Answered step by step

Verified Expert Solution

Question

1 Approved Answer

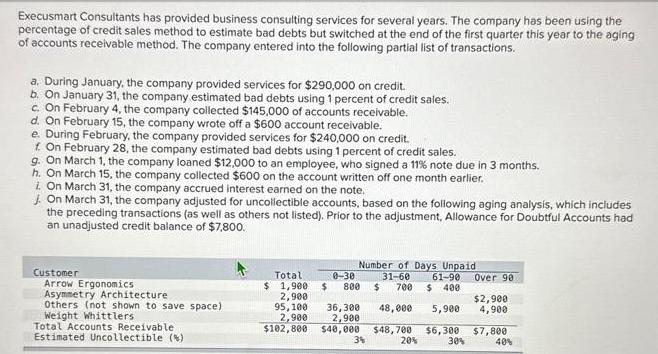

Execusmart Consultants has provided business consulting services for several years. The company has been using the percentage of credit sales method to estimate bad

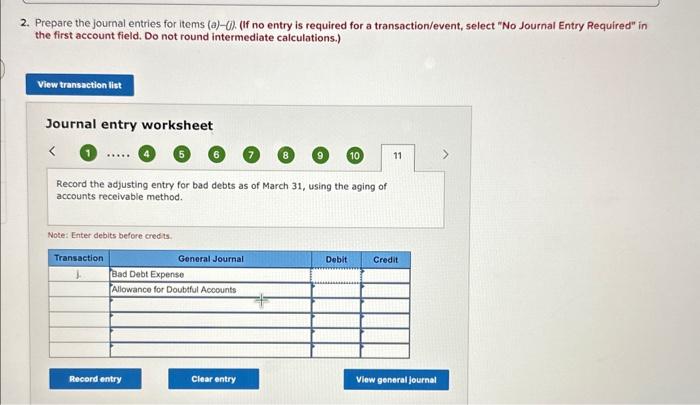

Execusmart Consultants has provided business consulting services for several years. The company has been using the percentage of credit sales method to estimate bad debts but switched at the end of the first quarter this year to the aging of accounts receivable method. The company entered into the following partial list of transactions. a. During January, the company provided services for $290,000 on credit. b. On January 31, the company estimated bad debts using 1 percent of credit sales. c. On February 4, the company collected $145,000 of accounts receivable. d. On February 15, the company wrote off a $600 account receivable. e. During February, the company provided services for $240,000 on credit. On February 28, the company estimated bad debts using 1 percent of credit sales. g. On March 1, the company loaned $12,000 to an employee, who signed a 11% note due in 3 months. h. On March 15, the company collected $600 on the account written off one month earlier. i. On March 31, the company accrued interest earned on the note. J. On March 31, the company adjusted for uncollectible accounts, based on the following aging analysis, which includes the preceding transactions (as well as others not listed). Prior to the adjustment, Allowance for Doubtful Accounts had an unadjusted credit balance of $7,800. Customer Arrow Ergonomics Asymmetry Architecture Others (not shown to save space) Weight Whittlers Total Accounts Receivable Estimated Uncollectible (%) $ 1,900 $ 800 $ 700 $ 400 Total 0-30 Number of Days Unpaid 31-60 61-90 Over 98 2,900 $2,900 95,100 2,900 $102,800 36,300 2,900 $40,000 48,000 5,900 4,900 $48,700 3% 20% $6,300 30% $7,800 40% 2. Prepare the journal entries for items (a)-(). (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) View transaction list Journal entry worksheet 8 10 11 Record the adjusting entry for bad debts as of March 31, using the aging of accounts receivable method. Note: Enter debits before credits. Transaction General Journal Debit Credit. Bad Debt Expense Allowance for Doubtful Accounts Record entry Clear entry View general journal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started