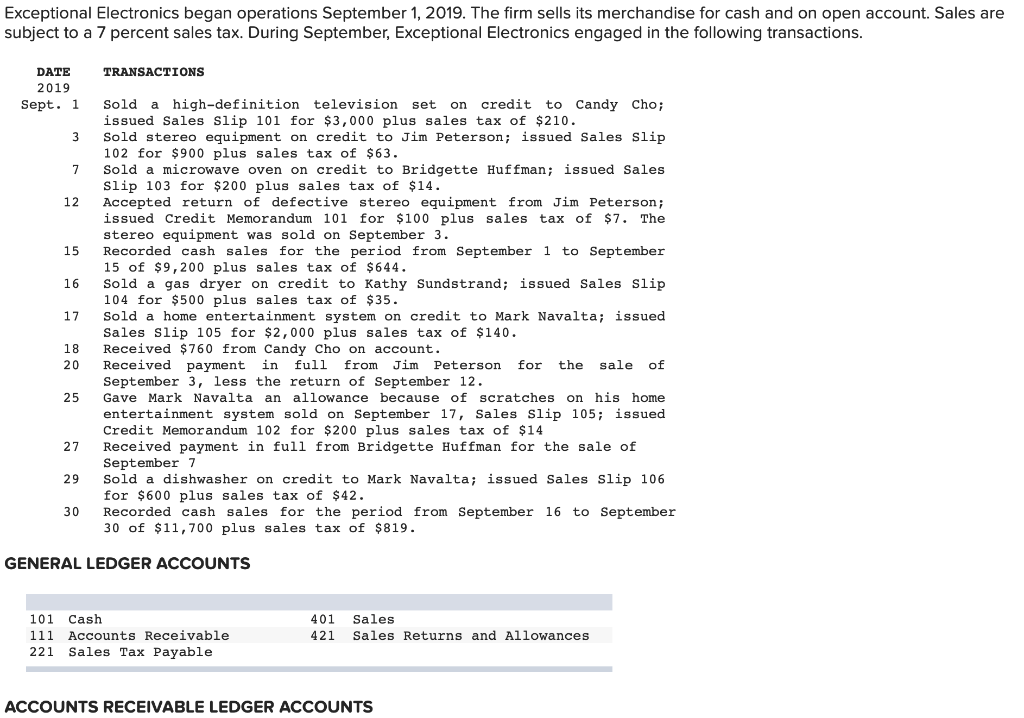

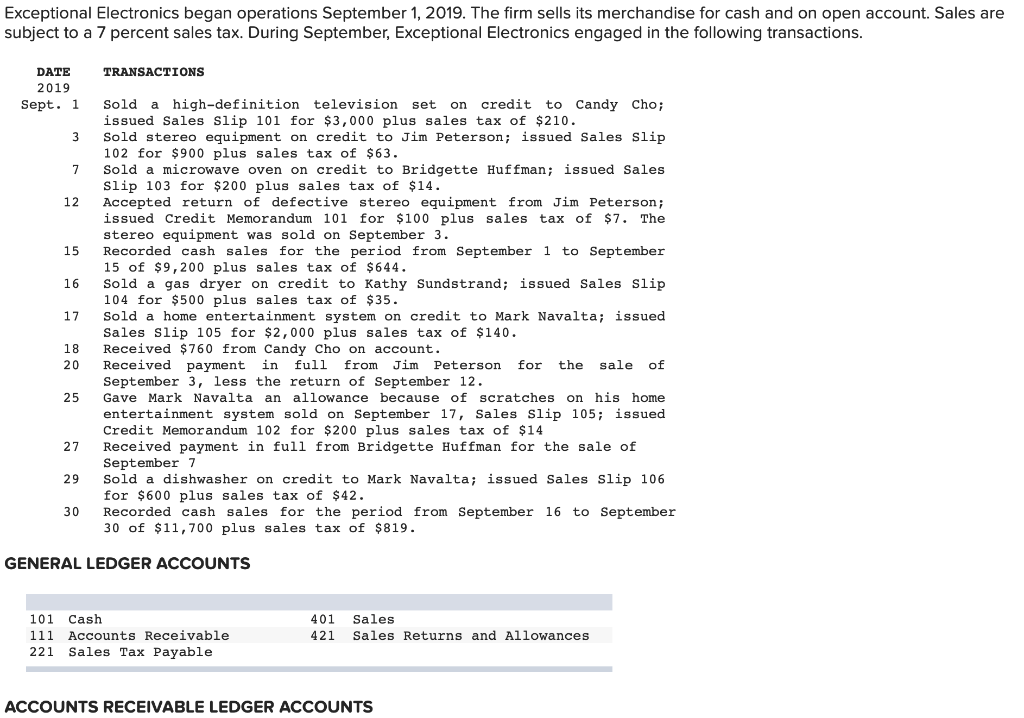

Exceptional Electronics began operations September 1, 2019. The firm sells its merchandise for cash and on open account. Sales are subject to a 7 percent sales tax. During September, Exceptional Electronics engaged in the following transactions.

