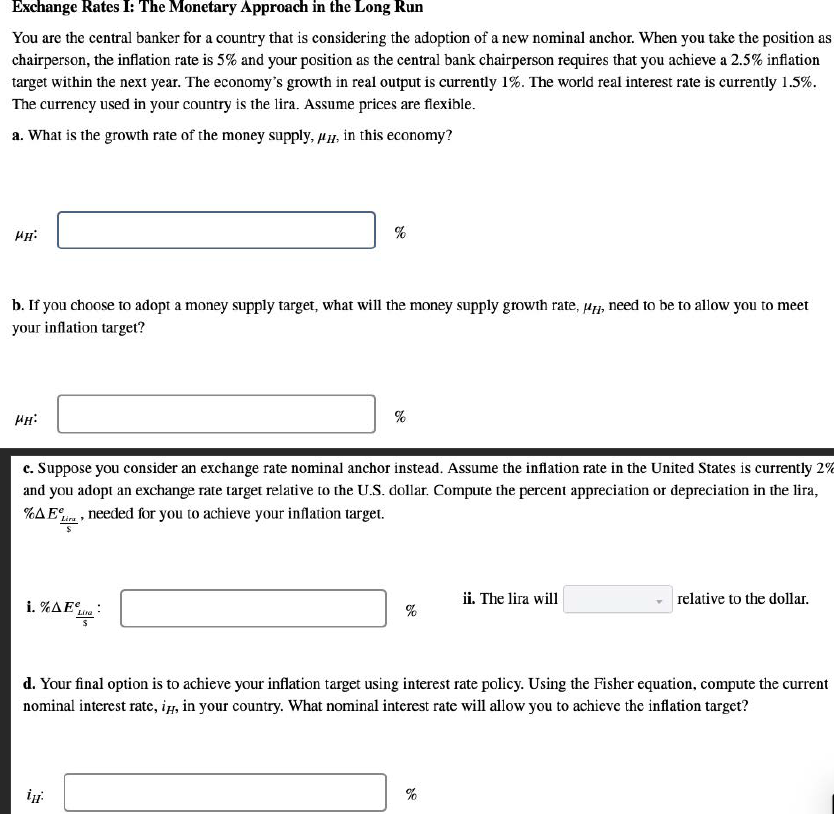

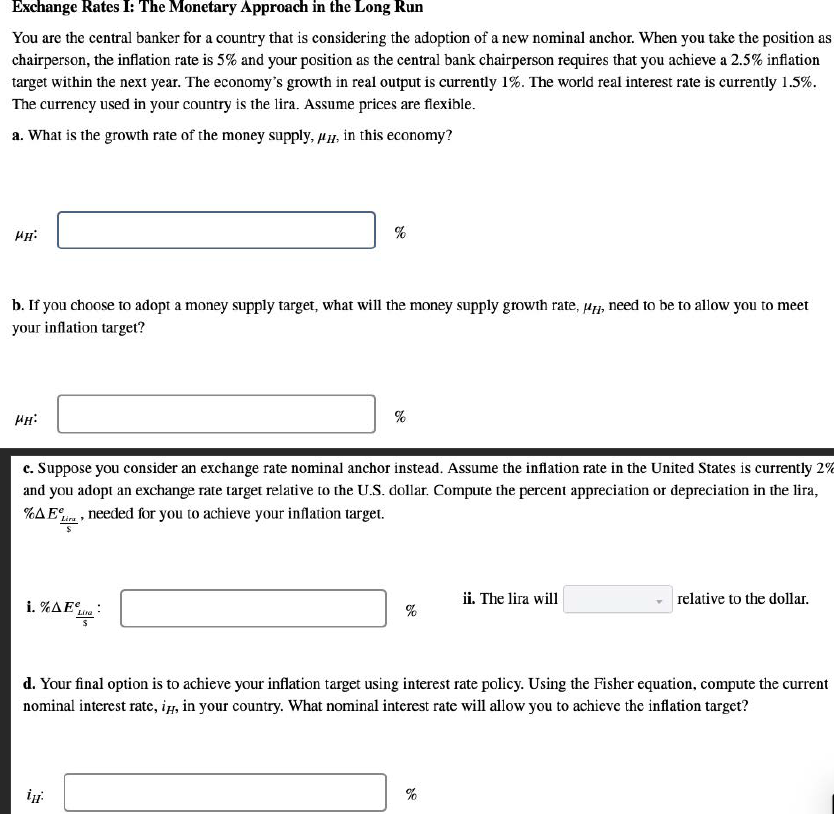

Exchange Rates I: The Monetary Approach in the Long Run You are the central banker for a country that is considering the adoption of a new nominal anchor. When you take the position as chairperson, the inflation rate is 5% and your position as the central bank chairperson requires that you achieve a 2.5% inflation target within the next year. The economy's growth in real output is currently 1%. The world real interest rate is currently 1.5%. The currency used in your country is the lira. Assume prices are flexible. a. What is the growth rate of the money supply, H, in this economy? H: % b. If you choose to adopt a money supply target, what will the money supply growth rate, H, need to be to allow you to meet your inflation target? H c c. Suppose you consider an exchange rate nominal anchor instead. Assume the inflation rate in the United States is currently 2% and you adopt an exchange rate target relative to the U.S. dollar. Compute the percent appreciation or depreciation in the lira, %EsLinse, needed for you to achieve your inflation target. ii. The lira will relative to the dollar. d. Your final option is to achieve your inflation target using interest rate policy. Using the Fisher equation, compute the current nominal interest rate, iH, in your country. What nominal interest rate will allow you to achieve the inflation target? Exchange Rates I: The Monetary Approach in the Long Run You are the central banker for a country that is considering the adoption of a new nominal anchor. When you take the position as chairperson, the inflation rate is 5% and your position as the central bank chairperson requires that you achieve a 2.5% inflation target within the next year. The economy's growth in real output is currently 1%. The world real interest rate is currently 1.5%. The currency used in your country is the lira. Assume prices are flexible. a. What is the growth rate of the money supply, H, in this economy? H: % b. If you choose to adopt a money supply target, what will the money supply growth rate, H, need to be to allow you to meet your inflation target? H c c. Suppose you consider an exchange rate nominal anchor instead. Assume the inflation rate in the United States is currently 2% and you adopt an exchange rate target relative to the U.S. dollar. Compute the percent appreciation or depreciation in the lira, %EsLinse, needed for you to achieve your inflation target. ii. The lira will relative to the dollar. d. Your final option is to achieve your inflation target using interest rate policy. Using the Fisher equation, compute the current nominal interest rate, iH, in your country. What nominal interest rate will allow you to achieve the inflation target