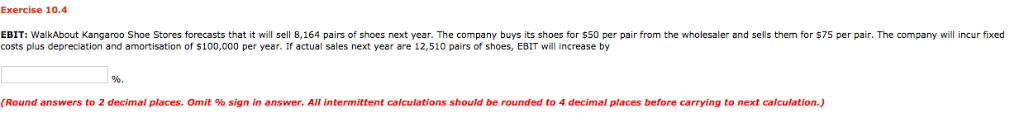

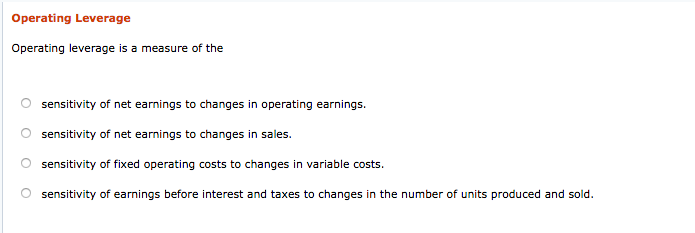

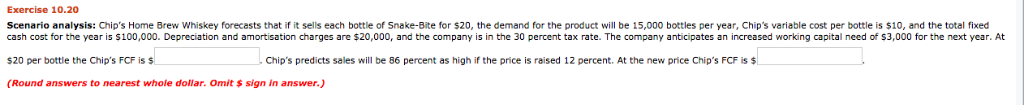

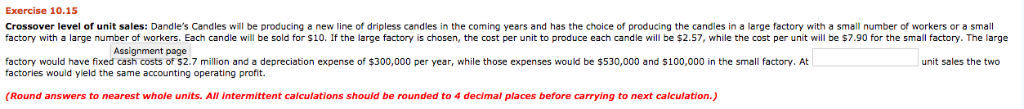

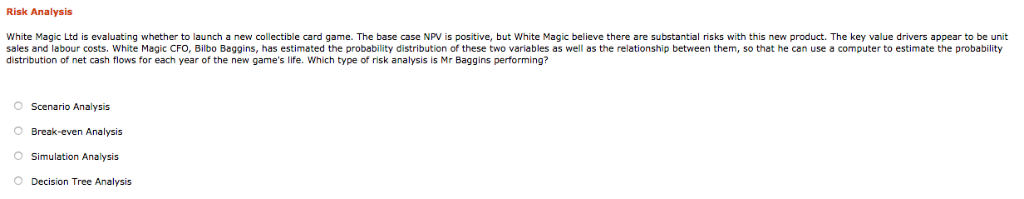

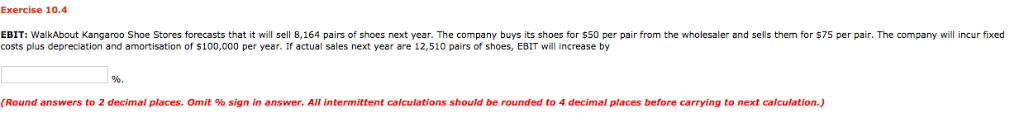

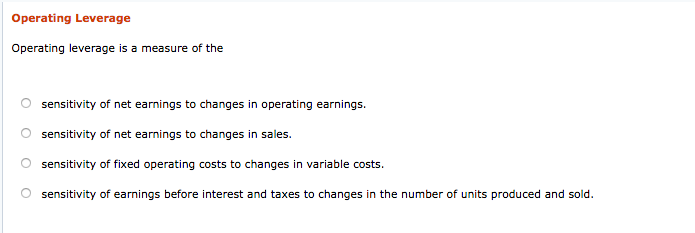

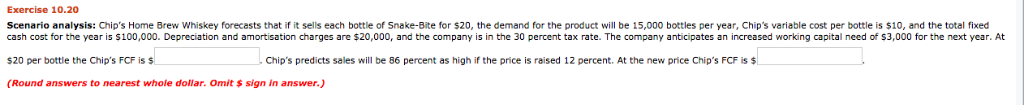

Exercise 10.4 EBIT: WalkAbout Kangaroo Shoe Stores forecasts that it will sell 8,164 pairs of shoes next year. The company buys its shoes for $50 per pair from the wholesaler and sells them for $75 per pair. The company will incur fixed costs plus depreciation and amortisation of $100,000 per year. If actual sales next year are 12,510 pairs of shoes, EBIT will increase by (Round answers to 2 decimal places. Omit 96 sign in answer. All intermittent calculations should be rounded to 4 decimal places before carrying to next ca culation. Operating Leverage Operating leverage is a measure of the O O O O sensitivity of net earnings to changes in operating earnings. sensitivity of net earnings to changes in sales. sensitivity of fixed operating costs to changes in variable costs. sensitivity of earnings before interest and taxes to changes in the number of units produced and sold. Exercise 10.20 Scenario analysis: Chip's Home Brew Whiskey forecasts that if it sells each bottle of Snake-Bite for $20, the demand for the product will be 15,000 bottles per year, Chip's variable cost per bottle is $10, and the total fixed cash cost for the year is $100,000. Depreciation and amortisation charges are $20,000, and the company is in the 30 percent tax rate. The company anticipates an increased working capital need of $3,000 for the next year. At $20 per bottle the Chip's FCF is $ (Round answers to nearest whole dollar. Omit $ sign in answer.) Chip's predicts sales will be 86 percent as high if the price is raised 12 percent. At the new price Chip's FCF is$ Exercise 10.15 Crossover level of unit sales: Dandle's Candles will be producing a new line of dripless candles in the coming years and has the choice of producing the candles in a large factory with a small number of workers or a small factory with a large number of workers. Each candle will be sold for $10. If the large factory is chosen, the cost per unit to produce each candle will be $2.57, while the cost per unit will be $7.90 for the small factory. The large Assignment page factory would have fixed cash costs of $2.7 million and a depreciation expense of $300,000 per year, while those expenses would be $530,000 and $100,000 in the small factory. At factories would yield the same accounting operating profit. unit sales the two (Round answers to nearest whole units. All intermittent calculations should be rounded to 4 decimal places before carrying to next calculation.) Risk Analysis White Magic Ltd is evaluating whether to launch a new collectible card game. The base case NPV is positive, but White Magic believe there are substantial risks with this new product. The key value drivers appear to be unit sales and labour costs, White Magic CFO, Bilbo Baggins, has estimated the probability distribution of these two variables as well as the relationship between them, so that he can use a computer to estimate the probability distribution of net cash flows for each year of the new game's life. Which type of risk analysis is Mr Baggins performing? O Scenario Analysis Break-even Analysis Simulation Analysis Decision Tree Analysis