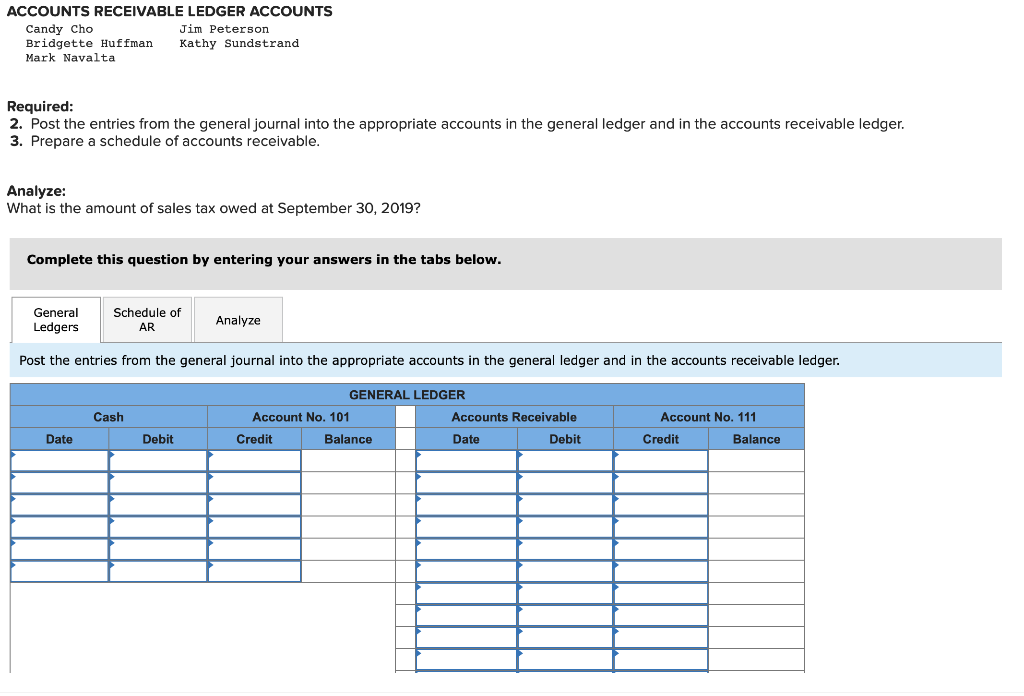

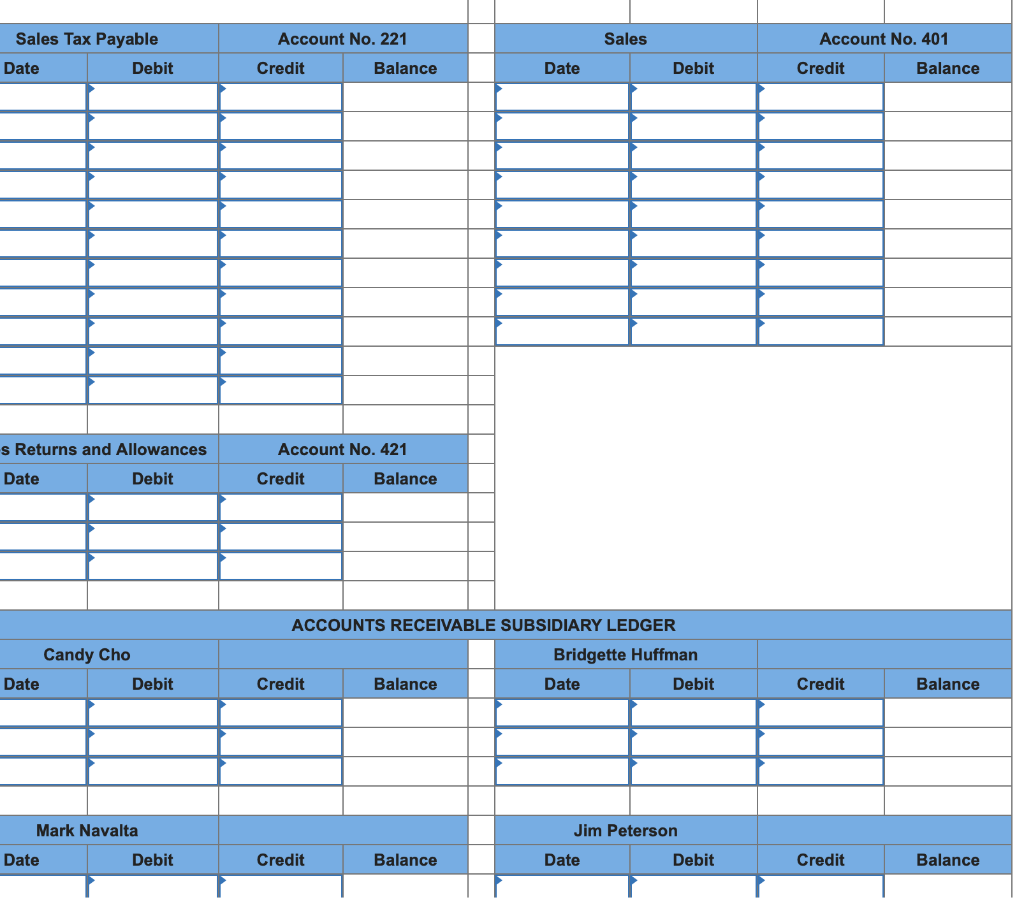

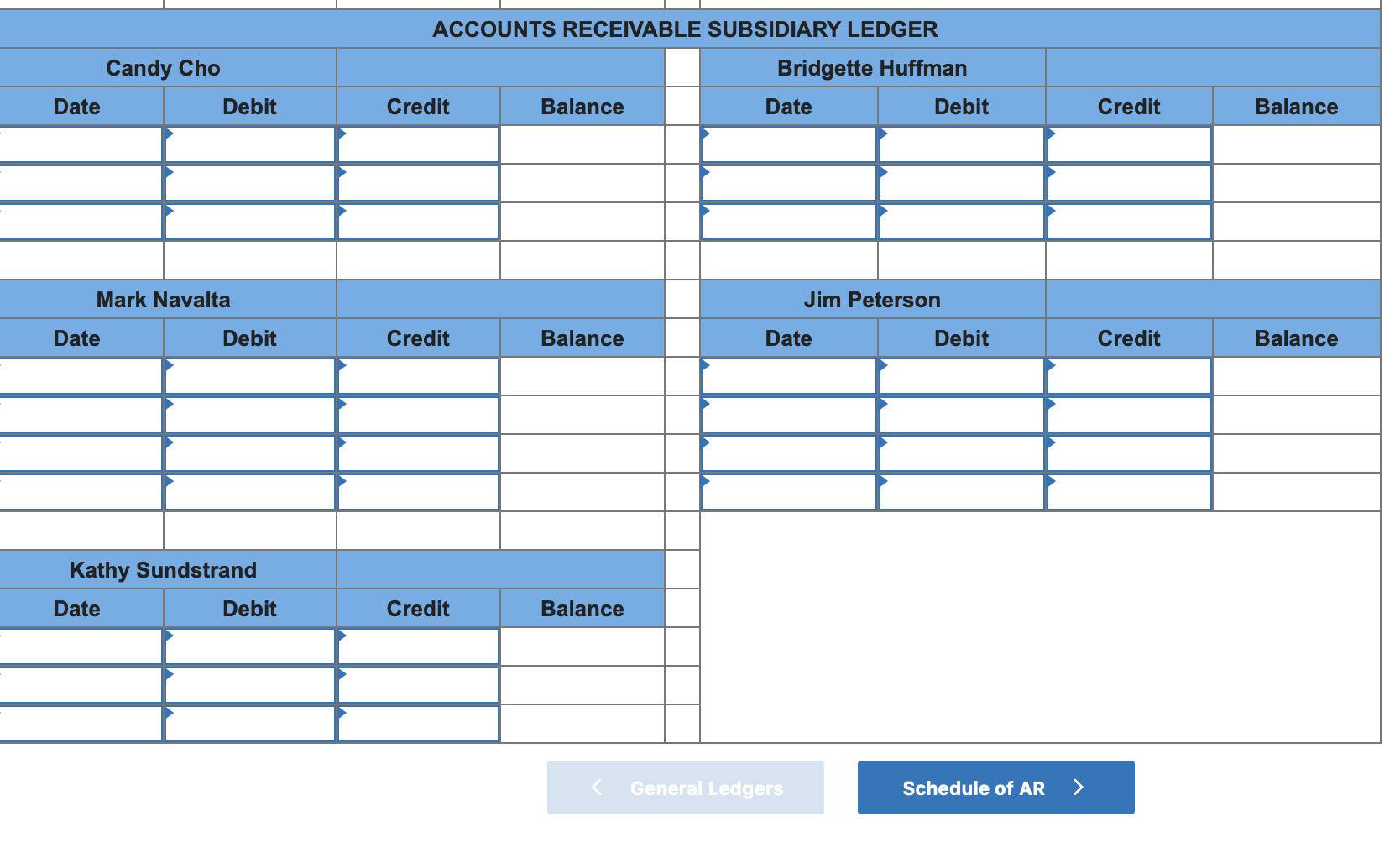

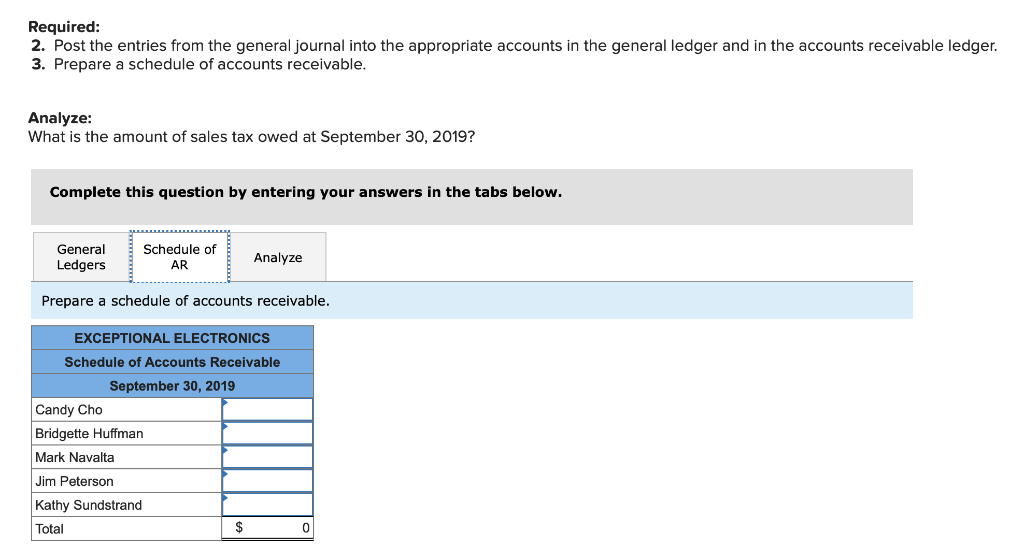

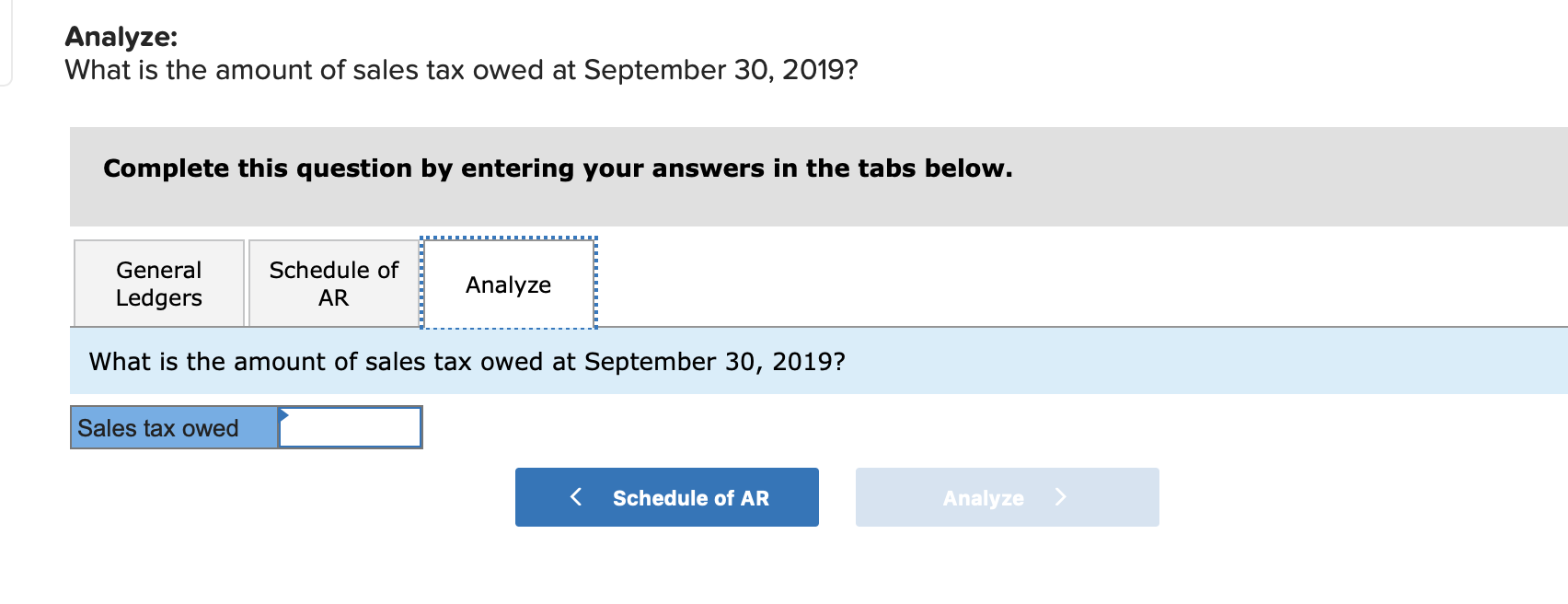

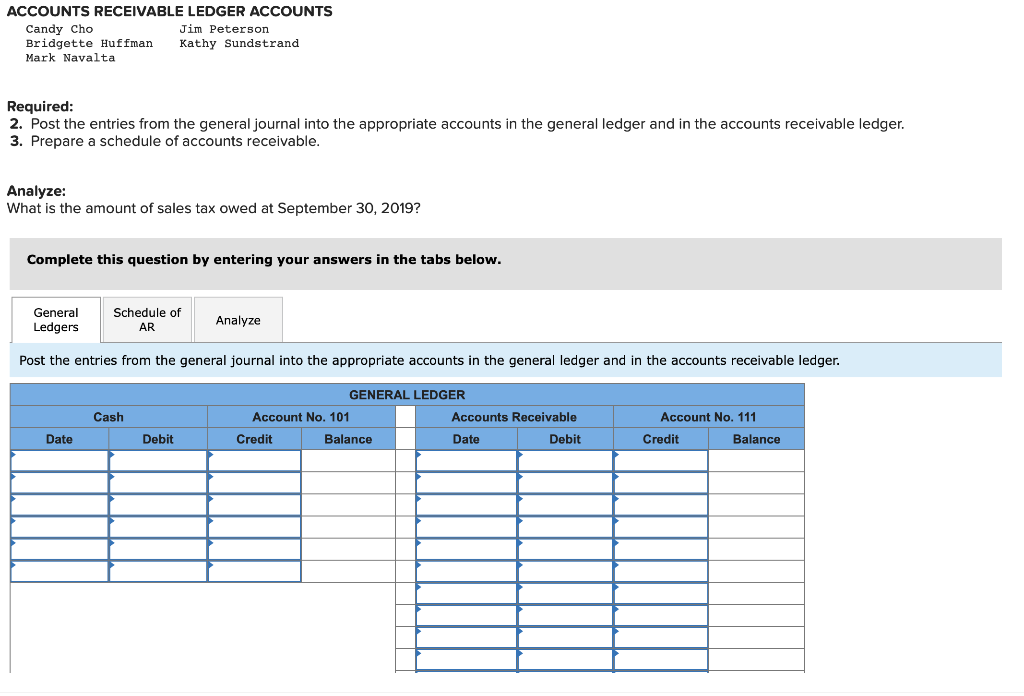

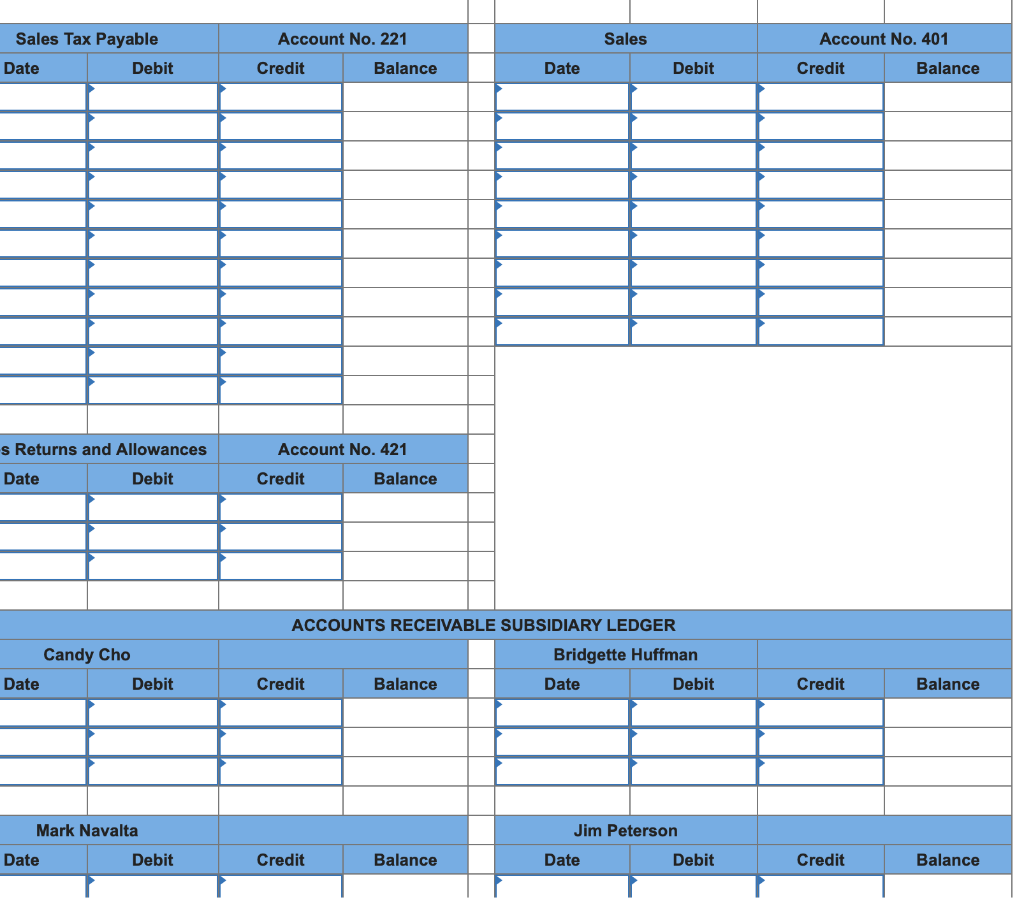

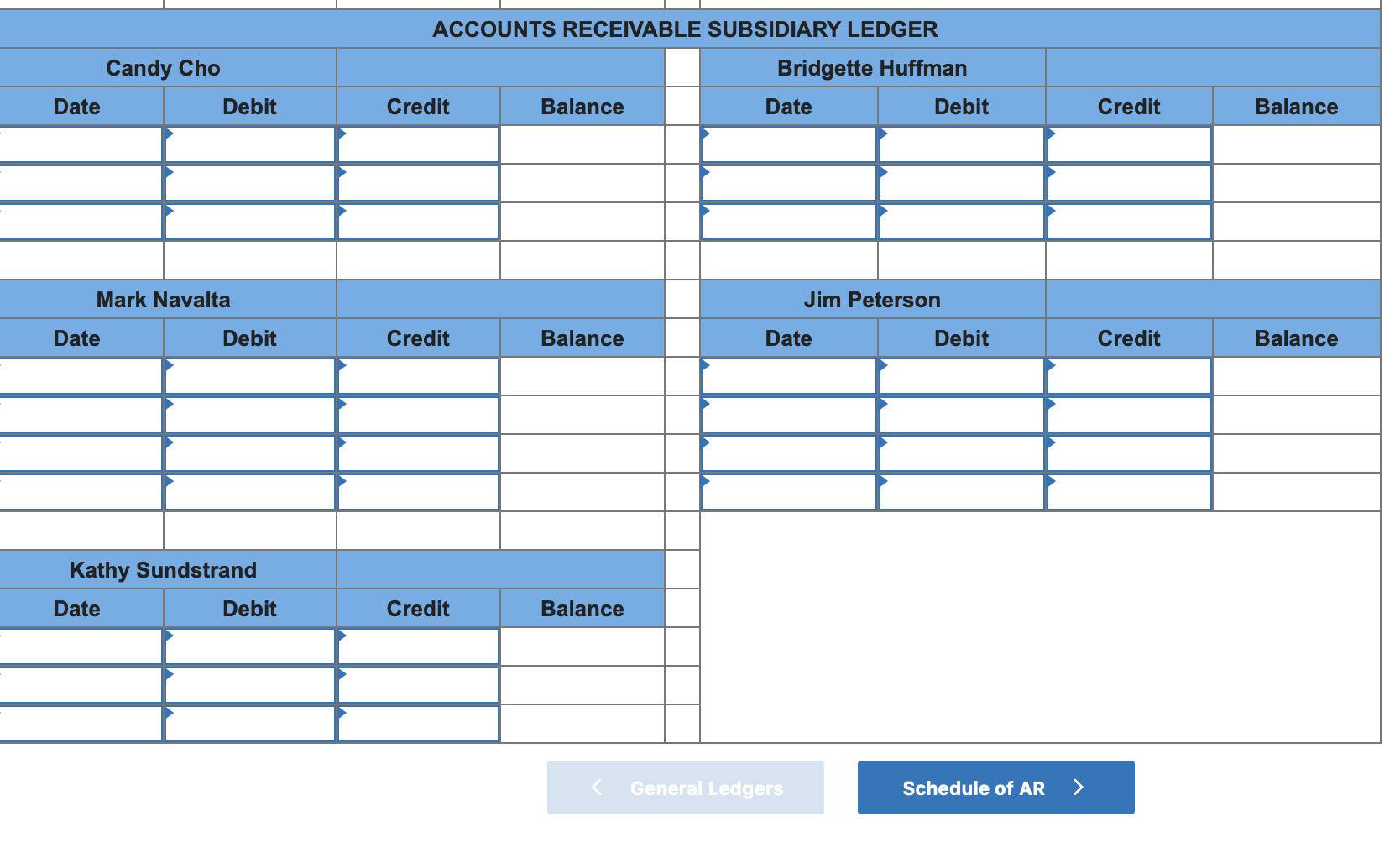

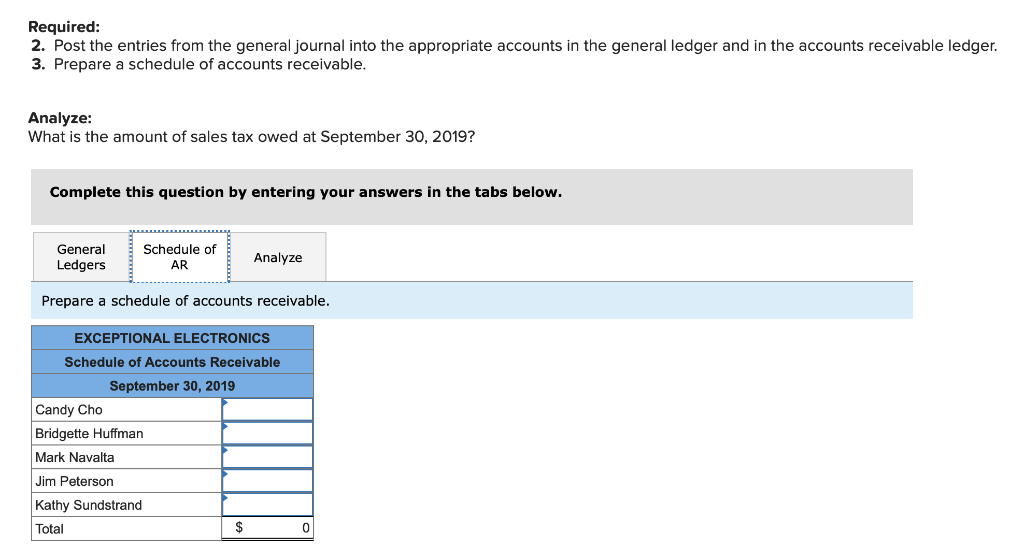

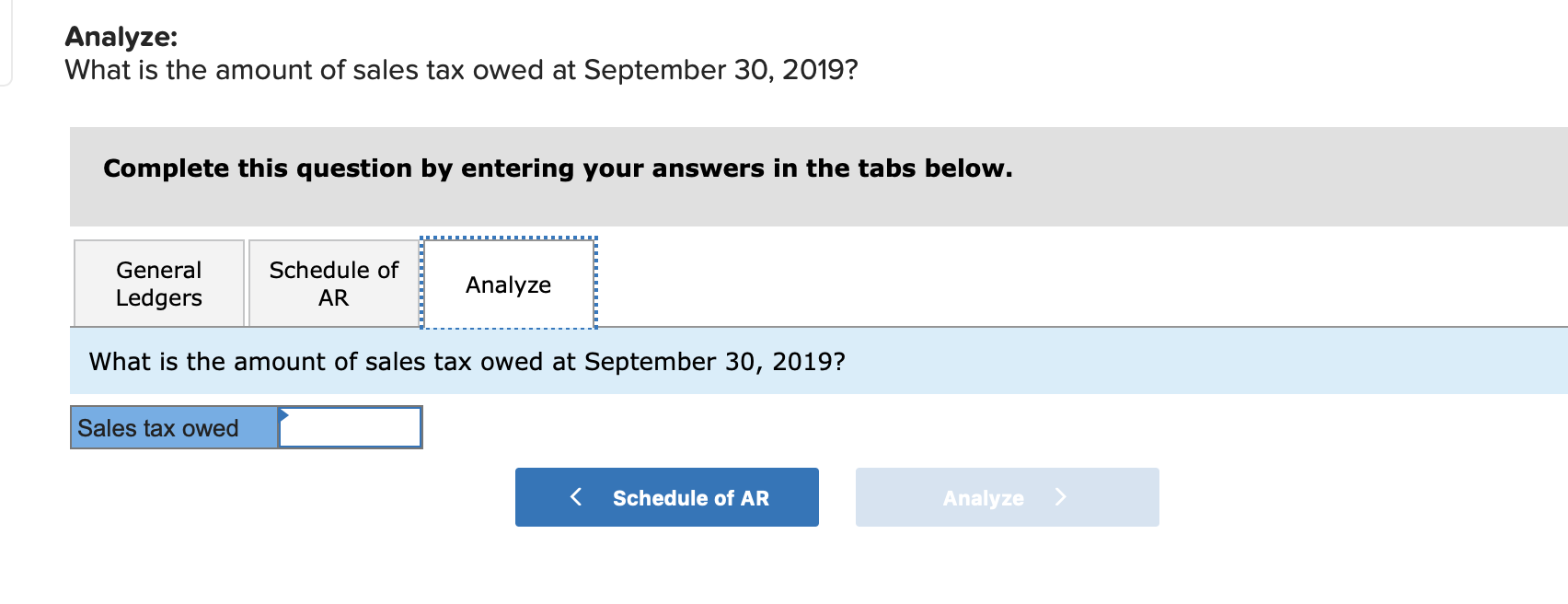

Exceptional Electronics began operations September 1, 2019. The firm sells its merchandise for cash and on open account. Sales are subject to a 7 percent sales tax. During September, Exceptional Electronics engaged in the