Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 1: Mean-variance portfolio analysis Assume the following objective function for the investor: max{2Et(rp,t+1)kVart(rp,t+1)} where E(rp,t+1) is the portfolio's expected yearly return and Var(rp,t+1) stands

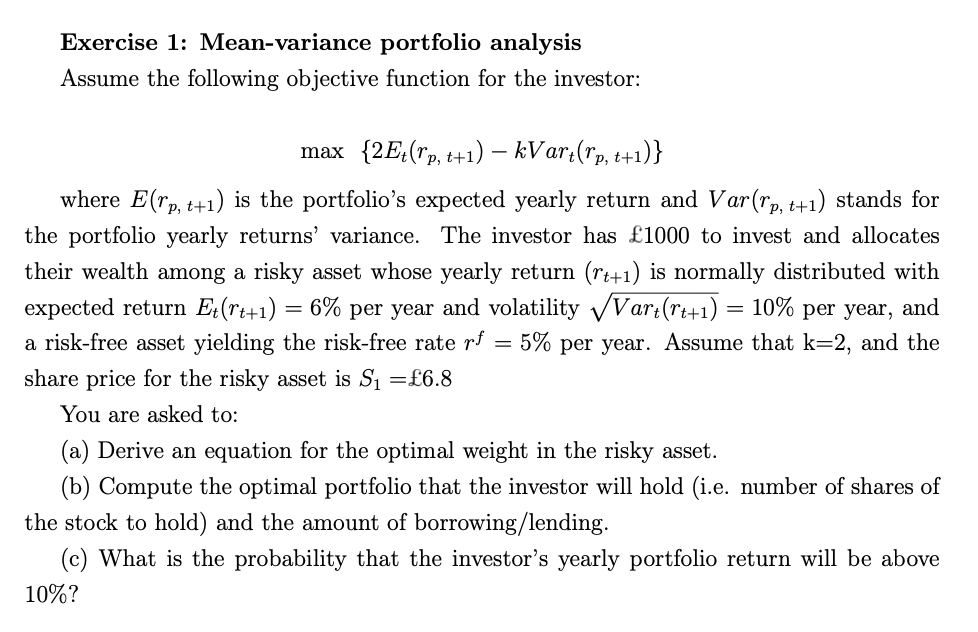

Exercise 1: Mean-variance portfolio analysis Assume the following objective function for the investor: max{2Et(rp,t+1)kVart(rp,t+1)} where E(rp,t+1) is the portfolio's expected yearly return and Var(rp,t+1) stands for the portfolio yearly returns' variance. The investor has 1000 to invest and allocates their wealth among a risky asset whose yearly return (rt+1) is normally distributed with expected return Et(rt+1)=6% per year and volatility Vart(rt+1)=10% per year, and a risk-free asset yielding the risk-free rate rf=5% per year. Assume that k=2, and the share price for the risky asset is S1=6.8 You are asked to: (a) Derive an equation for the optimal weight in the risky asset. (b) Compute the optimal portfolio that the investor will hold (i.e. number of shares of the stock to hold) and the amount of borrowing/lending. (c) What is the probability that the investor's yearly portfolio return will be above 10%

Exercise 1: Mean-variance portfolio analysis Assume the following objective function for the investor: max{2Et(rp,t+1)kVart(rp,t+1)} where E(rp,t+1) is the portfolio's expected yearly return and Var(rp,t+1) stands for the portfolio yearly returns' variance. The investor has 1000 to invest and allocates their wealth among a risky asset whose yearly return (rt+1) is normally distributed with expected return Et(rt+1)=6% per year and volatility Vart(rt+1)=10% per year, and a risk-free asset yielding the risk-free rate rf=5% per year. Assume that k=2, and the share price for the risky asset is S1=6.8 You are asked to: (a) Derive an equation for the optimal weight in the risky asset. (b) Compute the optimal portfolio that the investor will hold (i.e. number of shares of the stock to hold) and the amount of borrowing/lending. (c) What is the probability that the investor's yearly portfolio return will be above 10% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started