Answered step by step

Verified Expert Solution

Question

1 Approved Answer

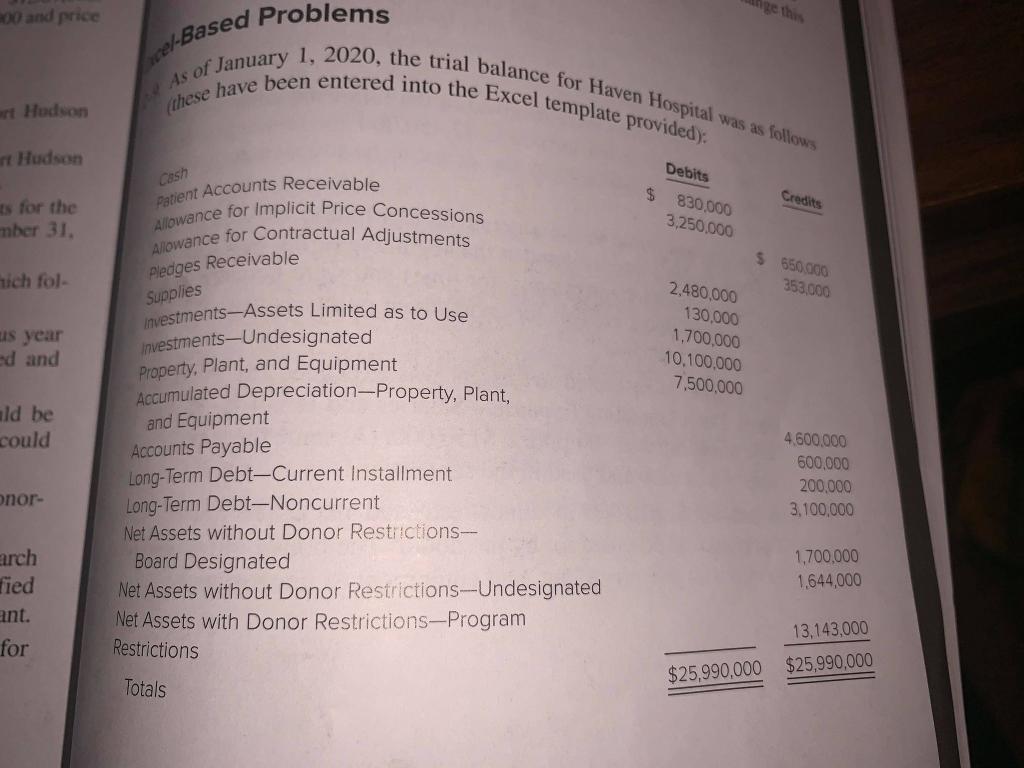

Excel-Based Problems 12-9 200 and price r Hudson (these scel-Based Problems As of January 1, 2020, the trial balance for Haven Hospital was as follows