following transactions. TRANSACTIONS DATE 2019 Sept. 1 3 12 16 17 Sold a high-definition television set on credit to Candy Cho; issued Sales Slip 101 for $3,000 plus sales tax of $210. Sold stereo equipment on credit to Jim Peterson; issued Sales Slip 102 for $900 plus sales tax of $63. Sold a microwave oven on credit to Bridgette Huffman; issued Sales Slip 103 for $200 plus sales tax of $14. Accepted return of defective stereo equipment from Jim Peterson; issued Credit Memorandum 101 for $100 plus sales tax of $7. The stereo equipment was sold on September 3. Recorded cash sales for the period from September 1 to September 15 of $9,200 plus sales tax of $644. Sold a gas dryer on credit to Kathy Sundstrand; issued Sales Slip 104 for $500 plus sales tax of $35. Sold a home entertainment system on credit to Mark Navalta; issued Sales Slip 105 for $2,000 plus sales tax of $140. Received $760 from Candy Cho on account. Received payment in full from Jim Peterson for the sale of September 3, less the return of September 12. Gave Mark Navalta an allowance because of scratches on his home entertainment system sold on September 17, Sales Slip 105; issued Credit Memorandum 102 for $200 plus sales tax of $14 Received payment in full from Bridgette Huffman for the sale of September 