Excel sheet needed for questions are at the bottom. Please help ASAP

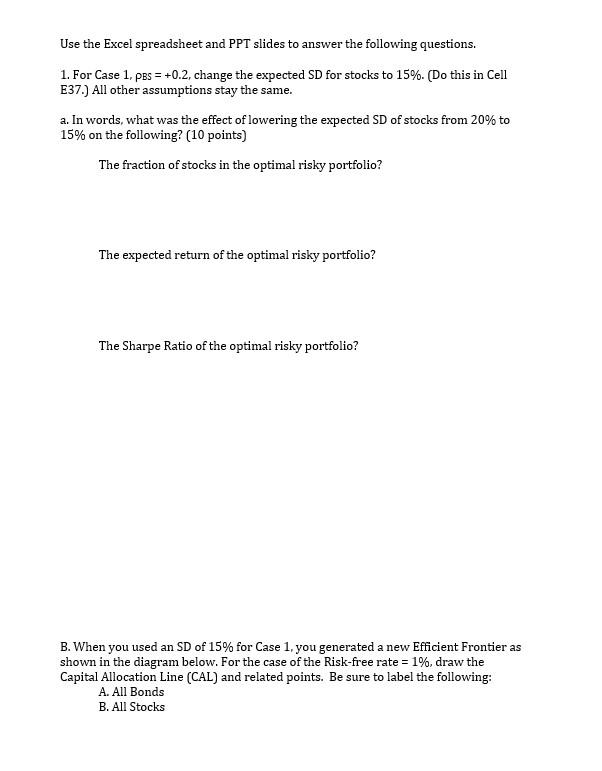

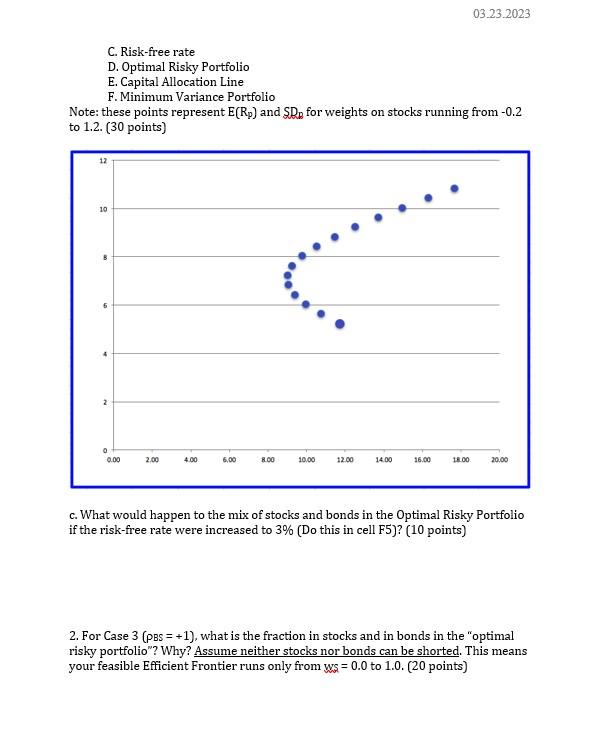

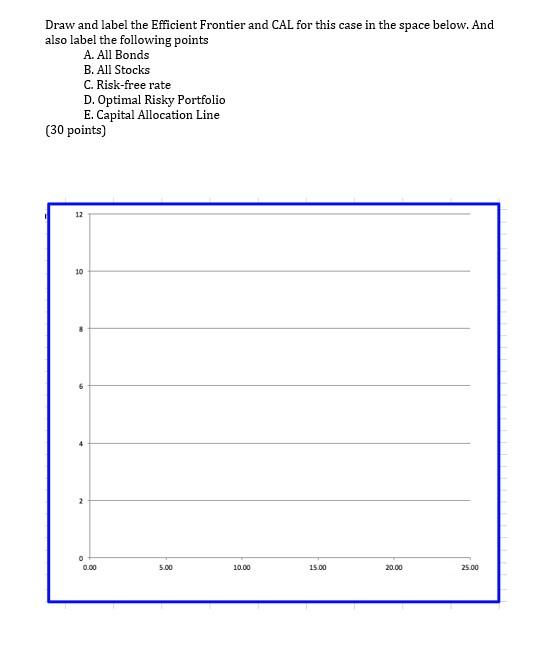

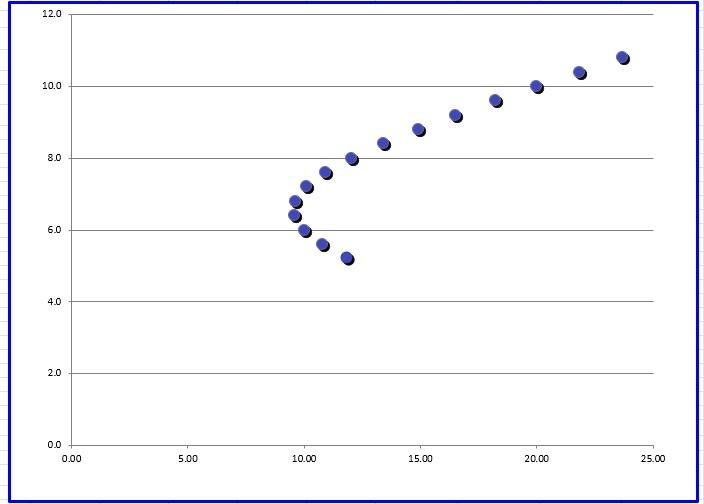

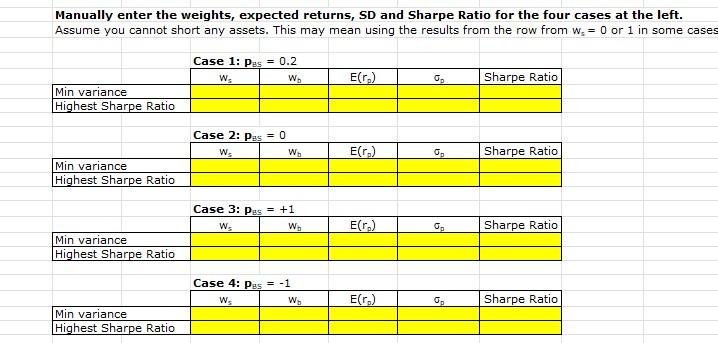

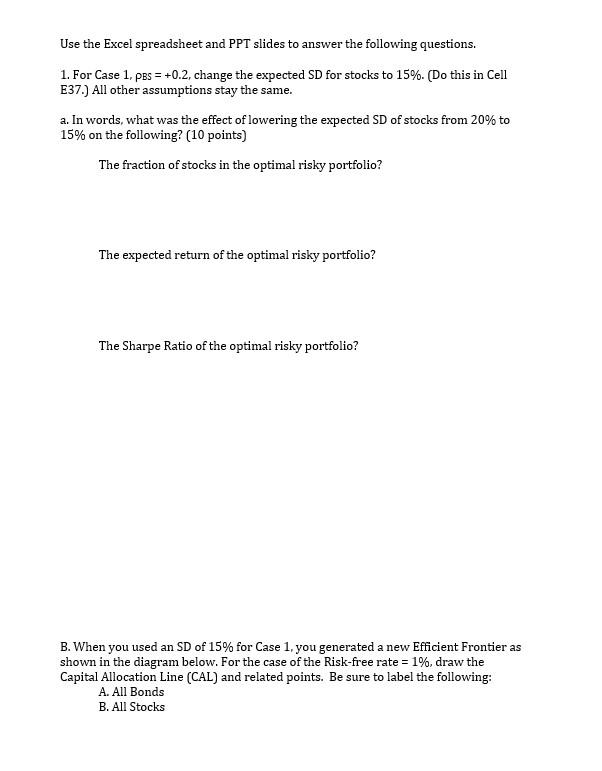

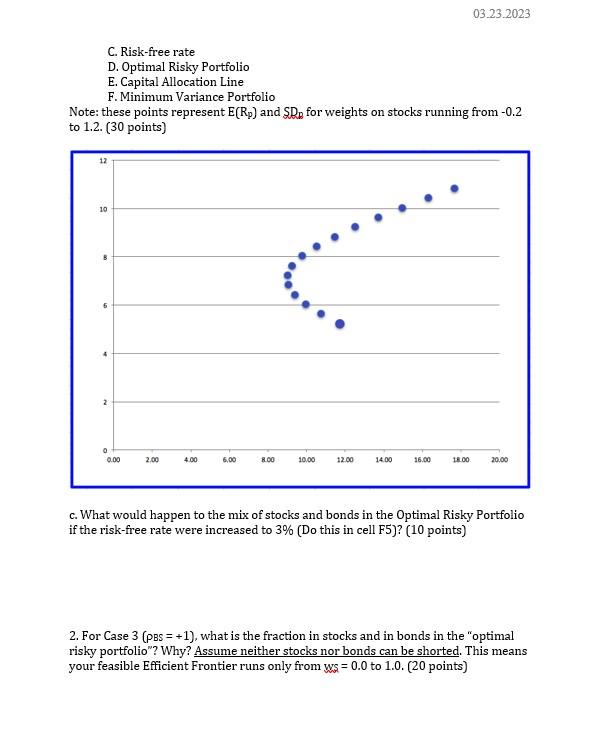

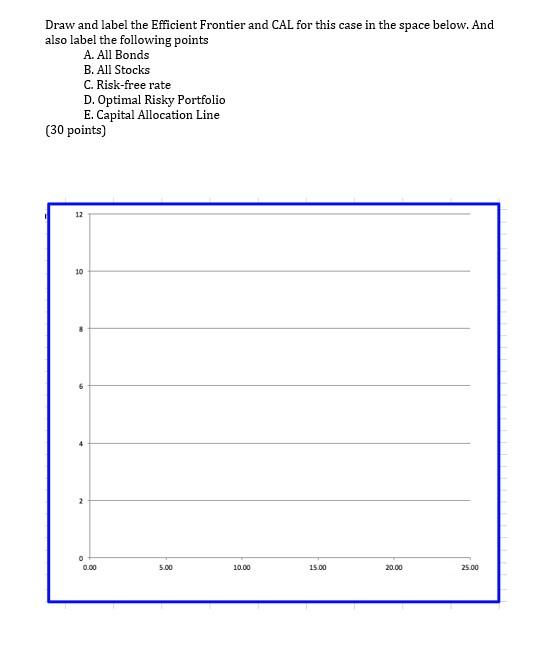

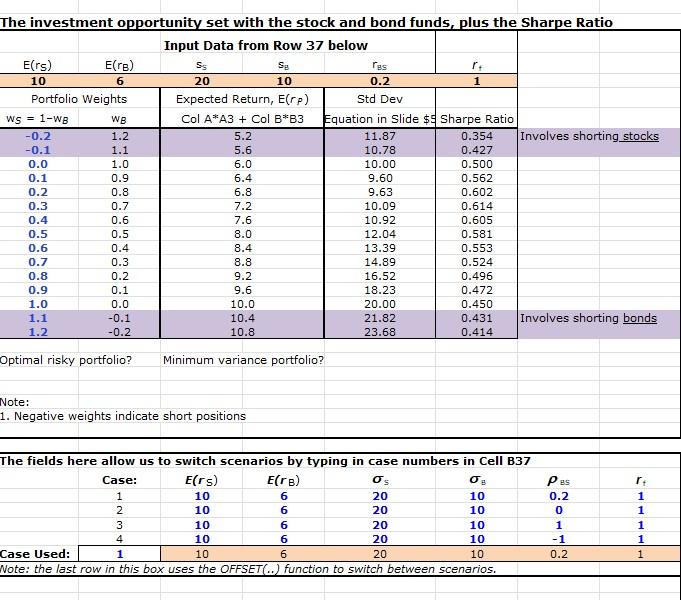

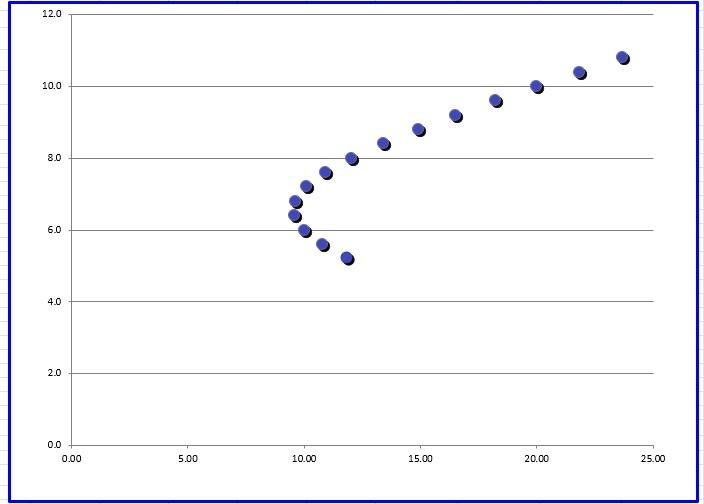

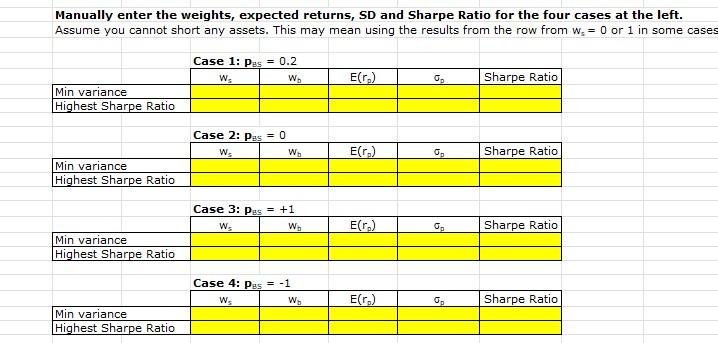

1. For Case 1, BS=+0.2, change the expected SD for stocks to 15%. (Do this in Cell E37.) All other assumptions stay the same. a. In words, what was the effect of lowering the expected SD of stocks from 20% to 15% on the following? ( 10 points) The fraction of stocks in the optimal risky portfolio? The expected return of the optimal risky portfolio? The Sharpe Ratio of the optimal risky portfolio? B. When you used an SD of 15% for Case 1, you generated a new Efficient Frontier as shown in the diagram below. For the case of the Risk-free rate =1%, draw the Capital Allocation Line (CAL) and