Answered step by step

Verified Expert Solution

Question

1 Approved Answer

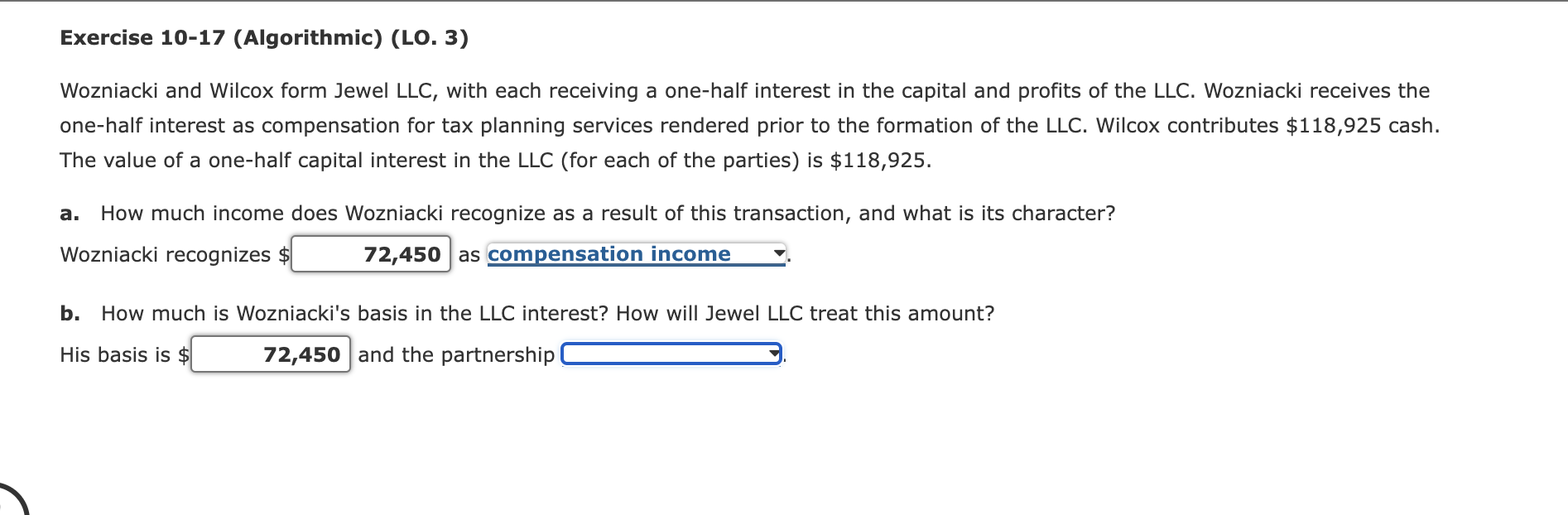

Exercise 1 0 - 1 7 ( Algorithmic ) ( LO . 3 ) Wozniacki and Wilcox form Jewel LLC , with each receiving a

Exercise AlgorithmicLO

Wozniacki and Wilcox form Jewel LLC with each receiving a onehalf interest in the capital and profits of the LLC Wozniacki receives the

onehalf interest as compensation for tax planning services rendered prior to the formation of the LLC Wilcox contributes $ cash.

The value of a onehalf capital interest in the LLC for each of the parties is $

a How much income does Wozniacki recognize as a result of this transaction, and what is its character?

Wozniacki recognizes $

as

b How much is Wozniacki's basis in the LLC interest? How will Jewel LLC treat this amount?

His basis is $

and the partnership

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started