Excel-Based Problems 12-9

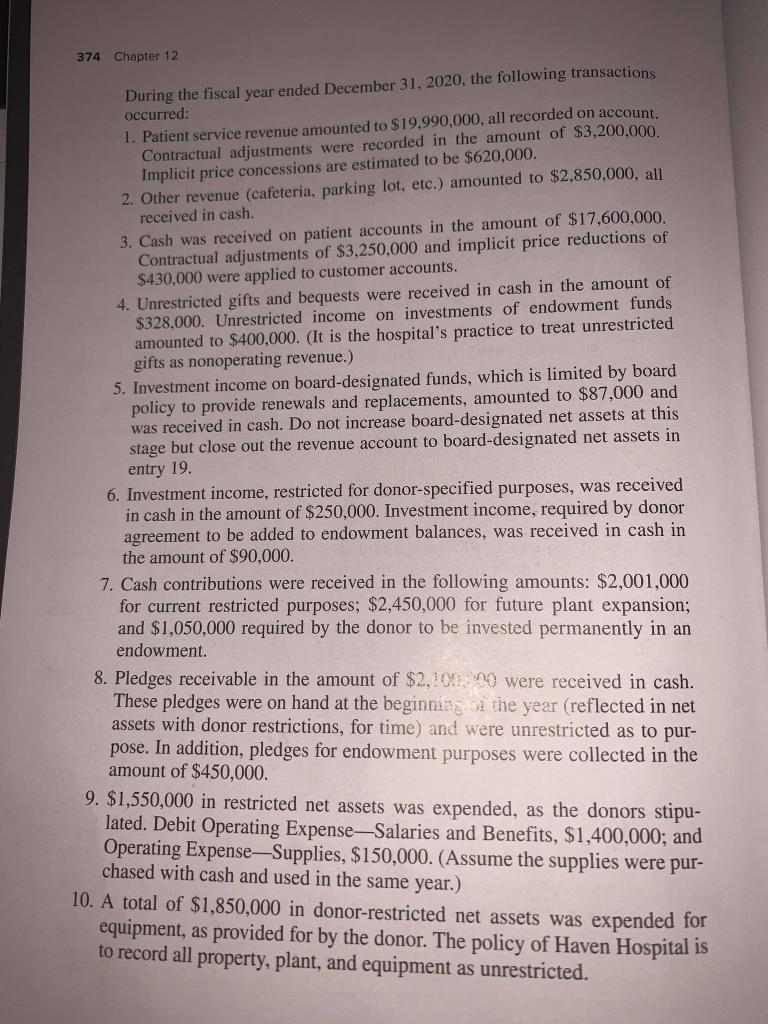

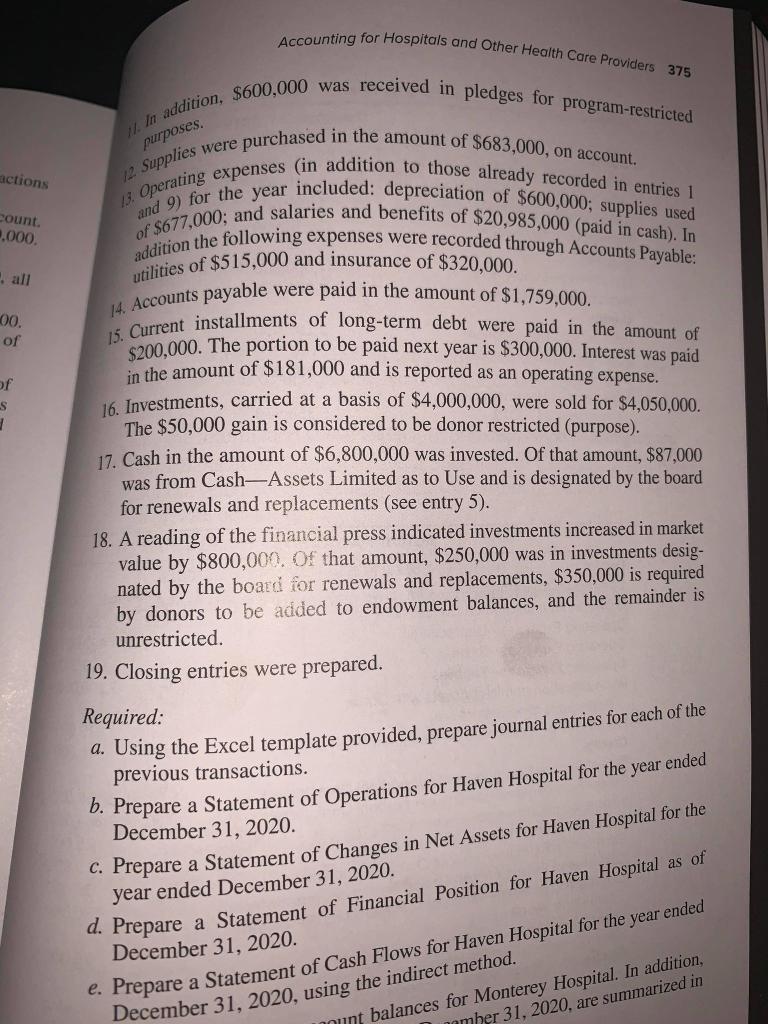

200 and price r Hudson (these scel-Based Problems As of January 1, 2020, the trial balance for Haven Hospital was as follows have been entered into the Excel template provided): Patient Accounts Receivable Allowance for Implicit Price Concessions Allowance for Contractual Adjustments Hudson Debits Cash $ Credits as for the mber 31. 830.000 3,250.000 $ 650.000 353,000 ich fol- Pledges Receivable Supplies as year 2.480.000 130.000 1,700,000 10,100,000 7.500.000 ed and ald be could Investments-Assets Limited as to Use InvestmentsUndesignated Property, Plant, and Equipment Accumulated Depreciation--Property, Plant, and Equipment Accounts Payable Long-Term Debt-Current Installment Long-Term Debt-Noncurrent Net Assets without Donor Restrictions- Board Designated Net Assets without Donor Restrictions-Undesignated Net Assets with Donor Restrictions-Program Restrictions 4600.000 600,000 200.000 3.100,000 onor- arch fied 1,700,000 1.644,000 ant. 13,143,000 for $25,990,000 $25,990,000 Totals 374 Chapter 12 During the fiscal year ended December 31, 2020, the following transactions occurred: 1. Patient service revenue amounted to $19.990,000, all recorded on account. Contractual adjustments were recorded in the amount of $3,200,000. Implicit price concessions are estimated to be $620,000. 2. Other revenue (cafeteria, parking lot, etc.) amounted to $2,850,000, all received in cash. 3. Cash was received on patient accounts in the amount of $17,600,000. Contractual adjustments of $3,250,000 and implicit price reductions of $430,000 were applied to customer accounts. 4. Unrestricted gifts and bequests were received in cash in the amount of $328,000. Unrestricted income on investments of endowment funds amounted to $400,000. (It is the hospital's practice to treat unrestricted gifts as nonoperating revenue.) 5. Investment income on board-designated funds, which is limited by board policy to provide renewals and replacements, amounted to $87,000 and was received in cash. Do not increase board-designated net assets at this stage but close out the revenue account to board-designated net assets in entry 19. 6. Investment income, restricted for donor-specified purposes, was received in cash in the amount of $250,000. Investment income, required by donor agreement to be added to endowment balances, was received in cash in the amount of $90,000. 7. Cash contributions were received in the following amounts: $2,001,000 for current restricted purposes; $2,450,000 for future plant expansion; and $1,050,000 required by the donor to be invested permanently in an endowment. 8. Pledges receivable in the amount of $2.10 were received in cash. These pledges were on hand at the beginning of the year (reflected in net assets with donor restrictions, for time) and were unrestricted as to pur- pose. In addition, pledges for endowment purposes were collected in the amount of $450,000. 9. $1,550,000 in restricted net assets was expended, as the donors stipu- lated. Debit Operating ExpenseSalaries and Benefits, $1,400,000; and Operating Expense-Supplies, $150,000. (Assume the supplies were pur- chased with cash and used in the same year.) 10. A total of $1,850,000 in donor-restricted net assets was expended for equipment, as provided for by the donor. The policy of Haven Hospital is to record all property, plant, and equipment as unrestricted. purposes. actions count. ,000. 