & & & & +1 & (n) \\ \hline 38 & Earnings before tax & & 450,000 & 1.450,000 & 450.000 & 450,000 & 450,000 & 450,000 & 450,000 & 450,000 \\ \hline 39. & & & & & - & E & Z & 11 & TII & III \\ \hline 40 & Loss revenue of wipers & - & - & & & . & - & - & +1 & t \\ \hline 41. & Saving on wipers COGS & H & - & . & - & & - & . & - & III:L \\ \hline 42 & Saving on operating costs related with wipers & & 1,591,705 & 1,623,539 & 1,656,010 & 1,689,130 & 1,722,913 & 1,757,371 & 1,792,518 & 1,328,369 \\ \hline 43 & Net loss revenue of wipers before tax & & 1,591,705 & 1,623,539 & 1,656,010 & 1,699,130 & 1,722,913 & 1,757,371 & 1,792,518 & 1.878,369 \\ \hline 44 & & & & & & & & & & \\ \hline 45 & Coshlfow before tax & - & 2,041,705 & 2,073,539 & 2,106,010 & 2,139,130 & 2,172,913 & 2,207,371 & 2,242,518 & 2,278,369 \\ \hline 46 & Tax & - & (449,175) & (456,179) & (453,322) & (470,609) & (478,041). & (485,622) & (493,354) & (501,241) \\ \hline 47 & Cashflow after tax & . & 1,592,530 & 1.617,361 & 1,642,688 & 1,668.522 & 1,694,872 & 1,721,749 & 1,749,164 & 1m,128 \\ \hline 48 & Depredation tax saving & . & + & - & - & . & & . & - & \\ \hline 49 & Net cash flow & & 1,592,530 & 1,617,361 & 1,642,683 & 1,568,522 & 1,694,872 & 1,721,769 & 1,749,164 & 1,77,128 \\ \hline so & NPV & 13,464,013 & & & & & & & & \\ \hline 51 & & & & & & & & & & \\ \hline 2 & & & & & & & & & & \\ \hline \end{tabular} Assumptions Covemmeat enant in demand New machine purchare cost Anhual depreciation rate in x) Annual depmeiation expense fotraikht inel Operitin expenies annual krowth Operat ng opense including depreciation Operating epensit ocludink depreciaton sale price whalesile Sule price ecommerce. cost. ecommere percentage Units sold Annual inctouse Cost of capital CCA rate ( 4 yean Tax me Harris salary in 2019 Anhual incrase of Hamts salar. Horis time allocatnd New machine netcost Salvage value in x uCC Bewinning CCA (finst yor only half CCA mate) uCC Ending Depecclation Tax Siving New machine (gross) Accumulated depreciation Now machine inet sale price Capital gain Tarable capicul gain tax Aher tux gain 42. Purchase new machine Covernment subsidy Units sold Revile ecommers hevenue wholesale Total monue Cout of roods sold Operaing eppons fieris salar. taming before tar tare Canfoes aher tos Prorediolion tar swine life of the machine (afler tai) We caih fow nrv. N95 Low Base High Total: 6 7 8 Face shields e-Commerce (N95 masks) Wholesale (N95 masks) Contribution margins comparison in 2019 Product Windshield wipers Airbags Tailored plastic trim \begin{tabular}{|r|r|} \hline Revenue & Costs \\ \hline 7,084 & 4,392 \\ \hline 9,532 & 6,291 \\ \hline 10,493 & 6,400 \\ \hline \end{tabular} Contribution Margins PriceCostFixedcosts Breakeven \begin{tabular}{|c|c|c|c|c|c|c|} \hline 1 & N95 & . & First Year & Annual Growth & Probability (as & Expected Sales in Y1 \\ \hline 2 & Low & - & & & 30% & \\ \hline 3 & Base & 3 & & & 20% & \\ \hline 4 & High & & & & 50% & \\ \hline 5 & Total: & & & & & \\ \hline 6 & & & & & & \\ \hline 7 & & & Price & Cost & Fixed costs & Breakeven \\ \hline 8 & Face shields & & & & i & \\ \hline 9 & e-Commerce (N95 masks) & & & & & \\ \hline 10 & Wholesale (N95 masks) & & & & & \\ \hline 11 & & & & & & \\ \hline 12 & & & & & & \\ \hline 13 & Contribution margins comp & on in 2019 & & & & \\ \hline 14 & Product & & Revenue & Costs & Contribution M & Margins \\ \hline 15 & Windshield wipers & es & 7,084 & - 4,392 & 2,692 & \\ \hline 16 & Airbags & & 9,532 & 6,291 & 3,241 & \\ \hline 17 & Tailored plastic trim & & 10,493 & 6,400 & 4,093 & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline 2 & A & B & C & D & 'E & F & H \\ \hline 1 & H & 2017 & 2018 & 2019 & 2020 & 2018-2019 Average & \\ \hline 2 & ROA & & & & & \#DIV/OI & Net Income/Total Assets \\ \hline 3 & ROE & & & & & HDIV/OI & Net income/Total Equity \\ \hline 4 & Interest coverage & & & & & HOIV/OI & EBIT/Interest \\ \hline 5 & Debt to assets & & & & & HOIV/0I & Total debt/Total Assets \\ \hline 6 & Dividend payout & & 80% & 80% & 80% & 80.04% & \\ \hline 7 & Number of employees & 40 & 40 & 40 & 40 & & 8 \\ \hline 8 & EPS & 0.68 & 0.63 & 0.60 & 0.57 & & \\ \hline 9 & & & & & & & \\ \hline 10 & Dividend = Retained earning b & ing + Net & ome-Ret & dearning & ing balanc & & \\ \hline 11 & & & & & & & \\ \hline 12 & Retained earning beginning & & 1,424 & 1,588 & 1,742 & & \\ \hline 13 & Net income & & 818 & 775 & 741 & & \\ \hline 14 & Retained earning ending & & 1,588 & 1,742 & 1,891 & & \\ \hline 15 & Dividends & & 654 & 621 & 592 & & \\ \hline 16 & & & & & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|} \hline & A & & & D & E & F & 6 & & \\ \hline 1 & & 2017 & 2018 & \begin{tabular}{r} 2019 \\ \end{tabular} & 2020 & & 10 & & \\ \hline 2 & DOL & & & & & CM/EBIT & Fixed costs: & perating expen & ises plus depreciation. \\ \hline 3 & DFL & & & & & EBIT/EBT & & & \\ \hline 4 & DCL. & & & & & & & & \\ \hline 5 & & & & & & & & E & \\ \hline \end{tabular} What are possible option(s) for Harris? Select all that apply. Retool the current equipment to produce face shields. Buy new equipment to produce N95 masks. Do both: Retool the current equipment to produce face shields AND purchase new equipment to produce N95 masks. Reject the investment opportunities and continue the usual business. Assume that MJD only considers the operating expenses in the income statement plus depreciatio as 'fixed cost'. Which of the following statements are correct? Select all that apply. MJD's' Degree of Financial Leverage (DFL) has decreased between 2017 and 2019. Based on the calculations from 2020: A 1\% increase in MJD's operating income (or operating income per share) would lead to an increase of more-than-one-percent of its net income (or earnings per share) An increase in sales by 1% has a stronger impact on operating income in 2017 than it does in 2020. The Degree of Operating Leverage (DOL) in 2020 is higher than in 2017. From Harris' perspective, briefly describe two main opportunities of the decision to produce face shields. How long is the estimated useful life of the new machine to produce N95 masks? (Hint: the case text refers to a 5% depreciation expense). 4 years 5 years 20 years 50 years Which of the following statements are correct? Select all that apply. In 2019, MJD's Earnings Per Share (EPS) were, 0.60 The forecasted 2020 Earnings Per Share (EPS) if none of the investment opportunities is pursued (and without consideration of COVID-19 impacts on the business) is lower than in 2019. The Earnings Per Share (EPS) show a downward trend, even though the Net Income increases every year between 2017 and 2020. Emma Harris is the single-majority shareholder of MJD. Which of the following conclusions can you draw from your calculations. Emma Harris should propose the production of N95 masks (independent of her decion to retool for face shield production or only produce N95). Emma Harris decision will depend strongly on the projection of the length of the COVID-19 pandemic. Even if the COVID-19 pandemic is over quickly, Emma Harris should transition to the production of face shields and N95 masks in any event to support local communities and her work force. In the decision whethter to produce face shields AND N95 masks, Emma Harris will have to consider the required financing for the investments carefully. Calculate MJD's cash conversion cycle (CCC). Which of the following statements is correct? Select all that apply. Face shields' inventory holding period (as per case text) is shorter than MJD's 2020 forecasted inventory holding period (which does not include investments in face shields or N95 masks). The positive number in the cash conversion cycle calculations tell us that MJD had a cash gap to fill each year. The current calculations of "Average collection period" are based on total sales (because we do not have the information for credit sales). If we would use credit sales, the "Average collection period" would be shorter (i.e., the number would be lower). The higher (i.e., longer) the Cash Conversion Cycle, the better it is for the business. Which of the following statements are correct? Select all that apply. MJD has family shareholders. MJD pays dividends regularly. Understand the financial calculations in the spreadsheet "Face Shield". which of the following statements is correct? Select all that apply. The current calculations are based on a demand-period of 8 years. If the number of years decreases from 8 to 4 years (all else equal), it would make the project more attractive. If Harris would secure $0.5 million government grants instead of $1 million (as used in this calculation) the net present value of the project would be lower. If Harris cannot secure a contract with the government, MJD can easily sell a similar amour of face shields online. The decision to produce face shields affects the windshield wiper production (due to retooling). From Harris' perspective, briefly describe two main risks of the decision to produce face shields. Which of the following statement(s) about Exhibit 1 is/are correct? Select all that apply. Oval technologies has the best interest cover. The company with the fewest number of employees pays the highest rate of dividends. The company with the best ROA also has the best ROE. The most profitable company pays the highest tax rate. Which of the following statements are correct? Select all that apply. ROA in 2020 is better than ROA in 2018. ROE in 2019 is better than ROE in 2020. Debt-to-asset ratio in 2020 is better than debt-to-asset ratio in 2018. MJD pays out about 70% of its net income as dividends in 2020 . Understand the financial calculations in the spreadsheet " N95 ". Which of the following statements are correct? Select all that apply. The investment in the N95 production machine does not require retooling and can therefore be done in addition to the regular business. While N95 masks sell at a higher price per unit through the e-commerce channel compared to wholesale, the total revenue for e-commerce masks is expected to be lower than for wholesale. MJD does not have enough retained earnings to invest in the N95 production equipment and consequently requires external funding. The calculations in the N95-sheet are based on the base-case scenario (for expected sales units and annual growth). If we would use the high-case scenario instead of the base-case scenario, the Net Present Value (NPV) would increase. Assume the following for MJDs estimated sales of N95 masks: If MJD would expect a 30% probability of the low-case scenario, 20% probability of the base-case scenario, and 50% probabilit of the high-case scenario, how many N95 masks would MJD expect to sell in the first year under these assumptions? Enter your response without \$-signs, commas or decimals. In order to get approval on Harris' proposal, what is the required minimum number of supporting shares? Enter the plain number without commas or decimals. MJD's current shareholders don't like new external shareholders. MJD has some room to borrow money without exceeding the target debt-to-asset ratio. If MJD rejects both investment opportunities (face shields and N95 masks) and continues with productions as usual, the COVID-19 pandemic will not affect the organization's profitability and forecasted revenue growth. The estimated length of the COVID-19 pandemic is an important factor in the decision whether MJD should pursue the new projects (face shields, N95 masks, or both). Which product in MJD's current production has the highest contribution margin in 2019? Windshield wipers Airbags Tailored plastic trim

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started