Excel pleass

Excel pleass eExcel please

eExcel please

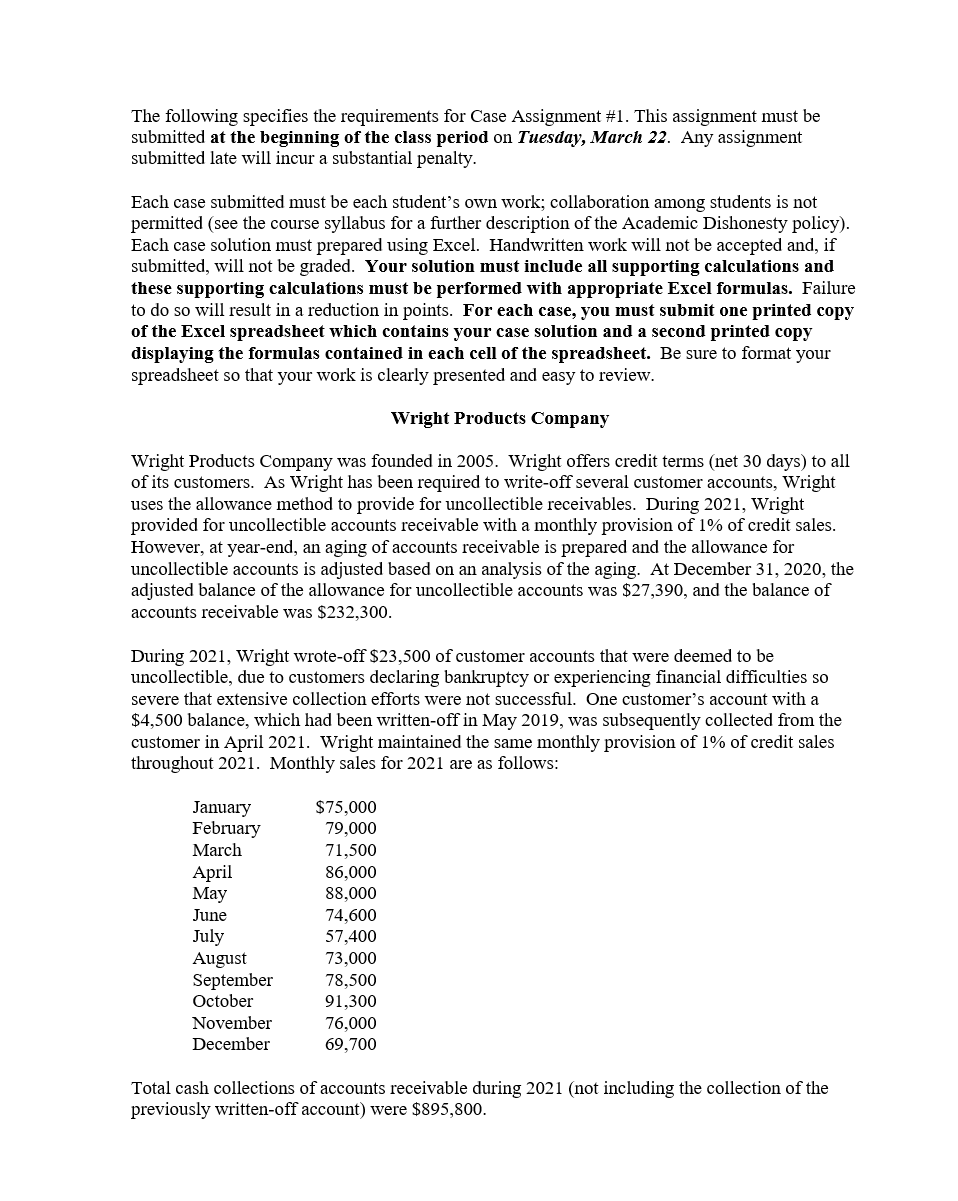

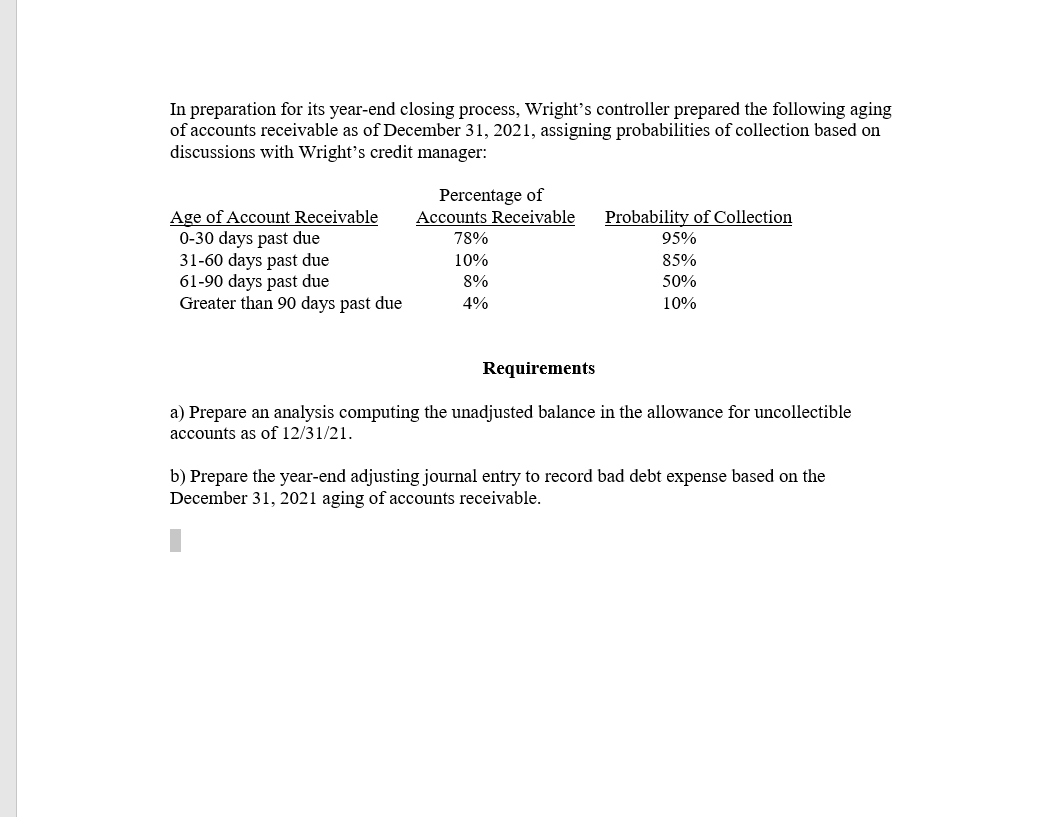

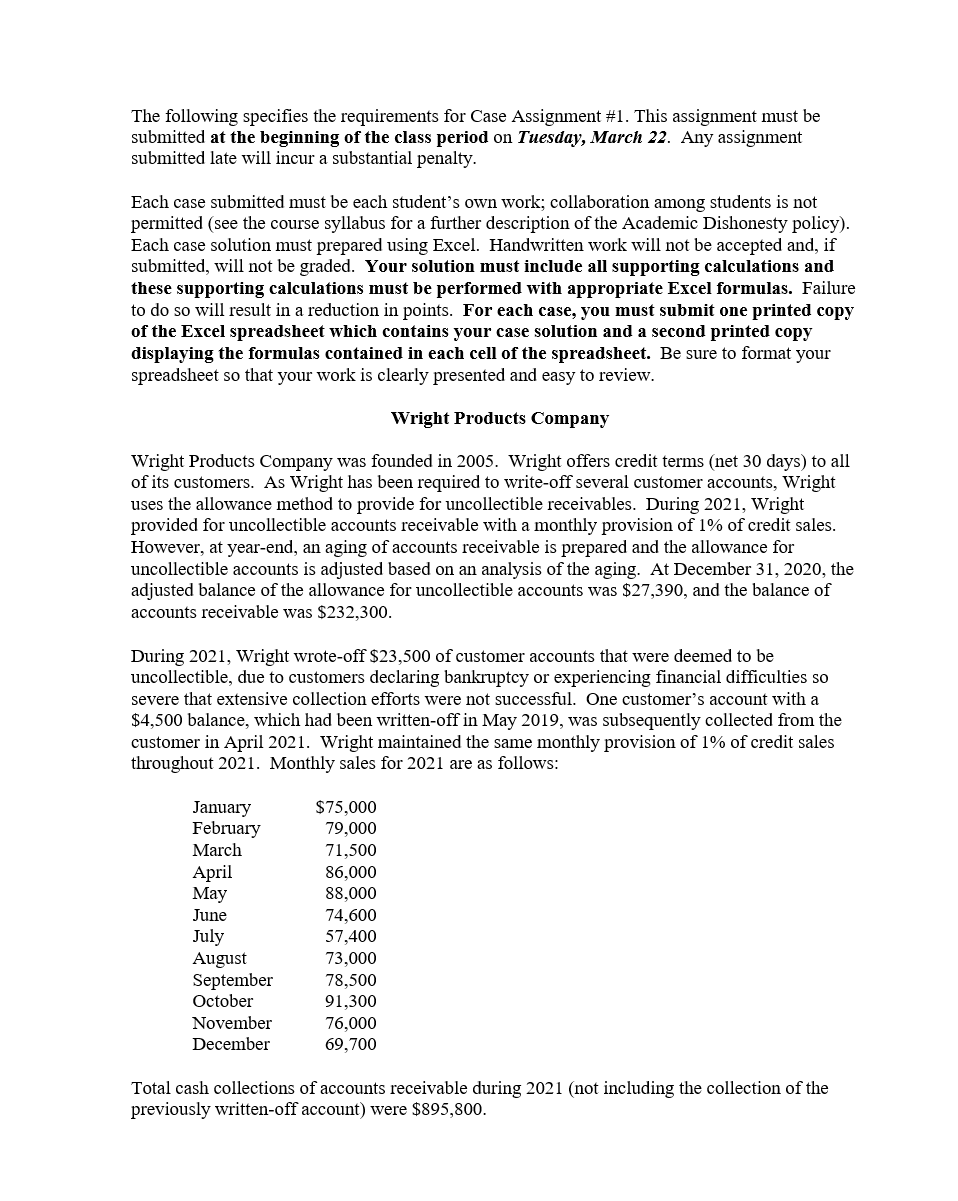

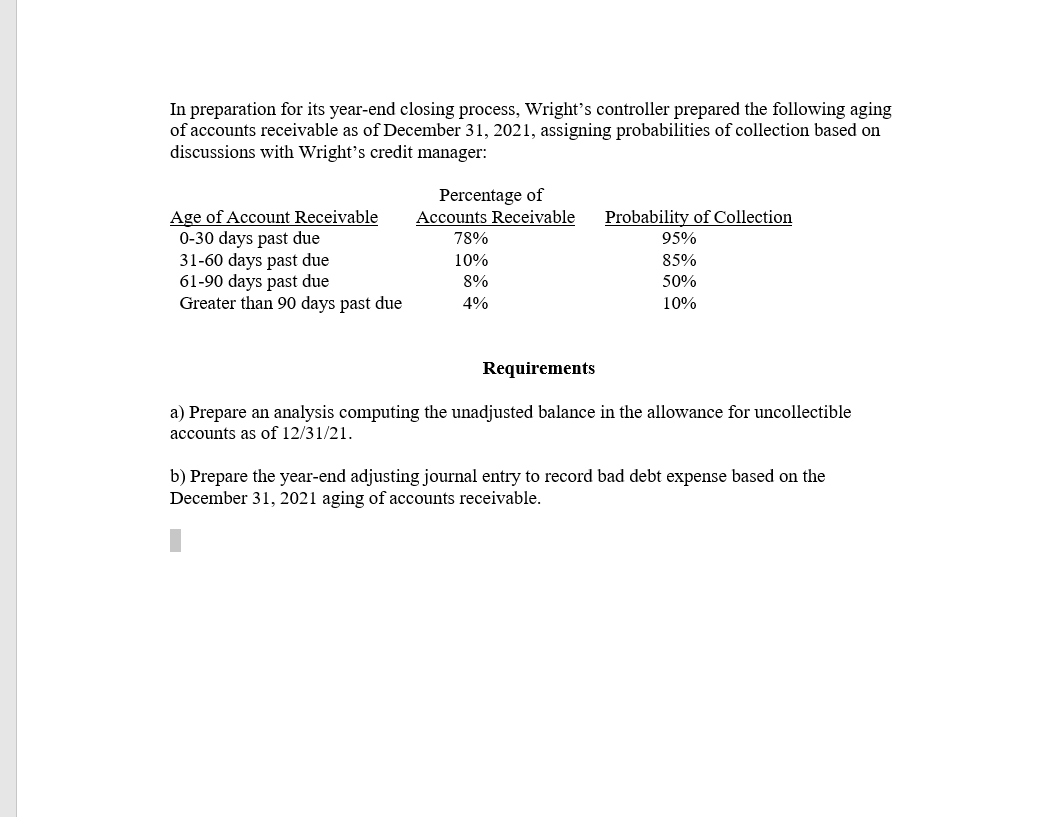

The following specifies the requirements for Case Assignment #1. This assignment must be submitted at the beginning of the class period on Tuesday, March 22. Any assignment submitted late will incur a substantial penalty. Each case submitted must be each student's own work; collaboration among students is not permitted (see the course syllabus for a further description of the Academic Dishonesty policy). Each case solution must prepared using Excel. Handwritten work will not be accepted and, if submitted, will not be graded. Your solution must include all supporting calculations and these supporting calculations must be performed with appropriate