00. of Accounting for Hospitals and Other Health Care Providers 375 11. In addition, $600,000 was received in pledges for program-restricted 13. Operating expenses (in addition to those already recorded in entries 1 12. Supplies were purchased in the amount of $683,000, on account. of $677,000; and salaries and benefits of $20,985,000 (paid in cash). In and 9) for the year included: depreciation of $600,000; supplies used addition the following expenses were recorded through Accounts Payable: utilities of $515,000 and insurance of $320,000. 14. Accounts payable were paid in the amount of $1,759,000. 15. Current installments of long-term debt were paid in the amount of $200,000. The portion to be paid next year is $300,000. Interest was paid in the amount of $181,000 and is reported as an operating expense. 16. Investments, carried at a basis of $4,000,000, were sold for $4,050,000. The $50,000 gain is considered to be donor restricted (purpose). 17. Cash in the amount of $6,800,000 was invested. Of that amount, $87,000 was from Cash-Assets Limited as to Use and is designated by the board for renewals and replacements (see entry 5). 18. A reading of the financial press indicated investments increased in market value by $800,000. Of that amount, $250,000 was in investments desig- nated by the board for renewals and replacements, $350,000 is required by donors to be added to endowment balances, and the remainder is unrestricted. 19. Closing entries were prepared. of S 3 Required: a. Using the Excel template provided, prepare journal entries for each of the previous transactions. b. Prepare a Statement of Operations for Haven Hospital for the year ended December 31, 2020. C. Prepare a Statement of Changes in Net Assets for Haven Hospital for the year ended December 31, 2020. d. Prepare a Statement of Financial Position for Haven Hospital as of December 31, 2020. e. Prepare a Statement of Cash Flows for Haven Hospital for the year ended December 31, 2020, using the indirect method. mount balances for Monterey Hospital. In addition, member 31, 2020. are summarized in 200 and price r Hudson (these scel-Based Problems As of January 1, 2020, the trial balance for Haven Hospital was as follows have been entered into the Excel template provided): Patient Accounts Receivable Allowance for Implicit Price Concessions Allowance for Contractual Adjustments Hudson Debits Cash $ Credits as for the mber 31. 830.000 3,250.000 $ 650.000 353,000 ich fol- Pledges Receivable Supplies as year 2.480.000 130.000 1,700,000 10,100,000 7.500.000 ed and ald be could Investments-Assets Limited as to Use InvestmentsUndesignated Property, Plant, and Equipment Accumulated Depreciation--Property, Plant, and Equipment Accounts Payable Long-Term Debt-Current Installment Long-Term Debt-Noncurrent Net Assets without Donor Restrictions- Board Designated Net Assets without Donor Restrictions-Undesignated Net Assets with Donor Restrictions-Program Restrictions 4600.000 600,000 200.000 3.100,000 onor- arch fied 1,700,000 1.644,000 ant. 13,143,000 for $25,990,000 $25,990,000 Totals 374 Chapter 12 During the fiscal year ended December 31, 2020, the following transactions occurred: 1. Patient service revenue amounted to $19.990,000, all recorded on account. Contractual adjustments were recorded in the amount of $3,200,000. Implicit price concessions are estimated to be $620,000. 2. Other revenue (cafeteria, parking lot, etc.) amounted to $2,850,000, all received in cash. 3. Cash was received on patient accounts in the amount of $17,600,000. Contractual adjustments of $3,250,000 and implicit price reductions of $430,000 were applied to customer accounts. 4. Unrestricted gifts and bequests were received in cash in the amount of $328,000. Unrestricted income on investments of endowment funds amounted to $400,000. (It is the hospital's practice to treat unrestricted gifts as nonoperating revenue.) 