Question

Excel please. Transactions during 2018: 5/3 Issued 100,000 shares of common stock to acquire a 200 meter shophouse at a market price of IDR 5,000,000

Excel please. Transactions during 2018:

5/3 Issued 100,000 shares of common stock to acquire a 200 meter shophouse at a market price of IDR 5,000,000 / m. At the time of the transaction, the stock market price was IDR 8,500 / share.

30/5 Sold 3,000 treasury shares totaling IDR 22,500,000

23/6 Issued 20,000 preferred shares in cash by debiting Share premium-Preference amounting to IDR 4,000,000

18/8 Sold all treasury shares with a total loss of IDR 3,250,000

20/12 Issued 50,000 ordinary shares to pay off bonds payable (Bonds) which will mature in the amount of IDR 400,000,000, - The market price of shares at transaction is IDR 8,000 / share.

22/12 Buy back 5,000 shares of common stock at a price 125% above par value.

30/12 Selling 50% of treasury shares owned by crediting Share Premium-Treasury Shares Rp 1,875,000, -

31/12 January net profit is IDR 75,000,000

1. Keep the transaction journal required for 2018!

2. Compile the Equity section of the Statement of Financial Position as of December 31

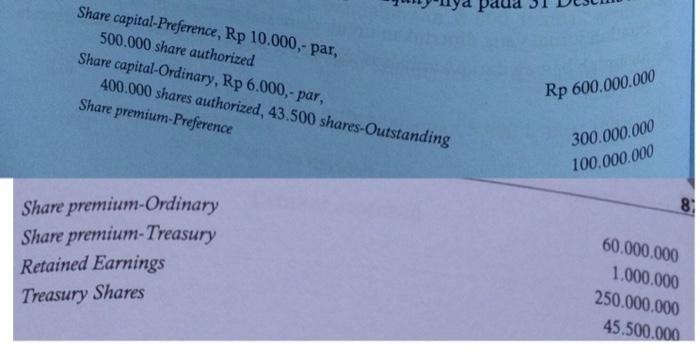

Share capital-Preference, Rp 10.000,- par, 500.000 share authorized Share capital-Ordinary, Rp 6.000,- par, 400.000 shares authorized, 43.500 shares-Outstanding Share premium-Preference Share premium-Ordinary Share premium-Treasury Retained Earnings Treasury Shares pada Rp 600.000.000 300.000.000 100.000.000 81 60.000.000 1.000.000 250.000.000 45.500.000

Step by Step Solution

3.40 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Soluti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started