Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ex?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question mework, part 1 Saved Exercise 3-4 Preparing adjusting entries (annual)-depreciation LO4 Mean Beans, a local coffee shop, has the following assets on January 1,

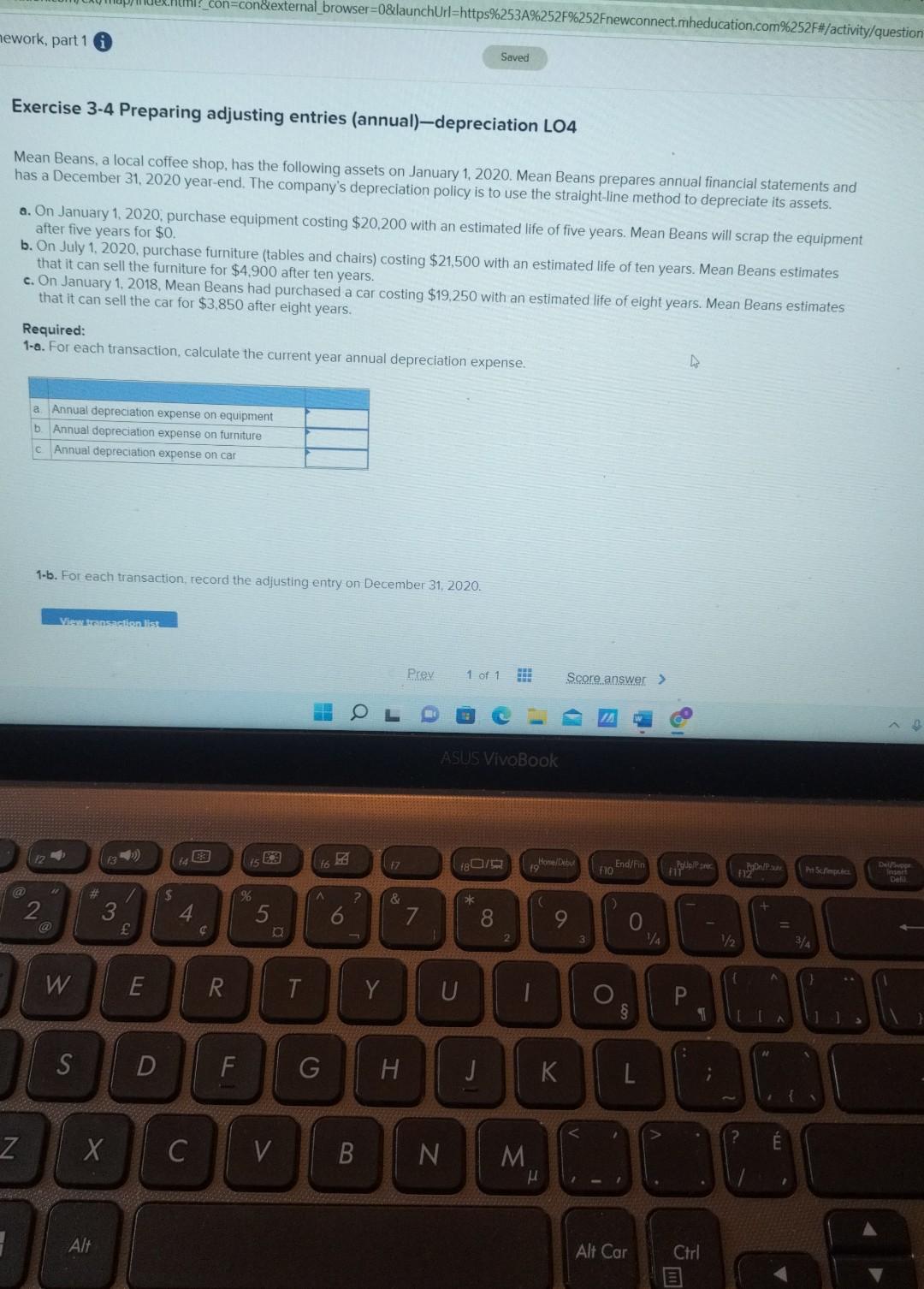

ex?_con=con&external_browser=0&launchUrl=https%253A%252F%252Fnewconnect.mheducation.com%252F#/activity/question mework, part 1 Saved Exercise 3-4 Preparing adjusting entries (annual)-depreciation LO4 Mean Beans, a local coffee shop, has the following assets on January 1, 2020. Mean Beans prepares annual financial statements and has a December 31, 2020 year-end. The company's depreciation policy is to use the straight-line method to depreciate its assets. a. On January 1, 2020, purchase equipment costing $20,200 with an estimated life of five years. Mean Beans will scrap the equipment after five years for $0. b. On July 1, 2020, purchase furniture (tables and chairs) costing $21,500 with an estimated life of ten years. Mean Beans estimates that it can sell the furniture for $4,900 after ten years. c. On January 1, 2018, Mean Beans had purchased a car costing $19,250 with an estimated life of eight years. Mean Beans estimates that it can sell the car for $3,850 after eight years. Required: 1-8. For each transaction, calculate the current year annual depreciation expense. 4 a Annual depreciation expense on equipment b. Annual depreciation expense on furniture c Annual depreciation expense on car 1-b. For each transaction, record the adjusting entry on December 31, 2020. View transaction list Prev OL # @ Z 3 2 W S 3 X Alt E D $ 4 C 1583 % 5 A ? 6 C 30 V 17 & 7 1 of 1 ASUS VivoBook 180/9 *k 8 2 19 R T Y U F G H J K B N M Hone/Debut ( 9 1 Score answer > 3 F10 End/Fin 0 L Alt Car 1/4 A Up/Pprec P 1 Ctrl PgDr/Pau + F12 { 11 Pt Scfimpics 3/4 Insert Defil

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started