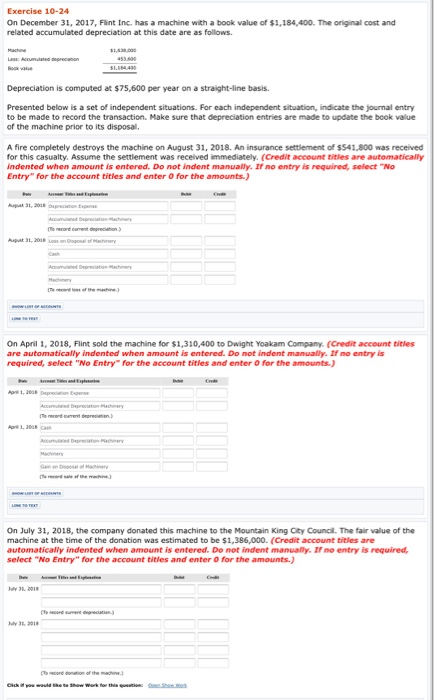

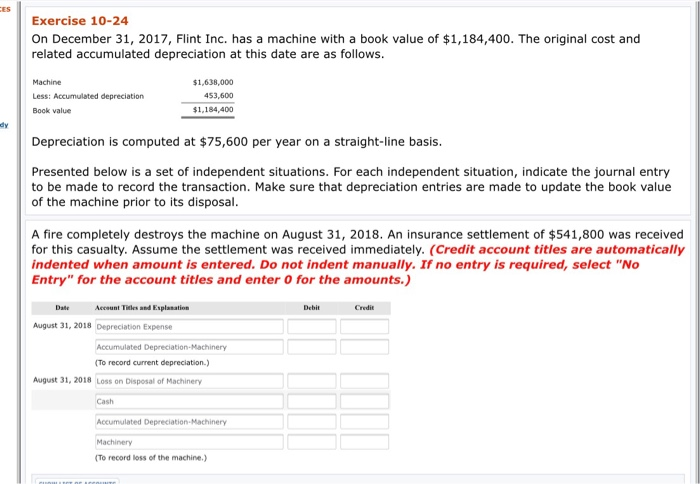

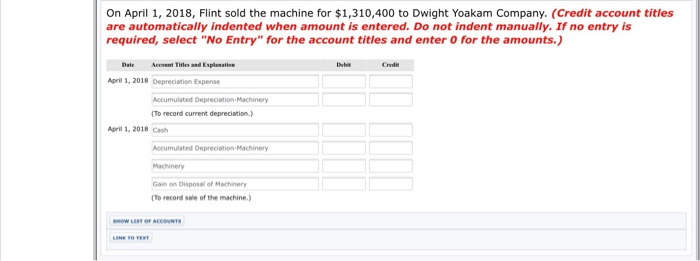

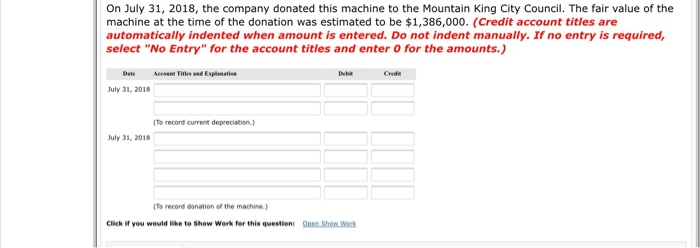

Exercise 10-24 On December 31, 2017, Fint Inc. has a machine with a book value of1,184,400. The onnal cost and related accumulated depreciation at this date are as follows. Depreciation is computed at $75,600 per year on a straight-line basis. Presented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the transaction Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. A fire completely destroys the machine on August 31, 2018. An insurance settlement of $$41,800 was received for this casualty. Assume the settlement was received immediately, (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) On April 1, 2018, Flint sold the machine for $1,310,400 to Dwight Yoakam Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts.) on July 31, 2018, the company donated this machine to th Mountain King cry Cund. The fair value of the machine at the time of the donation was estimated to be $1,386,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required select "No Entry" for the account titles and enter 0 for the amounts.) Exercise 10-24 On December 31, 2017, Flint Inc. has a machine with a book value of $1,184,400. The original cost and related accumulated depreciation at this date are as follows. Machine Less: Accumulated depreciation Book value $1,638,000 453,600 $1,184,400 dy Depreciation is computed at $75,600 per year on a straight-line basis. Presented below is a set of independent situations. For each independent situation, indicate the journal entry to be made to record the transaction. Make sure that depreciation entries are made to update the book value of the machine prior to its disposal. A fire completely destroys the machine on August 31, 2018. An insurance settlement of $541,800 was received for this casualty. Assume the settlement was received immediately. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Account Titles and Esplasation Debit August 31, 2018 Depreciation Expense Accumulated Depreciation-Machinery To record current depreciation.) August 31, 2018 Loss on Disposal of Machinery Depreciation-Machinery Machinery To record loss of the machine On April 1, 2018, Flint sold the machine for $1,310,400 to Dwight Yoakam Company. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) Date Accoent Titls and Explanation Debi April 1, 2018 Depreciation Expense Accumulated Depreciation-Machinery To record current depreciation) April 1, 2018 cash Accumulated Depreciation-Machinery Gain on Disposal of Machinery (To record sale of the machine On July 31, 2018, the company donated this machine to the Mountain King City Council. The fair value of the machine at the time of the donation was estimated to be $1,386,000. (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required select "No Entry" for the account titles and enter O for the amounts Dale Accoent Titles ndEsplanstion July 31, 2018 To record current depreciation July 31, 2018 (To record donation of the machine) Click if yor would lake to Show Work fer this questiens Oen Show Wack