7 Sold a dishwasher on credit to Mark Navalta; issued Sales Slip 106 for $600 plus sales tax of $42. Recorded cash sales for the period from September 16 to September 30 of $11,700 plus sales tax of $819. 18 25 27 29 30 GENERAL LEDGER ACCOUNTS 101 Cash 111 Accounts Receivable 221 Sales Tax Payable 401 Sales 421 Sales Returns and Allowances ACCOUNTS RECEIVABLE LEDGER ACCOUNTS ACCOUNTS RECEIVABLE LEDGER ACCOUNTS Candy Cho Jim Peterson Bridgette Huffman Kathy Sundstrand Mark Navalta Required: 2. Post the entries from the general journal into the appropriate accounts in the general ledger and in the accounts receivable ledger. 3. Prepare a schedule of accounts receivable. Analyze: What is the amount of sales tax owed at September 30, 2019? Complete this question by entering your answers in the tabs below. General Ledgers Schedule of AR Analyze Post the entries from the general journal into the appropriate accounts in the general ledger and in the accounts receivable ledger. Cash GENERAL LEDGER Account No. 101 Accounts Receivable Credit Balance Date Debit Account No. 111 Credit Balance Date Debit Sales Sales Tax Payable Date Debit Account No. 221 Credit Balance Account No. 401 Credit Balance Date Debit s Returns and Allowances Date Debit Account No. 421 Credit Balance | Candy