Exercise #1

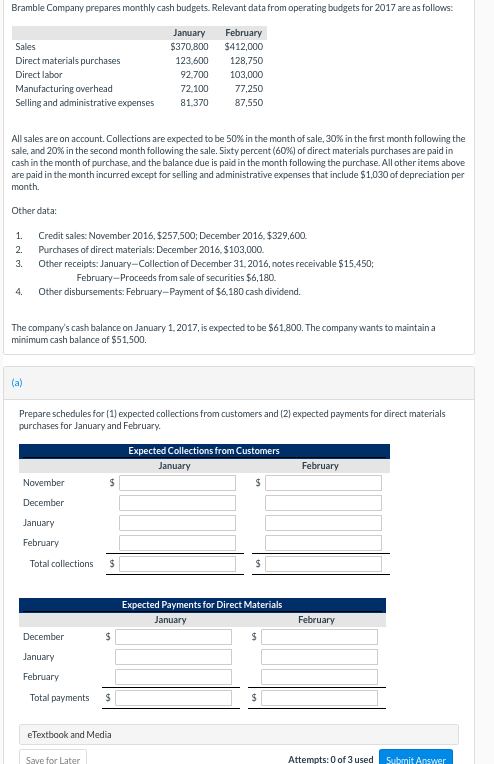

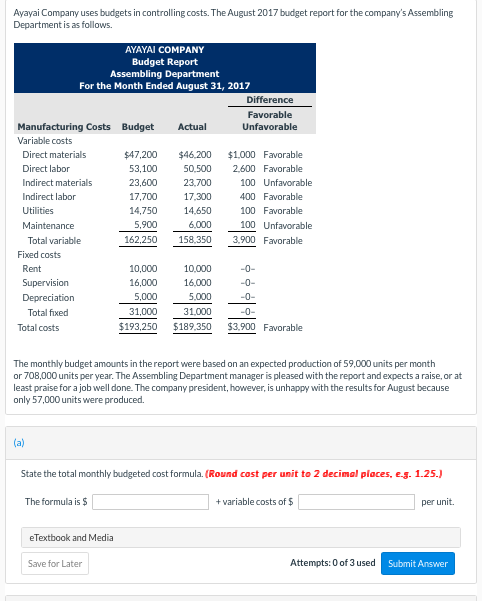

Bramble Company prepares monthly cash budgets. Relevant data from operating budgets for 2017 are as follows: January February Sales $370.800 $412,000 Direct materials purchases 123.600 128,750 Direct labor 92.700 103,000 Manufacturing overhead 72.100 77,250 Selling and administrative expenses 81.370 87,550 All sales are on account. Collections are expected to be 50% in the month of sale, 30%% in the first month following the sale, and 20%% in the second month following the sale. Sixty percent (60%4) of direct materials purchases are paid in cash in the month of purchase, and the balance due is paid in the month following the purchase. All other items above are paid in the month incurred except for selling and administrative expenses that include $1,030 of depreciation per month. Other data: 1. Credit sales: November 2016, $257,500; December 2016. $329,600. 2. Purchases of direct materials: December 2016, $103,000. 3. Other receipts: January-Collection of December 31, 2016, notes receivable $15.450; February-Proceeds from sale of securities $6, 180. 4. Other disbursements: February-Payment of $6.180 cash dividend. The company's cash balance on January 1, 2017, is expected to be $61,800. The company wants to maintain a minimum cash balance of $51,500. (a) Prepare schedules for (1) expected collections from customers and (2) expected payments for direct materials purchases for January and February. Expected Collections from Customers January February November December January February Total collections Expected Payments for Direct Materials January February December $ January February Total payments eTextbook and Media Attempts: 0 of 3 used Submit AnewAyayai Company uses budgets in controlling costs. The August 2017 budget report for the company's Assembling Department is as follows. AYAYAI COMPANY Budget Report Assembling Department For the Month Ended August 31, 2017 Difference Favorable Manufacturing Costs Budget Actual Unfavorable Variable costs Direct materials $47.200 $46.200 $1,000 Favorable Direct labor 53,100 50.500 2.600 Favorable Indirect materials 23,600 23.700 100 Unfavorable Indirect labor 17,700 17.300 400 Favorable Utilities 14,750 14.650 100 Favorable Maintenance 5,900 6.000 100 Unfavorable Total variable 162,250 158.350 3.900 Favorable Fixed costs Rent 10,000 10.000 -0- Supervision 16,000 16.000 -0- Depreciation 5,000 5.000 -0- Total fixed 31,000 31,000 -0- Total costs $193,250 $189.350 13.900 Favorable The monthly budget amounts in the report were based on an expected production of 59,000 units per month or 708,000 units per year. The Assembling Department manager is pleased with the report and expects a raise, or at least praise for a job well done. The company president, however, is unhappy with the results for August because only 57,000 units were produced. (a) State the total monthly budgeted cost formula. (Round cost per unit to 2 decimal places, e.g. 1.25.] The formula is $ + variable costs of $ per unit. eTextbook and Media Save for Later Attempts: 0 of 3 used Submit