5. Investment income on board-designated funds, which is limited by board policy to provide renewals and replacements, amounted to $87,000 and was received in cash. Do not increase board-designated net assets at this stage but close out the revenue account to board-designated net assets in entry 19. 6. Investment income, restricted for donor-specified purposes, was received in cash in the amount of $250,000. Investment income, required by donor agreement to be added to endowment balances, was received in cash in the amount of $90,000. 7. Cash contributions were received in the following amounts: $2,001,000 for current restricted purposes; $2,450,000 for future plant expansion; and $1,050,000 required by the donor to be invested permanently in an endowment. 8. Pledges receivable in the amount of $2.10 were received in cash. These pledges were on hand at the beginning of the year (reflected in net assets with donor restrictions, for time) and were unrestricted as to pur- pose. In addition, pledges for endowment purposes were collected in the amount of $450,000. 9. $1,550,000 in restricted net assets was expended, as the donors stipu- lated. Debit Operating ExpenseSalaries and Benefits, $1,400,000; and Operating Expense-Supplies, $150,000. (Assume the supplies were pur- chased with cash and used in the same year.) 10. A total of $1,850,000 in donor-restricted net assets was expended for equipment, as provided for by the donor. The policy of Haven Hospital is to record all property, plant, and equipment as unrestricted. purposes. actions count. ,000. 00. of Accounting for Hospitals and Other Health Care Providers 375 11. In addition, $600,000 was received in pledges for program-restricted 13. Operating expenses (in addition to those already recorded in entries 1 12. Supplies were purchased in the amount of $683,000, on account. of $677,000; and salaries and benefits of $20,985,000 (paid in cash). In and 9) for the year included: depreciation of $600,000; supplies used addition the following expenses were recorded through Accounts Payable: utilities of $515,000 and insurance of $320,000. 14. Accounts payable were paid in the amount of $1,759,000. 15. Current installments of long-term debt were paid in the amount of $200,000. The portion to be paid next year is $300,000. Interest was paid in the amount of $181,000 and is reported as an operating expense. 16. Investments, carried at a basis of $4,000,000, were sold for $4,050,000. The $50,000 gain is considered to be donor restricted (purpose). 17. Cash in the amount of $6,800,000 was invested. Of that amount, $87,000 was from Cash-Assets Limited as to Use and is designated by the board for renewals and replacements (see entry 5). 18. A reading of the financial press indicated investments increased in market value by $800,000. Of that amount, $250,000 was in investments desig- nated by the board for renewals and replacements, $350,000 is required by donors to be added to endowment balances, and the remainder is unrestricted. 19. Closing entries were prepared. of S 3 Required: a. Using the Excel template provided, prepare journal entries for each of the previous transactions. b. Prepare a Statement of Operations for Haven Hospital for the year ended December 31, 2020. C. Prepare a Statement of Changes in Net Assets for Haven Hospital for the year ended December 31, 2020. d. Prepare a Statement of Financial Position for Haven Hospital as of December 31, 2020. e. Prepare a Statement of Cash Flows for Haven Hospital for the year ended December 31, 2020, using the indirect method. mount balances for Monterey Hospital. In addition, member 31, 2020. are summarized in

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started