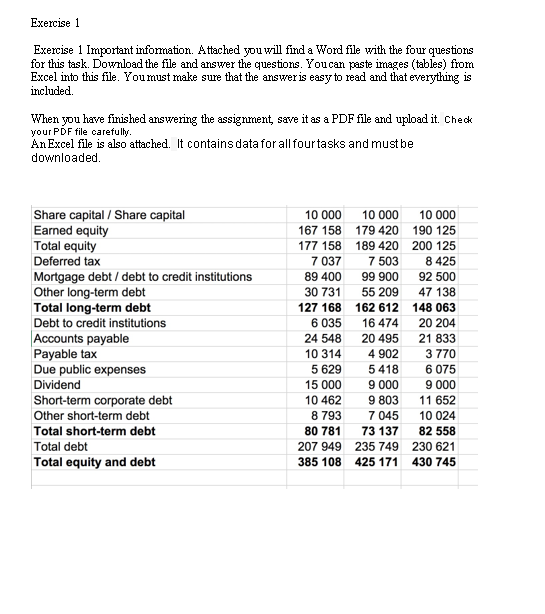

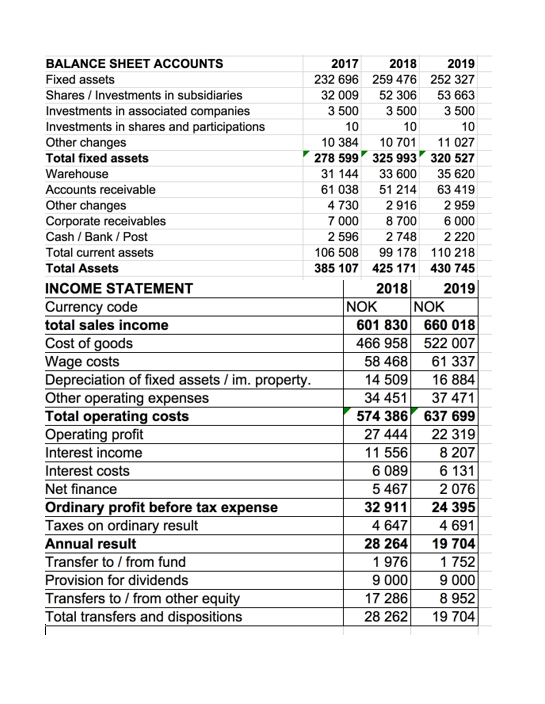

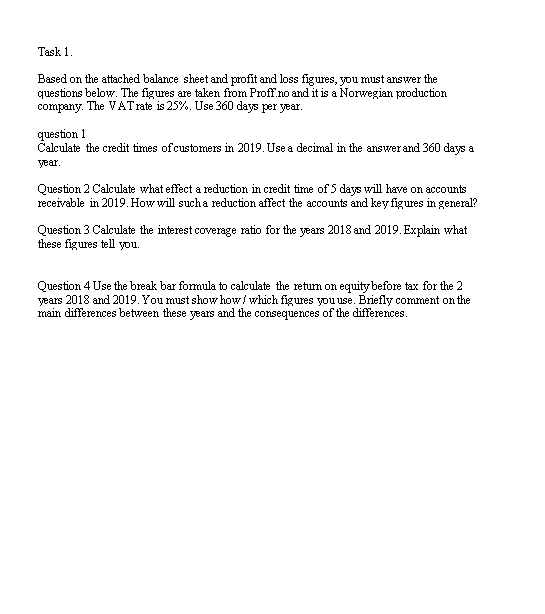

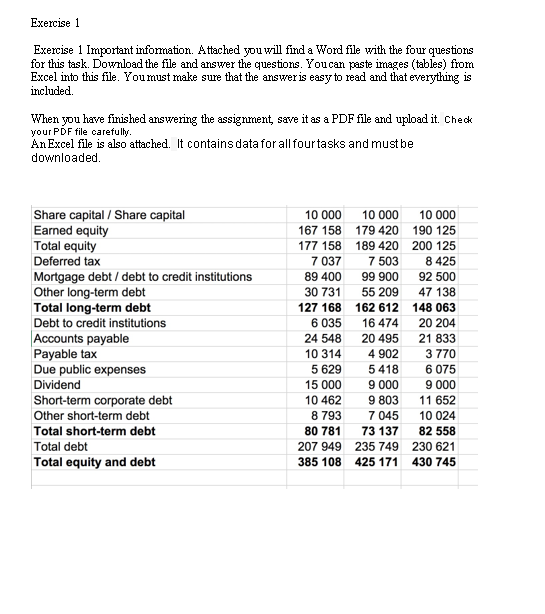

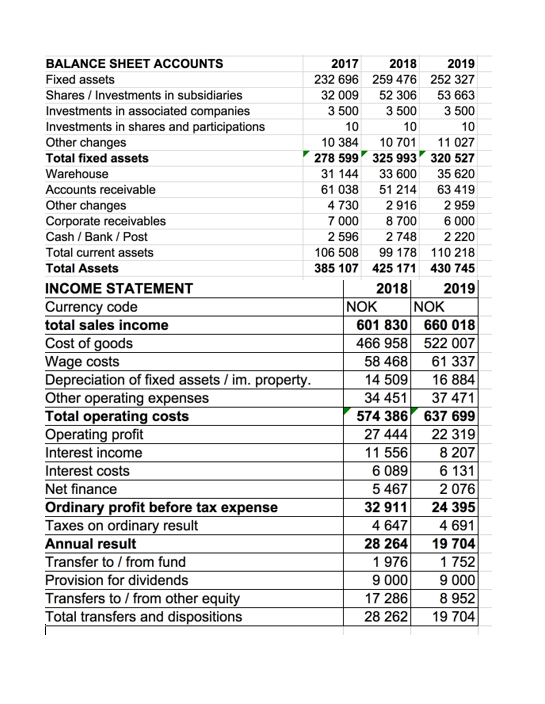

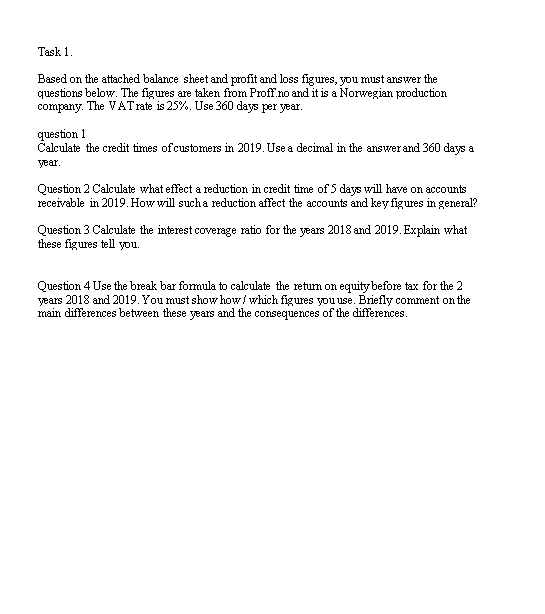

Exercise 1 Exercise 1 Important information. Attached you will find a Word file with the four questions for this task. Download the file and answer the questions. Youcan paste images (tables) from Excel into this file. You must make sure that the answer is easy to read and that everything is included When you have finished answering the assignment, save it as a PDF file and upload it. Check your PDF file carefully. An Excel file is also attached. It contains data for all four tasks and must be downloaded. Share capital / Share capital Earned equity Total equity Deferred tax Mortgage debt / debt to credit institutions Other long-term debt Total long-term debt Debt to credit institutions Accounts payable Payable tax Due public expenses Dividend Short-term corporate debt Other short-term debt Total short-term debt Total debt Total equity and debt 10 000 10 000 10 000 167 158 179 420 190 125 177 158 189 420 200 125 7 037 7503 8 425 89 400 99 900 92 500 30 731 55 209 47 138 127 168 162 612 148 063 6 035 16 474 20 204 24 548 20 495 21 833 10 314 4 902 3770 5 629 5 418 6 075 15 000 9 000 9 000 10 462 9 803 11 652 8 793 7045 10 024 80 781 73 137 82 558 207 949 235 749 230 621 385 108 425 171 430 745 BALANCE SHEET ACCOUNTS 2017 2018 2019 Fixed assets 232 696 259 476 252 327 Shares / Investments in subsidiaries 32 009 52 306 53 663 Investments in associated companies 3 500 3 500 3 500 Investments in shares and participations 10 10 10 Other changes 10 384 10 701 11 027 Total fixed assets 278 599 325 993320 527 Warehouse 31 144 33 