Question

On January 1, 2018, Phili Corporation acquired 90 percent of shares in Shili Corporation for $ 351,000,000, while Shili's share capital was $ 195,000,000 and

Additional information:

1. On July 1, 2018, Priya sold the machine with a book value of IDR 35,000,000 to Sunil at a price of IDR 43,570,000. The remaining useful life of the machines was 3.5 (three and a half) years at the time of sale, using the straight-line depreciation method.

2. During 2019, Priya sold the land with a book value of $ 18,750,000 to Sunil for $ 25,000,000

3. Priya's trade receivables as of December 31, 2019, including $ 12,500,000 from Sunil.

4. Priya sold supplies to Sunil for $ 75,000,000 during 2019 and $ 90,000,000 during 2019.

5. Sunil's inventory as of December 31, 2018 and 2019, including unrealized profit of $ 12,500,000 and $ 15,000,000, respectively

6. Priya uses the equity method for 90% of her ownership in Sunil.

Requested:

1. Prepare an elimination and adjusting entry as of December 31, 2019

2. Prepare working papers for Priya and her subsidiaries for the year ended 31 December 2019

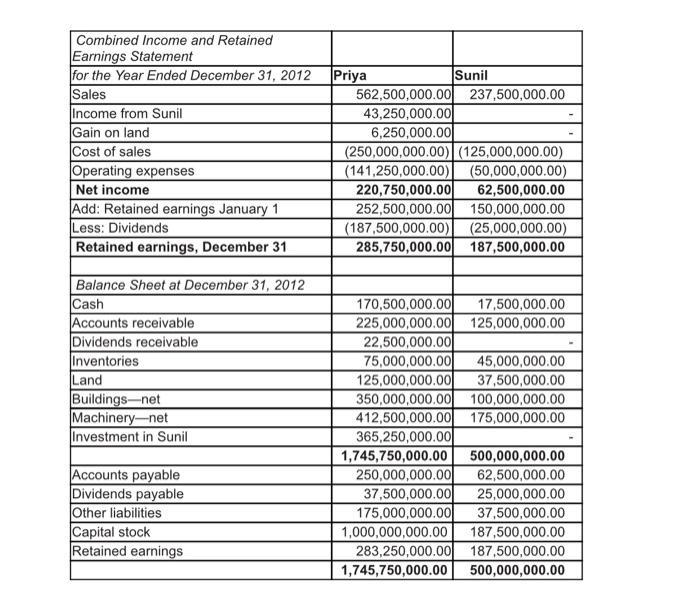

Combined Income and Retained Earnings Statement for the Year Ended December 31, 2012 Sales Income from Sunil Gain on land Cost of sales Operating expenses Net income Add: Retained earnings January 1 Less: Dividends Retained earnings, December 31 Balance Sheet at December 31, 2012 Cash Accounts receivable Dividends receivable Inventories Land Buildings-net Machinery-net Investment in Sunil Accounts payable Dividends payable Other liabilities Capital stock Retained earnings Priya Sunil 562,500,000.00 237,500,000.00 43,250,000.00 6,250,000.00 (250,000,000.00) (125,000,000.00) (141,250,000.00) (50,000,000.00) 220,750,000.00 62,500,000.00 252,500,000.00 150,000,000.00 (187,500,000.00) (25,000,000.00) 285,750,000.00 187,500,000.00 170,500,000.00 17,500,000.00 225,000,000.00 125,000,000.00 22,500,000.00 75,000,000.00 45,000,000.00 125,000,000.00 37,500,000.00 350,000,000.00 100,000,000.00 412,500,000.00 175,000,000.00 365,250,000.00 1,745,750,000.00 500,000,000.00 250,000,000.00 62,500,000.00 37,500,000.00 25,000,000.00 175,000,000.00 37,500,000.00 1,000,000,000.00 187,500,000.00 283,250,000.00 187,500,000.00 1,745,750,000.00 500,000,000.00

Step by Step Solution

3.43 Rating (156 Votes )

There are 3 Steps involved in it

Step: 1

1 Elimination and adjustment entry as of December 31 2019 000 Dr Cash 1705000 Dr Accounts receivable ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started