Excel formulas. Failure to do so will result in a reduction in points. For each case, you must submit one printed copy of the Excel spreadsheet which contains your case solution and a second printed copy displaying the formulas contained in each cell of the spreadsheet. Be sure to format your spreadsheet so that your work is clearly presented and easy to review. Wright Products Company Wright Products Company was founded in 2005. Wright offers credit terms (net 30 days) to all of its customers. As Wright has been required to write-off several customer accounts, Wright uses the allowance method to provide for uncollectible receivables. During 2021, Wright provided for uncollectible accounts receivable with a monthly provision of 1% of credit sales. However, at year-end, an aging of accounts receivable is prepared and the allowance for uncollectible accounts is adjusted based on an analysis of the aging. At December 31, 2020, the adjusted balance of the allowance for uncollectible accounts was $27,390, and the balance of accounts receivable was $232,300. During 2021, Wright wrote-off $23,500 of customer accounts that were deemed to be uncollectible, due to customers declaring bankruptcy or experiencing financial difficulties so severe that extensive collection efforts were not successful. One customer's account with a $4,500 balance, which had been written-off in May 2019, was subsequently collected from the customer in April 2021. Wright maintained the same monthly provision of 1% of credit sales throughout 2021. Monthly sales for 2021 are as follows: January February March April May June July August September October November December $75,000 79,000 71,500 86,000 88,000 74,600 57,400 73,000 78,500 91,300 76,000 69,700 Total cash collections of accounts receivable during 2021 (not including the collection of the previously written-off account) were $895,800. In preparation for its year-end closing process, Wright's controller prepared the following aging of accounts receivable as of December 31, 2021, assigning probabilities of collection based on discussions with Wright's credit manager: Age of Account Receivable 0-30 days past due 31-60 days past due 61-90 days past due Greater than 90 days past due Percentage of Accounts Receivable 78% 10% 8% 4% Probability of Collection 95% 85% 50% 10% Requirements a) Prepare an analysis computing the unadjusted balance in the allowance for uncollectible accounts as of 12/31/21. b) Prepare the year-end adjusting journal entry to record bad debt expense based on the December 31, 2021 aging of accounts receivable

Excel pleass

Excel pleass eExcel please

eExcel please