Answered step by step

Verified Expert Solution

Question

1 Approved Answer

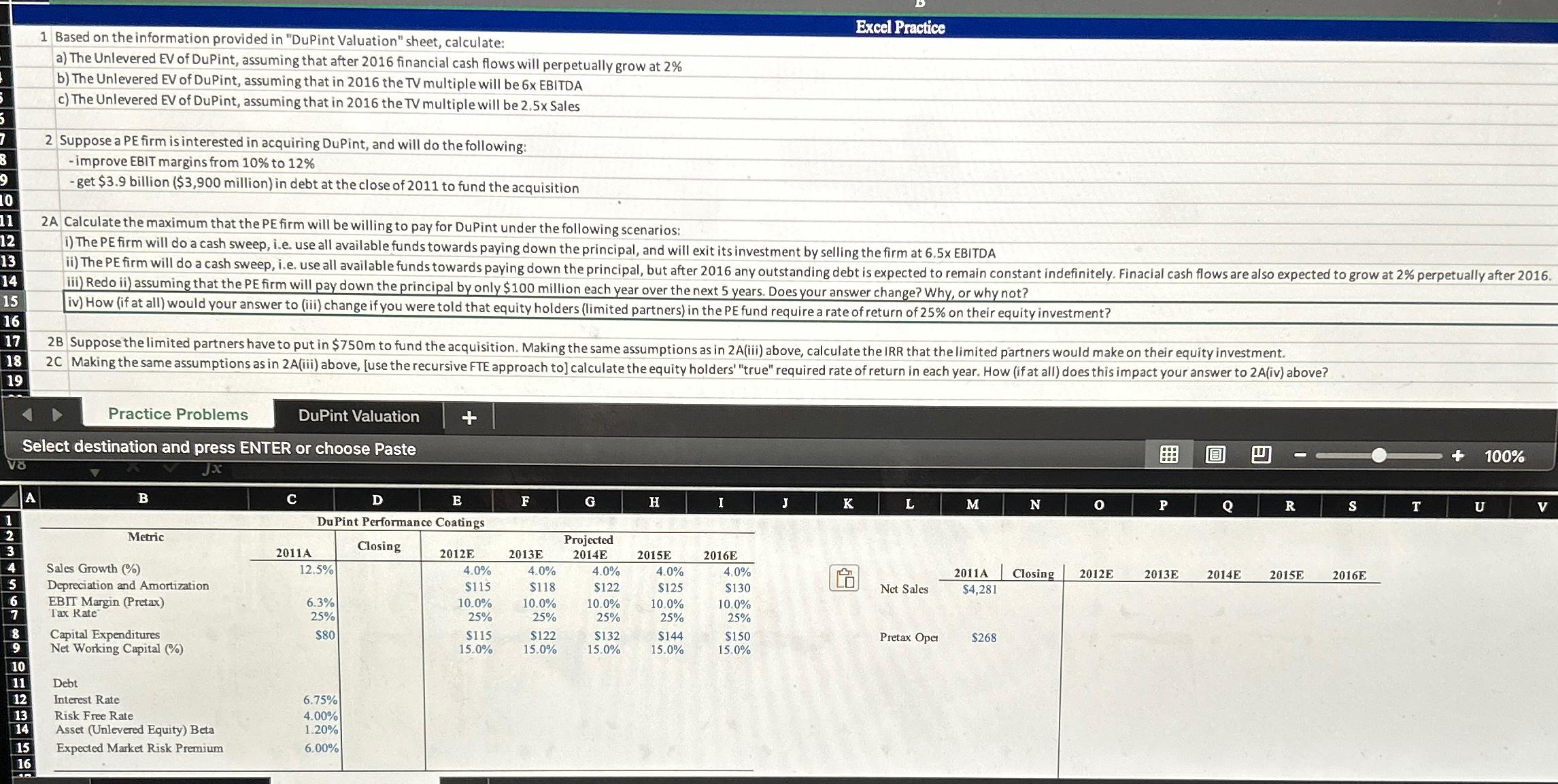

Excel Practice 1 Based on the information provided in DuPint Valuation sheet, calculate: a ) The Unlevered EV of DuPint, assuming that after 2 0

Excel Practice

Based on the information provided in "DuPint Valuation" sheet, calculate:

a The Unlevered EV of DuPint, assuming that after financial cash flows will perpetually grow at

b The Unlevered EV of DuPint, assuming that in the TV multiple will be x EBITDA

c The Unlevered EV of DuPint, assuming that in the TV multiple will be Sales

Suppose a PE firm is interested in acquiring DuPint, and will do the following:

improve EBIT margins from to

get $ billion million in debt at the close of to fund the acquisition

A Calculate the maximum that the PE firm will be willing to pay for DuPint under the following scenarios:

i The PE firm will do a cash sweep, ie use all available funds towards paying down the principal, and will exit its investment by selling the firm at EBITDA

iii Redo ii assuming that the PE firm will pay down the principal by only $ million each year over the next years. Does your answer change? Why, or why not?

iv How if at all would your answer to iii change if you were told that equity holders limited partners in the PE fund require a rate of return of on their equity investment?

B Suppose the limited partners have to put in $ to fund the acquisition. Making the same assumptions as in iii above, calculate the IRR that the limited partners would make on their equity investment.

C Making the same assumptions as in iii above, use the recursive FTE approach to calculate the equity holders' "true" required rate of return in each year. How if at all does this impact your answer to iv above?

Practice Problems

DuPint Valuation

Select destination and press ENTER or choose Paste

tableBcDGHIDuPint Performance CoatingsMetric,Closing,Projected,

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started