Question

Excerpts from Phillips 66s financial statements, from their December 31, 2019 10-K are presented. Watch the dates on the statements. The year 2019 means the

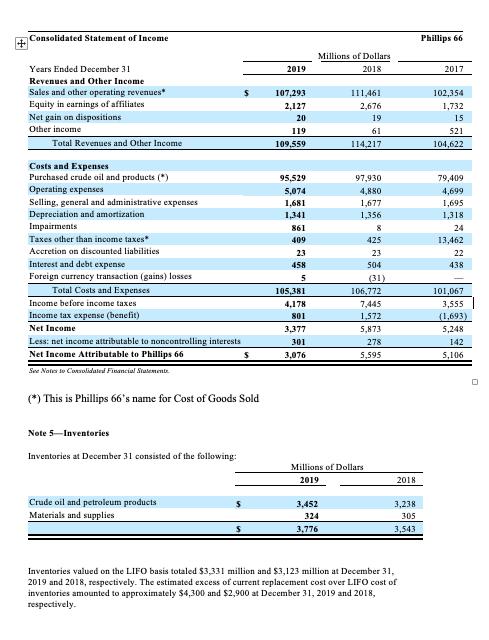

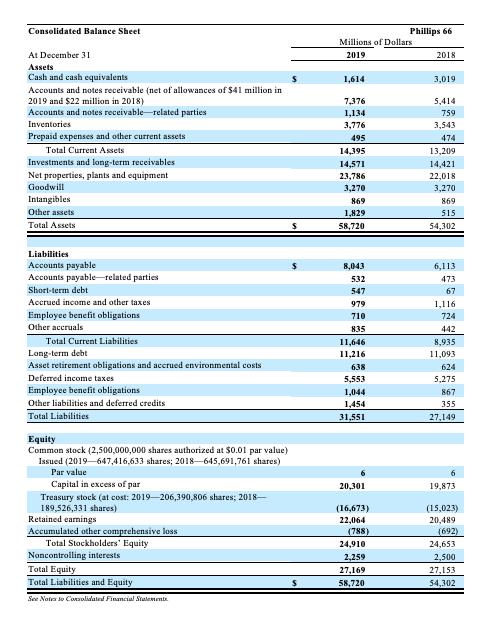

Excerpts from Phillips 66’s financial statements, from their December 31, 2019 10-K are presented. Watch the dates on the statements. The year 2019 means the year ended December 31, 2019. Like the statements, all numbers are in millions of dollars.

1) Had Phillips 66 always used FIFO to account for all of their inventories, what would have been Phillips 66’s debt-to-equity ratio (defined as total liabilities divided by total equity) as of December 31, 2019? Assume that Phillips 66 faces a 20% marginal tax rate and that any differences in taxes would be reflected in “Accrued income and other taxes” on the balance sheet. Please express your answer to two decimal places (i.e., 1.23, not 1.2). ______________

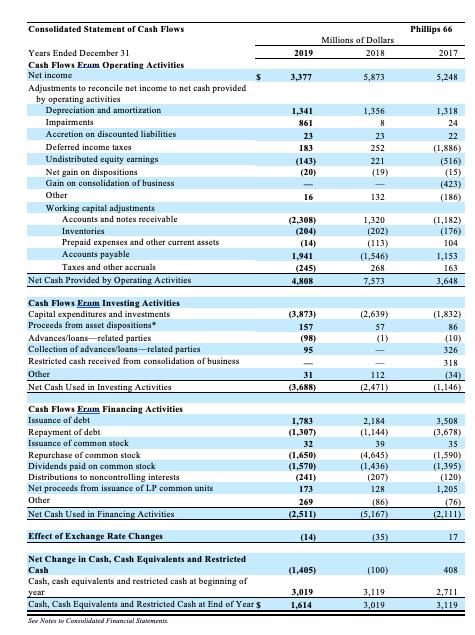

Consolidated Statement of Cash Flows Years Ended December 31 Cash Flows Eram Operating Activities Net income Adjustments to reconcile net income to net cash provided by operating activities Depreciation and amortization Impairments Accretion on discounted liabilities Deferred income taxes Undistributed equity earnings Net gain on dispositions Gain on consolidation of business Other Working capital adjustments Accounts and notes receivable Inventories Prepaid expenses and other current assets Accounts payable Taxes and other accruals Net Cash Provided by Operating Activities Cash Flows From Investing Activities Capital expenditures and investments Proceeds from asset dispositions Advances/loans related parties Collection of advances/loans-related parties Restricted cash received from consolidation of business Other Net Cash Used in Investing Activities Cash Flows From Financing Activities Issuance of debt Repayment of debt Issuance of common stock Repurchase of common stock Dividends paid on common stock Distributions to noncontrolling interests Net proceeds from issuance of LP common units Other Net Cash Used in Financing Activities Effect of Exchange Rate Changes Net Change in Cash, Cash Equivalents and Restricted Cash Cash, cash equivalents and restricted cash at beginning of year Cash, Cash Equivalents and Restricted Cash at End of Year $ See Notes to Consolidated Financial Statements 2019 3,377 1,341 861 23 183 (143) (20) 16 (2,308) (204) (14) 1.941 (245) 4,808 (3,873) 157 (98) 95 31 (3,688) 1,783 (1,307) 32 (1,650) (1,570) (241) 173 269 (2,511) (14) (1,405) 3,019 1,614 Millions of Dollars 2018 5,873 1,356 8 23 252 221 (19) 132 1,320 (202) (113) (1,546) 268 7,573 (2,639) 57 (1) 112 (2,471) 2,184 (1,144) 39 (4,645) (1,436) (207) 128 (86) (5,167) (35) (100) 3,119 3,019 Phillips 66 2017 5,248 1,318 24 22 (1,886) (516) (15) (423) (186) (1,182) (176) 104 1,153 163 3,648 (1,832) 86 (10) 326 318 (34) (1,146) 3,508 (3,678) 35 (1,590) (1,395) (120) 1,205 (76) (2,111) 17 408 2,711 3,119

Step by Step Solution

3.58 Rating (180 Votes )

There are 3 Steps involved in it

Step: 1

Given Debt Equity Ratio DebtEquity Debt Fixed Interest Payment Liability Eq...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started