Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 10-18 Depletion of natural resources LO P1, P3 On April 2, 2017, Montana Mining Co. pays $3,463,400 for an ore deposit containing 1,403,000 tons.

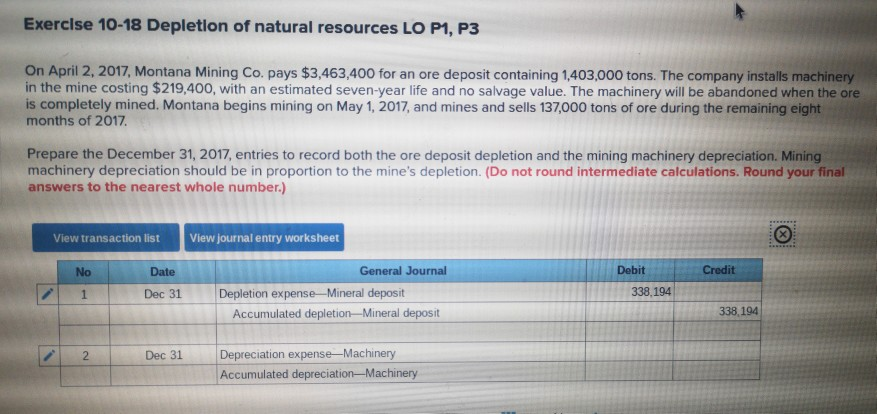

Exercise 10-18 Depletion of natural resources LO P1, P3 On April 2, 2017, Montana Mining Co. pays $3,463,400 for an ore deposit containing 1,403,000 tons. The company installs machinery in the mine costing $219,400, with an estimated seven-year life and no salvage value. The machinery will be abandoned when the ore is completely mined. Montana begins mining on May 1, 2017, and mines and sells 137,000 tons of ore during the remaining eight months of 2017 Prepare the December 31, 2017, entries to record both the ore deposit depletion and the mining machinery depreciation. Mining machinery depreciation should be in proportion to the mine's depletion. (Do not round intermediate calculations. Round your final answers to the nearest whole number.) View transaction listView journal entry worksheet Debit General Journal Credit No Date 338,194 Dec 31 Depletion expense-Mineral deposit 338,194 Accumulated depletion-Mineral deposit Dec 31 Depreciation expense-Machinery Accumulated depreciation-Machinery

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started