related points. Be sure to label the following: A. All Bonds B. All Stocks C. Risk-free rate D. Optimal Risky Portfolio E. Capital Allocation Line F. Minimum Variance Portfolio Note: these points represent E(Rp) and SRp for weights on stocks running from -0.2 to 1.2 . (30 points) c. What would happen to the mix of stocks and bonds in the Optimal Risky Portfolio if the risk-free rate were increased to 3% (Do this in cell F5)? (10 points) 2. For Case 3(PBS=+1), what is the fraction in stocks and in bonds in the "optimal risky portfolio"? Why? Assume neither stocks nor bonds can be shorted. This means your feasible Efficient Frontier runs only from WS=0.0 to 1.0. (20 points) Draw and label the Efficient Frontier and CAL for this case in the space below. And also label the following points A. All Bonds B. All Stocks C. Risk-free rate D. Optimal Risky Portfolio E. Capital Allocation Line ( 30 points) The investment opportunity set with the stock and bond funds, plus the Sharpe Ratio Optimal risky portfolio? Minimum variance portfolio? Note: 1. Negative weights indicate short positions The fields here allow us to switch scenarios by typing in case numbers in Cell B37 Note: the last row in this box uses the OFFSET(..) function to switch between scenarios. Manuallv enter the weiahts. expected returns. SD and Sharpe Ratio for the four cases at the left. vs=0or1insomecas 1. For Case 1, BS=+0.2, change the expected SD for stocks to 15%. (Do this in Cell E37.) All other assumptions stay the same. a. In words, what was the effect of lowering the expected SD of stocks from 20% to 15% on the following? ( 10 points) The fraction of stocks in the optimal risky portfolio? The expected return of the optimal risky portfolio? The Sharpe Ratio of the optimal risky portfolio? B. When you used an SD of 15% for Case 1, you generated a new Efficient Frontier as shown in the diagram below. For the case of the Risk-free rate =1%, draw the Capital Allocation Line (CAL) and related points. Be sure to label the following: A. All Bonds B. All Stocks C. Risk-free rate D. Optimal Risky Portfolio E. Capital Allocation Line F. Minimum Variance Portfolio Note: these points represent E(Rp) and SRp for weights on stocks running from -0.2 to 1.2 . (30 points) c. What would happen to the mix of stocks and bonds in the Optimal Risky Portfolio if the risk-free rate were increased to 3% (Do this in cell F5)? (10 points) 2. For Case 3(PBS=+1), what is the fraction in stocks and in bonds in the "optimal risky portfolio"? Why? Assume neither stocks nor bonds can be shorted. This means your feasible Efficient Frontier runs only from WS=0.0 to 1.0. (20 points) Draw and label the Efficient Frontier and CAL for this case in the space below. And also label the following points A. All Bonds B. All Stocks C. Risk-free rate D. Optimal Risky Portfolio E. Capital Allocation Line ( 30 points) The investment opportunity set with the stock and bond funds, plus the Sharpe Ratio Optimal risky portfolio? Minimum variance portfolio? Note: 1. Negative weights indicate short positions The fields here allow us to switch scenarios by typing in case numbers in Cell B37 Note: the last row in this box uses the OFFSET(..) function to switch between scenarios. Manuallv enter the weiahts. expected returns. SD and Sharpe Ratio for the four cases at the left. vs=0or1insomecas