Cho Date Debit ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Bridgette Huffman Credit Balance Date Debit Credit Balance Mark Navalta Date Debit Jim Peterson Date Debit Credit Balance Credit Balance Candy Cho ACCOUNTS RECEIVABLE SUBSIDIARY LEDGER Bridgette Huffman Credit Balance Date Debit Date Debit Credit Balance Mark Navalta Date Debit Jim Peterson Date Debit Credit Balance Credit Balance Kathy Sundstrand Date Debit Credit Balance Required: 2. Post the entries from the general journal into the appropriate accounts in the general ledger and in the accounts receivable ledger. 3. Prepare a schedule of accounts receivable. Analyze: What is the amount of sales tax owed at September 30, 2019? Complete this question by entering your answers in the tabs below. General Ledgers Schedule of AR Analyze Prepare a schedule of accounts receivable. EXCEPTIONAL ELECTRONICS Schedule of Accounts Receivable September 30, 2019 Candy Cho Bridgette Huffman Mark Navalta Jim Peterson Kathy Sundstrand Total $ 0 Analyze: What is the amount of sales tax owed at September 30, 2019? Complete this question by entering your answers in the tabs below. Schedule of General Ledgers ART Analyze What is the amount of sales tax owed at September 30, 2019? Sales tax owed Schedule of AR Analyze >