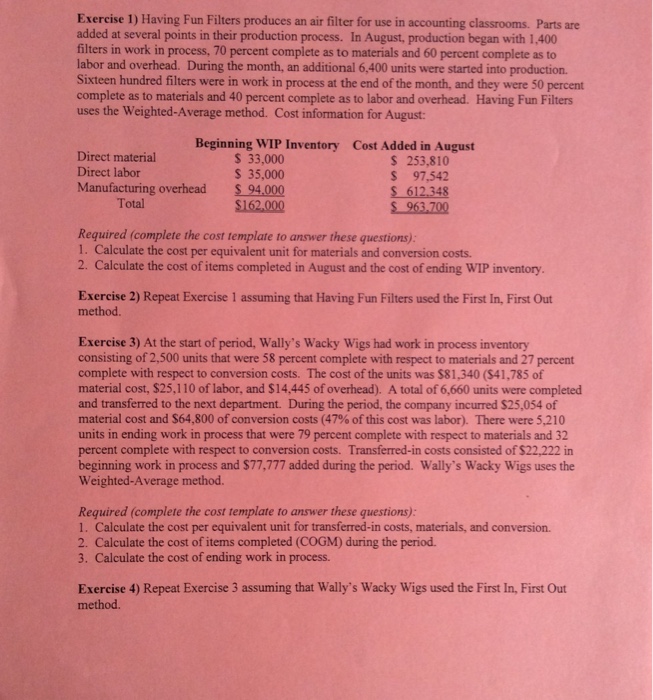

Exercise 1) Having Fun Filters produces an air filter for use in accounting classrooms. Parts are added at several points in their production process. In August, production began with 1,400 filters in work in process, 70 percent complete as to materials and 60 percent complete as to labor and overhead. During the month, an additional 6,400 units were started into production. Sixteen hundred filters were in work in process at the end of the month, and they were 50 percent complete as to materials and 40 percent complete as to labor and overhead. Having Fun Filters uses the Weighted-Average method. Cost information for August Beginning WIP Inventory Cost Added in August Direct material Direct labor Manufacturing overhead $ 94.000 S 33,000 S 35,000 s 253,810 S 97,542 S 612.348 S 963.700 Total S162,000 Required (complete the cost template to answer these questions) 1. Calculate the cost per equivalent unit for materials and conversion costs. 2. Calculate the cost of items completed in August and the cost of ending WIP inventory. Exercise 2) Repeat Exercise 1 assuming that Having Fun Filters used the First In, First Out method Exercise 3) At the start of period, Wally's Wacky Wigs had work in process inventory consisting of 2,500 units that were 58 percent complete with respect to materials and 27 percent complete with respect to conversion costs. The cost of the units was $81,340 ($41,785 of material cost, $25,110 of labor, and $14,445 of overhead). A total of 6,660 units were completed and transferred to the next department. During the period, the company incurred $25,054 of material cost and S64 ,800 of conversion costs (47% of this cost was labor). There were 5,210 units in ending work in process that were 79 percent complete with respect to materials and 32 percent complete with respect to conversion costs. Transferred-in costs consisted of $22,222 in beginning work in process and $77,777 added during the period. Wally's Wacky Wigs uses the Weighted-Average method. Required (complete the cost template to answer these questions) 1. Calculate the cost per equivalent unit for transferred-in costs, materials, and conversion. 2. Calculate the cost of items completed (COGM) during the period. 3. Calculate the cost of ending work in process. Exercise 4) Repeat Exercise 3 assuming that Wally's Wacky Wigs used the First In, First Out method