600 35 620 Accounts receivable 61 038 51 214 63 419 Other changes 4 730 2 916 2 959 Corporate receivables 7 000 8 700 6 000 Cash / Bank / Post 2 596 2 748 2 220 Total current assets 106 508 99 178 110 218 Total Assets 385 107 425 171 430 745 INCOME STATEMENT 2018 2019 Currency code NOK NOK total sales income 601 830 660 018 Cost of goods 466 958 522 007 Wage costs 58 468 61 337 Depreciation of fixed assets / im. property. 14 509 16 884 Other operating expenses 34 451 37 471 Total operating costs 574 386 637 699 Operating profit 27 444 22 319 Interest income 11 556 8 207 Interest costs 6 089 6 131 Net finance 5 467 2 076 Ordinary profit before tax expense 32 911 24 395 Taxes on ordinary result 4 647 4 691 Annual result 28 264 19 704 Transfer to/from fund 1 976 1 752 Provision for dividends 9 000 9 000 Transfers to/from other equity 17 286 8 952 Total transfers and dispositions 28 262 19 704 Task 1. Based on the attached balance sheet and profit and loss figures, you must answer the questions below. The figures are taken from Proff.no and it is a Norwegian production company. The VAT rate is 25%. Use 360 days per year. question 1 Calculate the credit times of customers in 2019. Use a decimal in the answer and 360 days a year Question 2 Calculate what effect a reduction in credit time of 5 days will have on accounts receivable in 2019. How will such a reduction affect the accounts and key figures in general? Question 3 Calculate the interest coverage ratio for the years 2018 and 2019. Explain what these figures tell you. Question 4 Use the break bar formula to calculate the return on equity before tax for the 2 years 2018 and 2019. You must show how which figures you use. Briefly comment on the main differences between these years and the consequences of the differences