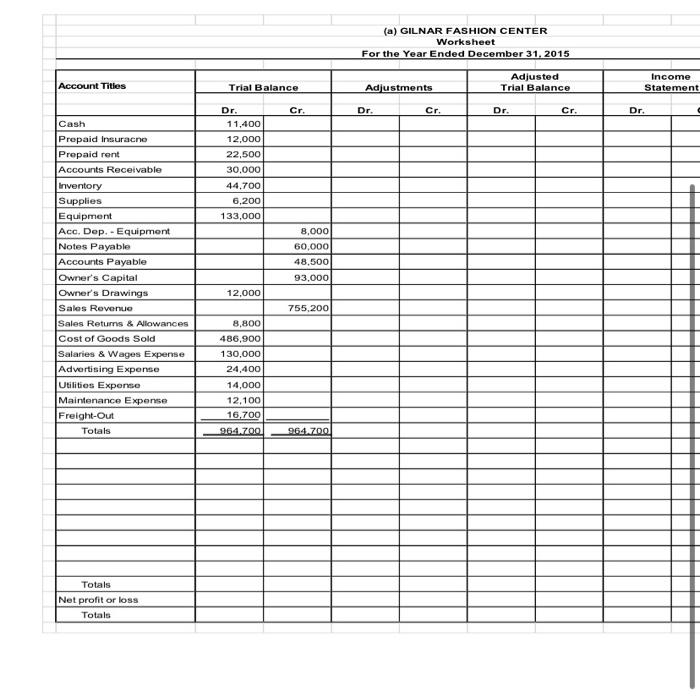

Excercise One: The worksheet for GILNAR FASHION CENTER appears below. Using the adjustment data below, 1) complete the worksheet. Add any accounts that are necessary. 2) Prepare (a) an income statement and (b) owner's equity statement for the year ended December 31, 2015 and (c) Classified balance sheet as on December 31, 2015. Knowing that the owner didn't make any additonal investments in the business during the year. 3) Journalize the adjusting entries as on December 31, 2015 Adjustment data: (a) Supplies on hand on December 31 amounted to $2,500. (b) Depreciation expense on equipment is calculated using straight line method, estimated salvage value is $18,000 at the end of its expected useful life of 10 years. (c) The Notes payable was signed on July 1, 2015 for five years. Interest payable is at 12% per annum but this has not been recorded anywhere as at December 31, 2015. (d) A physical count of inventory at year end indicates that $44,400 are still actually on hand. (e) The company has estimated that 2% of accounts receivable balance will not be collected, knowing that Allowance for doubtful debt balance as on December 31, 2015 is zero. (f) Salaries and wages expense incurred at December 31 but not yet paid amounted to $10,000. (g) The prepaid insurance was made on April 1, 2015 for one year. (h) Prepaid rent was made on January 1, 2015 for two years. (a) GILNAR FASHION CENTER Worksheet For the Year Ended December 31, 2015 Account Titles Trial Balance Adjustments Adjusted Trial Balance Income Statement Cr. Dr. Cr. Dr. Cr. Dr. Dr. 11.400 Cash Prepaid Insuracne Prepaid rent 12.000 22,500 30,000 44,700 Accounts Receivable 6.200 133,000 8.000 60.000 48.500 93.000 12,000 Inventory Supplies Equipment Acc. Dep. - Equipment Notes Payable Accounts Payable Owner's Capital Owner's Drawings Sales Revenue Sales Returns & Allowances Cost of Goods Sold Salaries & Wages Expense Advertising Expense Utilities Expense Maintenance Expense Freight-Out Totals 755.2001 8,800 486,900 130,000 24,400 14,000 12.100 16.700 964.700 964.700 Totals Net profit or loss Totals (a) GILNAR FASHION CENTER Worksheet For the Year Ended December 31, 2015 Account Titles Trial Balance Adjustments Adjusted Trial Balance Income Statement Cr. Dr. Cr. Dr. Cr. Dr. Dr. 11.400 Cash Prepaid Insuracne Prepaid rent 12.000 22,500 30,000 44,700 Accounts Receivable 6.200 133,000 8.000 60.000 48.500 93.000 12,000 Inventory Supplies Equipment Acc. Dep. - Equipment Notes Payable Accounts Payable Owner's Capital Owner's Drawings Sales Revenue Sales Returns & Allowances Cost of Goods Sold Salaries & Wages Expense Advertising Expense Utilities Expense Maintenance Expense Freight-Out Totals 755.2001 8,800 486,900 130,000 24,400 14,000 12.100 16.700 964.700 964.700 Totals Net profit or loss Totals