Answered step by step

Verified Expert Solution

Question

1 Approved Answer

EXCEL Questions. Develop your answers for each question on a separate tab and submit a single EXCEL file. Put your final answer for each question

EXCEL Questions. Develop your answers for each question on a separate tab and submit a single EXCEL file. Put your final answer for each question in the Answer Document and submit.

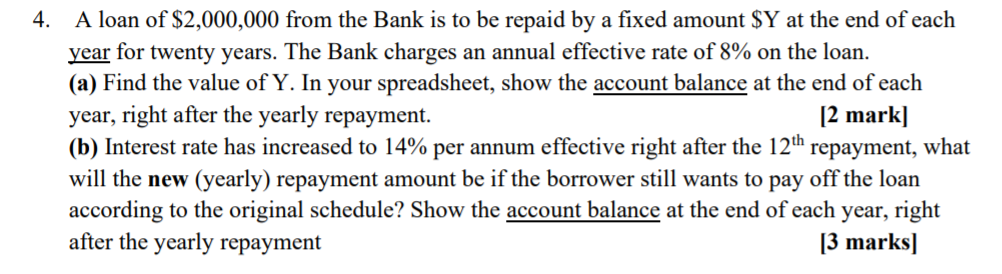

4. A loan of $2,000,000 from the Bank is to be repaid by a fixed amount $Y at the end of each year for twenty years. The Bank charges an annual effective rate of 8% on the loan. (a) Find the value of Y. In your spreadsheet, show the account balance at the end of each year, right after the yearly repayment. [2 mark] (b) Interest rate has increased to 14% per annum effective right after the 12th repayment, what will the new (yearly) repayment amount be if the borrower still wants to pay off the loan according to the original schedule? Show the account balance at the end of each year, right after the yearly repayment [3 marks]Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started