Answered step by step

Verified Expert Solution

Question

1 Approved Answer

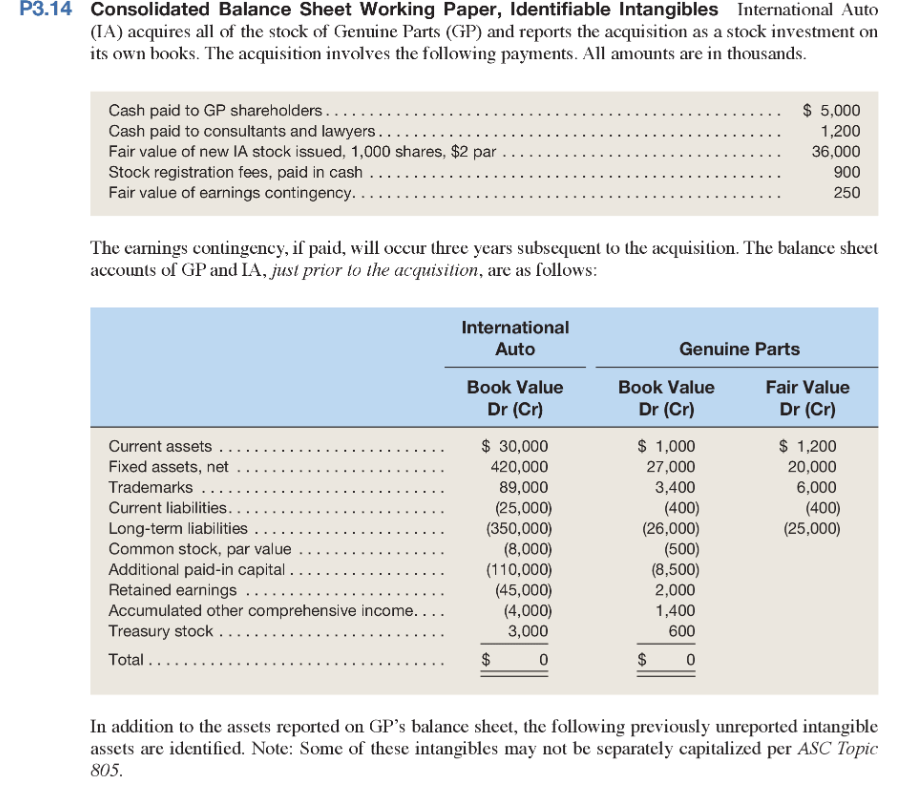

Excel Type working preferably P3.14 Consolidated Balance Sheet Working Paper, Identifiable Intangibles International Auto (IA) acquires all of the stock of Genuine Parts (GP) and

Excel Type working preferably

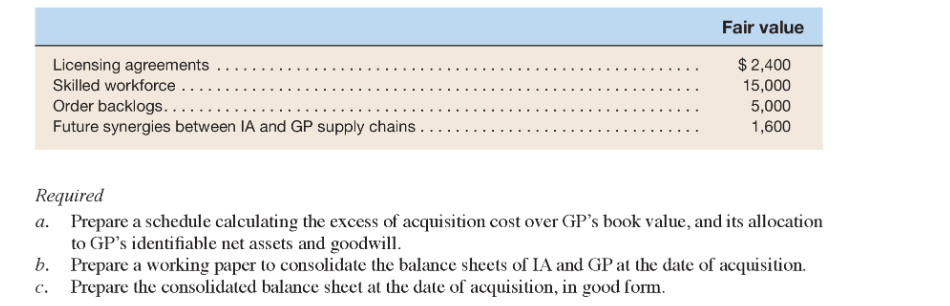

P3.14 Consolidated Balance Sheet Working Paper, Identifiable Intangibles International Auto (IA) acquires all of the stock of Genuine Parts (GP) and reports the acquisition as a stock investment on its own books. The acquisition involves the following payments. All amounts are in thousands Cash paid to GP shareholders.. . .. Cash paid to consultants and lawyers... Fair value of new IA stock issued, 1,000 shares, $2 par Stock registration fees, paid in cash Fair value of earnings contingency.. $ 5,000 1,200 36,000 900 250 The earnings contingency, if paid, will occur three years subsequent to the acquisition. The balance sheet accounts of GP and IA, just prior to he acquisition, are as follows: International Genuine Parts Auto Book Value Book Value Fair Value Dr (Cr) Dr (Cr) Dr (Cr) Current assets .. Fixed assets, net Trademarks Current liabilities.. Long-term liabilities Common stock, par value Additional paid-in capital.. Retained earnings .... Accumulated other comprehensive income. . Treasury stock. .. $ 30,000 $1,000 $1,200 20,000 6,000 (400) (25,000) 420,000 27,000 89,000 (25,000) (350,000) (8,000) (110,000) (45,000) (4,000) 3,000 3,400 (400) (26,000) (500) (8,500) 2,000 1,400 600 $ $ Total. 0 0 In addition to the assets reported on GP's balance sheet, the following previously unreported intangible assets are identified. Note: Some of these intangibles may not be separately capitalized per ASC Topic 805. Fair value Licensing agreements $2,400 15,000 Skilled workforce Order backlogs. . 5,000 Future synergies between IA and GP supply chains 1,600 Required Prepare a schedule calculating the excess of acquisition cost over GP's book value, and its allocation to GP's identifiable net assets and goodwill b. Prepare a working paper to consolidate the balance sheets of IA and GPat the date of acquisition c. Prepare the consolidated balance sheet at the date of acquisition, in good form. aStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started