Answered step by step

Verified Expert Solution

Question

1 Approved Answer

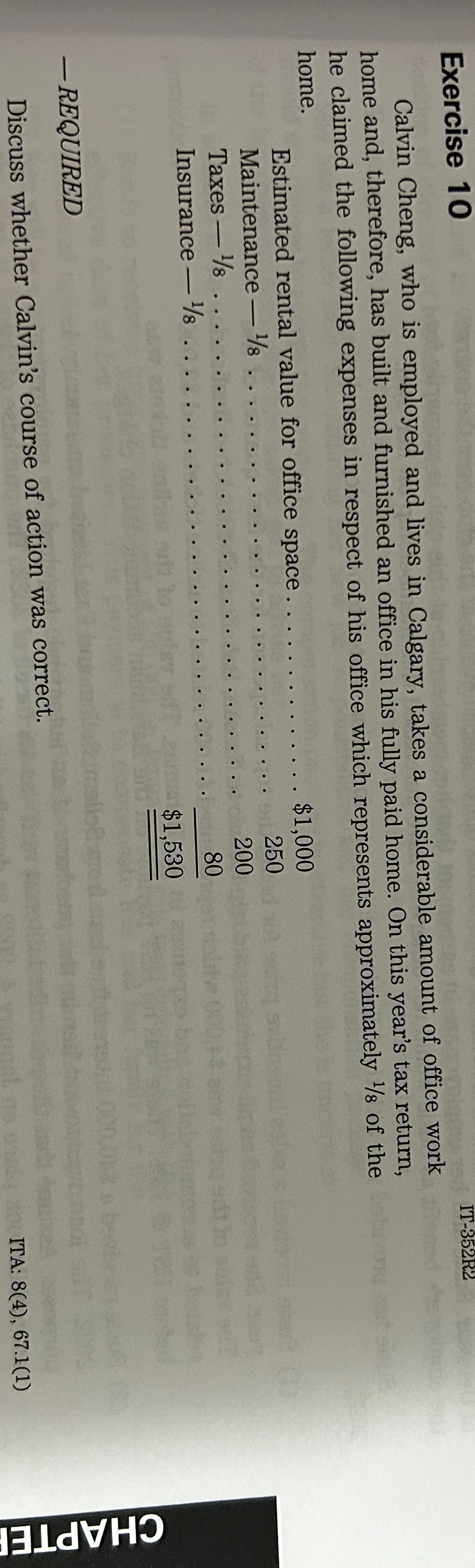

Exercise 10 Calvin Cheng, who is employed and lives in Calgary, takes a considerable amount of office work home and, therefore, has built and

Exercise 10 Calvin Cheng, who is employed and lives in Calgary, takes a considerable amount of office work home and, therefore, has built and furnished an office in his fully paid home. On this year's tax return, he claimed the following expenses in respect of his office which represents approximately 8 of the home. Estimated rental value for office space Maintenance - 1/8 Taxes - 1/8 Insurance 18... .. $1,000 250 200 80 $1,530 IT-352R2 -REQUIRED Discuss whether Calvin's course of action was correct. ITA: 8(4), 67.1(1) CHAPTER

Step by Step Solution

★★★★★

3.32 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided Calvin Cheng claimed certain expenses related to his home office o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started