Answered step by step

Verified Expert Solution

Question

1 Approved Answer

(exchange rates) Burton Manufacturing. Jason Stedman is the director of finance for Burton Manufacturing, a U.S.-based manufacturer of handheld computer systems for inventory management. Burton's

(exchange rates)

(exchange rates)

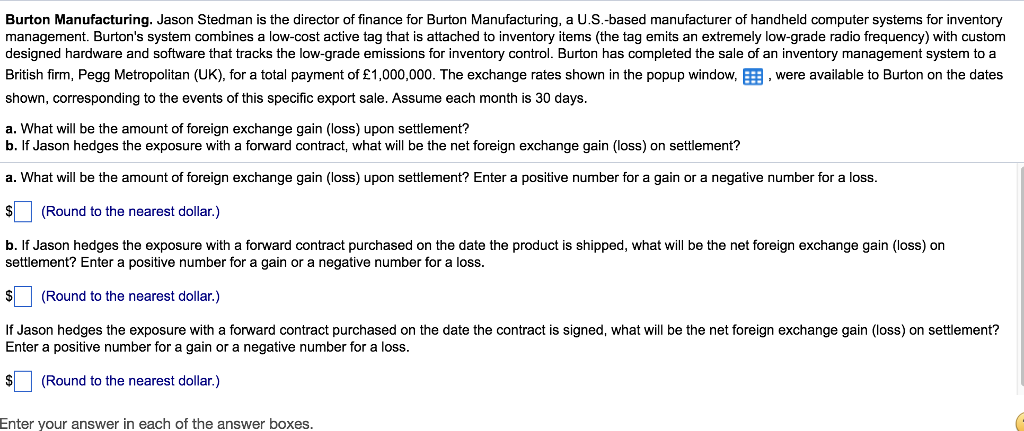

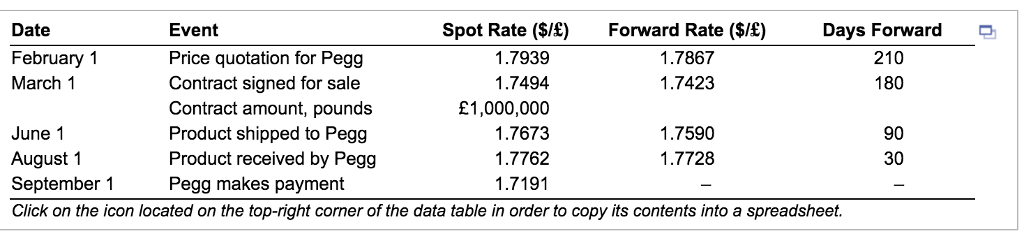

Burton Manufacturing. Jason Stedman is the director of finance for Burton Manufacturing, a U.S.-based manufacturer of handheld computer systems for inventory management. Burton's system combines a low-cost active tag that is attached to inventory items (the tag emits an extremely low-grade radio frequency) with custom designed hardware and software that tracks the low-grade emissions for inventory control. Burton has completed the sale of an inventory management system to a British firm, Pegg Metropolitan (UK), for a total payment of 1,000,000. The exchange rates shown in the popup window, were available to Burton on the dates shown, corresponding to the events of this specific export sale. Assume each month is 30 days a. What will be the amount of foreign exchange gain (loss) upon settlement? b. If Jason hedges the exposure with a forward contract, what will be the net foreign exchange gain (loss) on settlement? a. What will be the amount of foreign exchange gain (loss) upon settlement? Enter a positive number for a gain or a negative number for a loss (Round to the nearest dollar. b. If Jason hedges the exposure with a forward contract purchased on the date the product is shipped, what will be the net foreign exchange gain (loss) o settlement? Enter a positive number for a gain or a negative number for a loss. Round to the nearest dollar.) If Jason hedges the exposure with a forward contract purchased on the date the contract is signed, what will be the net foreign exchange gain (loss) on settlement? Enter a positive number for a gain or a negative number for a loss. (Round to the nearest dollar.) Enter your answer in each of the answer boxes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started