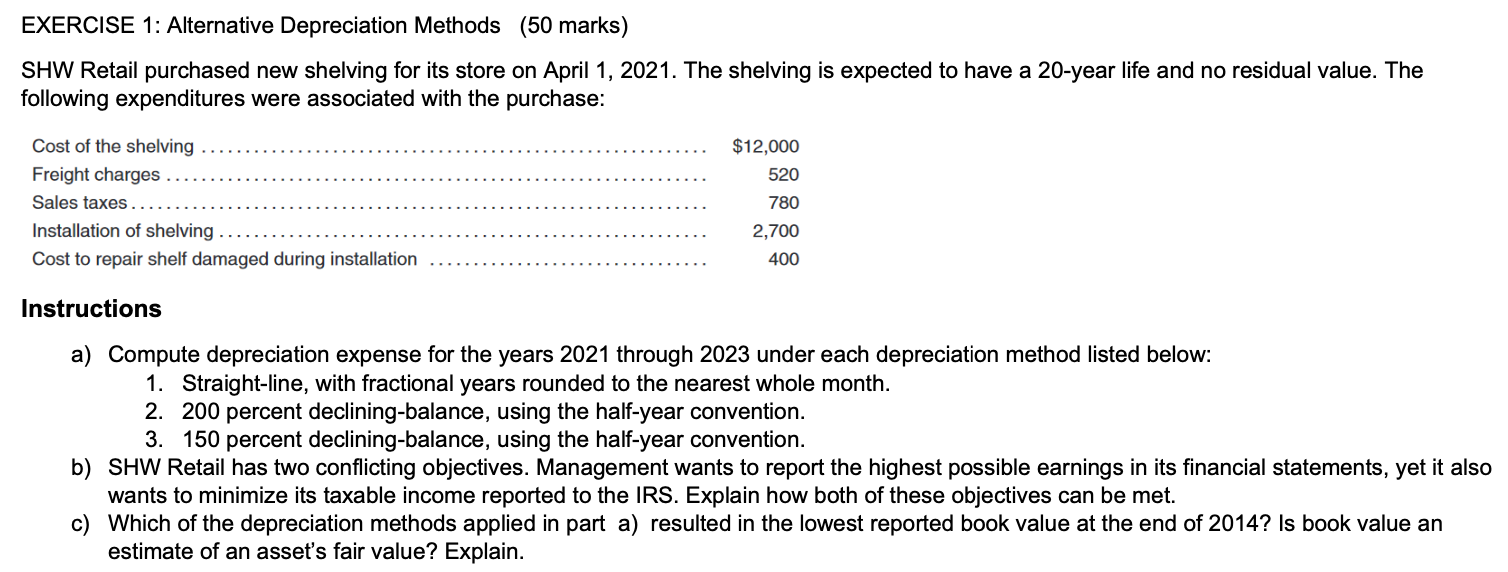

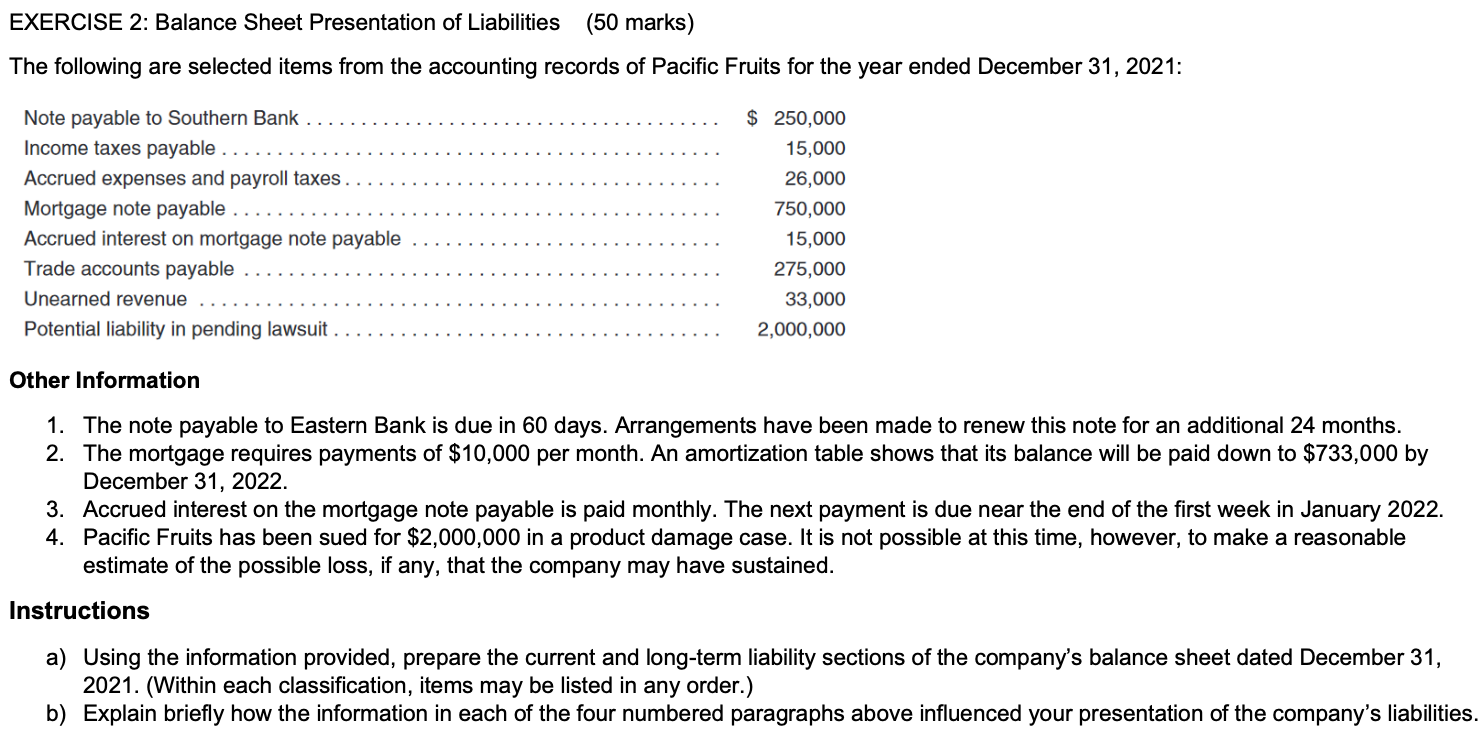

EXERCISE 1: Alternative Depreciation Methods (50 marks) SHW Retail purchased new shelving for its store on April 1, 2021. The shelving is expected to have a 20year life and no residual value. The following expenditures were associated with the purchase: Cost of the shelving .......................................................... $12.000 Freight charges .............................................................. 520 Sales taxes .................................................................. 780 Installation of shelving ........................................................ 2,700 Cost to repair shelf damaged during installation ................................ 400 Instructions a) Compute depreciation expense for the years 2021 through 2023 under each depreciation method listed below: 1. Straight-line, with fractional years rounded to the nearest whole month. 2. 200 percent declining-balance, using the half-year convention. 3. 150 percent declining-balance, using the half-year convention. b) SHW Retail has two conicting objectives. Management wants to report the highest possible earnings in its financial statements, yet it also wants to minimize its taxable income reported to the IRS. Explain how both of these objectives can be met. c) Which of the depreciation methods applied in part a) resulted in the lowest reported book value at the end of 2014? Is book value an estimate of an asset's fair value? Explain. EXERCISE 2: Balance Sheet Presentation of Liabilities (50 marks) The following are selected items from the accounting records of Pacic Fruits for the year ended December 31, 2021: Note payable to Southern Bank ..................................... $ 250,000 Income taxes payable ............................................. 15,000 Accrued expenses and payroll taxes .................................. 26,000 Mortgage note payable ............................................ 750.000 Accrued interest on mortgage note payable ............................ 15.000 Trade accounts payable ........................................... 275,000 Unearned revenue ............................................... 33,000 Potential liability in pending lawsuit ................................... 2,000,000 Other lnfonnation 1. The note payable to Eastern Bank is due in 60 days. Arrangements have been made to renew this note for an additional 24 months. 2. The mortgage requires payments of $10,000 per month. An amortization table shows that its balance will be paid down to $733,000 by December 31 , 2022. 3. Accrued interest on the mortgage note payable is paid monthly. The next payment is due near the end of the rst week in January 2022. 4. Pacific Fruits has been sued for $2,000,000 in a product damage case. It is not possible at this time, however, to make a reasonable estimate of the possible loss, if any, that the company may have sustained. Instructions a) Using the information provided, prepare the current and long-term liability sections of the company's balance sheet dated December 31, 2021. (Within each classification, items may be listed in any order.) b) Explain briey how the information in each of the four numbered paragraphs above inuenced your presentation of the company's liabilities