Question

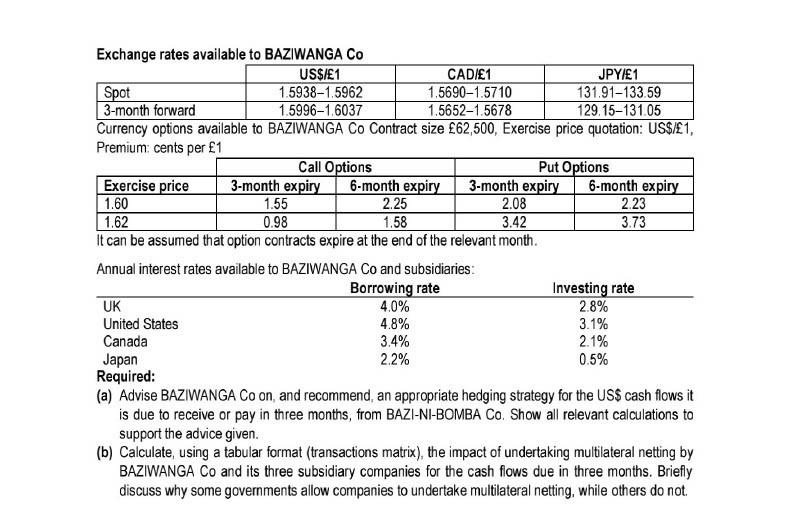

Exchange rates available to BAZIWANGA Co Spot 3-month forward US$/1 1.5938-1.5962 1.5996-1.6037 CAD/1 1.5690-1.5710 1.5652-1.5678 JPY/1 131.91-133.59 129.15-131.05 Currency options available to BAZIWANGA Co

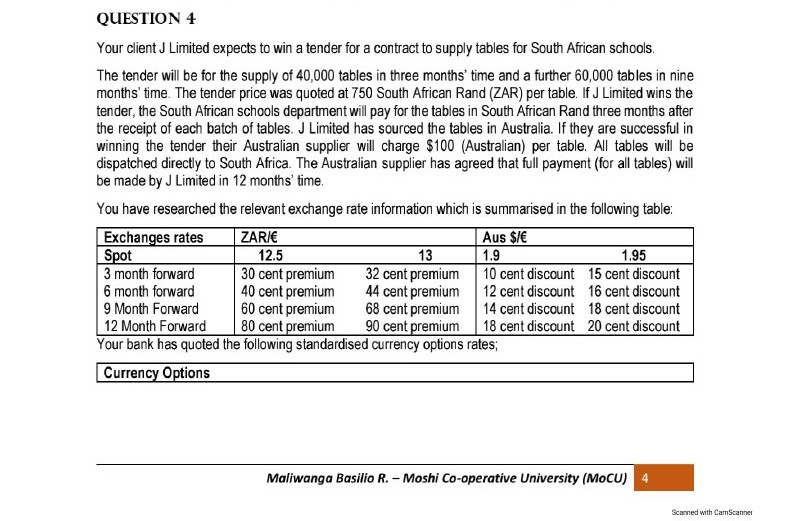

Exchange rates available to BAZIWANGA Co Spot 3-month forward US$/1 1.5938-1.5962 1.5996-1.6037 CAD/1 1.5690-1.5710 1.5652-1.5678 JPY/1 131.91-133.59 129.15-131.05 Currency options available to BAZIWANGA Co Contract size 62,500, Exercise price quotation: US$/1, Premium: cents per 1 Exercise price 1.60 1.62 Call Options 3-month expiry Put Options 6-month expiry 3-month expiry 6-month expiry 1.55 2.25 2.08 2.23 0.98 1.58 3.42 3.73 It can be assumed that option contracts expire at the end of the relevant month. Annual interest rates available to BAZIWANGA Co and subsidiaries: UK United States Canada Japan Required: Borrowing rate 4.0% 4.8% 3.4% 2.2% Investing rate 2.8% 3.1% 2.1% 0.5% (a) Advise BAZIWANGA Co on, and recommend, an appropriate hedging strategy for the US$ cash flows it is due to receive or pay in three months, from BAZI-NI-BOMBA Co. Show all relevant calculations to support the advice given. (b) Calculate, using a tabular format (transactions matrix), the impact of undertaking multilateral netting by BAZIWANGA Co and its three subsidiary companies for the cash flows due in three months. Briefly discuss why some governments allow companies to undertake multilateral netting, while others do not. QUESTION 4 Your client J Limited expects to win a tender for a contract to supply tables for South African schools. The tender will be for the supply of 40,000 tables in three months' time and a further 60,000 tables in nine months' time. The tender price was quoted at 750 South African Rand (ZAR) per table. If J Limited wins the tender, the South African schools department will pay for the tables in South African Rand three months after the receipt of each batch of tables. J Limited has sourced the tables in Australia. If they are successful in winning the tender their Australian supplier will charge $100 (Australian) per table. All tables will be dispatched directly to South Africa. The Australian supplier has agreed that full payment (for all tables) will be made by J Limited in 12 months' time. You have researched the relevant exchange rate information which is summarised in the following table: Exchanges rates Spot ZARI 12.5 Aus $/ 1.9 13 3 month forward 30 cent premium 32 cent premium 6 month forward 40 cent premium 44 cent premium 9 Month Forward 60 cent premium 68 cent premium 12 Month Forward 80 cent premium 90 cent premium 10 cent discount 12 cent discount 14 cent discount 18 cent discount 1.95 15 cent discount 16 cent discount 18 cent discount 20 cent discount Your bank has quoted the following standardised currency options rates; Currency Options Maliwanga Basilio R. - Moshi Co-operative University (MoCU) 4 Scanned with CamScanner

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access with AI-Powered Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started