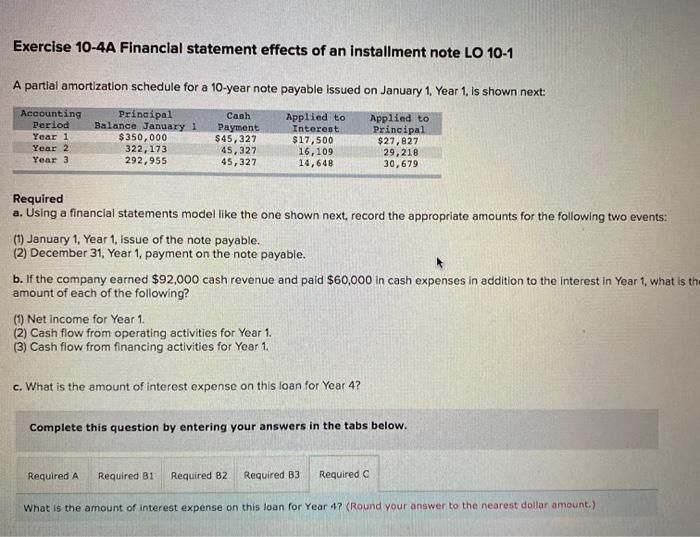

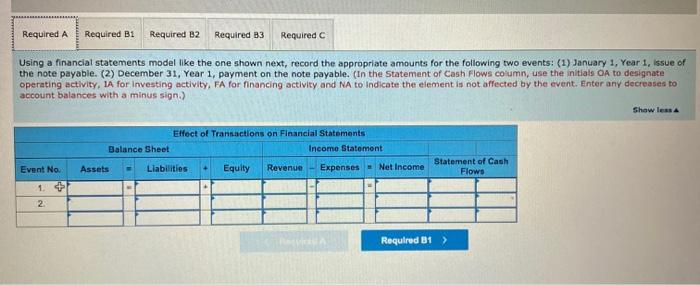

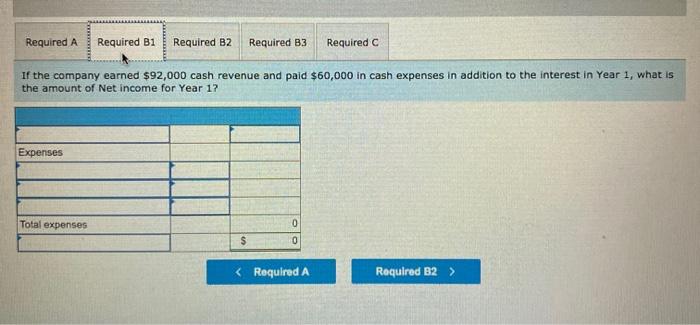

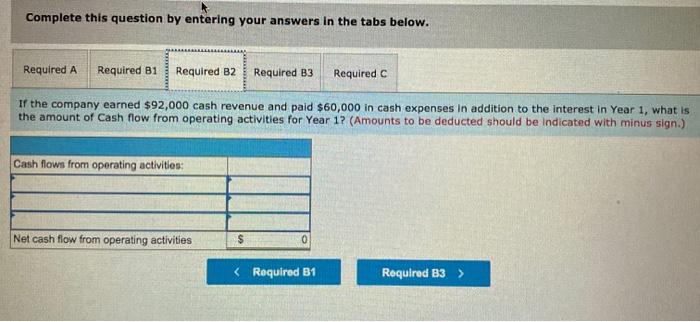

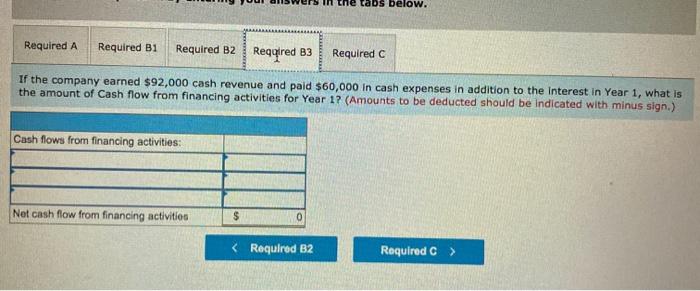

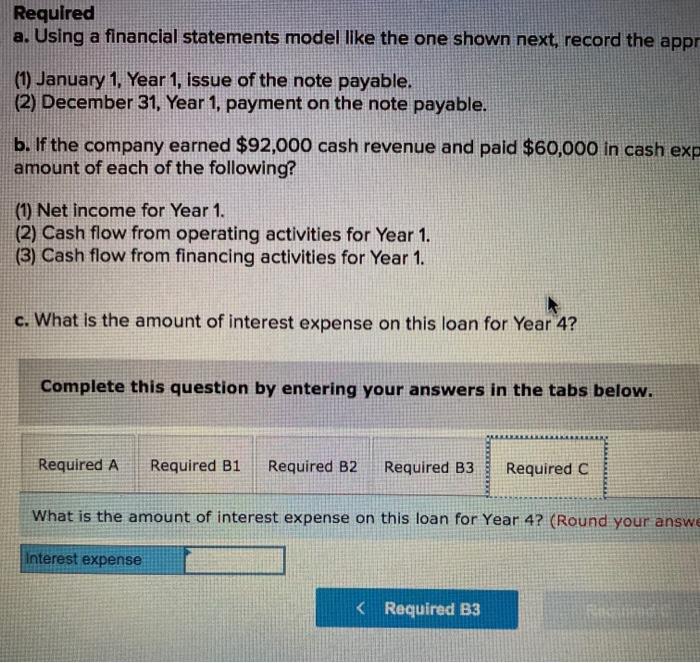

Exercise 10-4A Financial statement effects of an installment note LO 10-1 A partial amortization schedule for a 10-year note payable issued on January 1, Year 1. is shown next: Accounting Period Year 1 Year 2 Year 3 Principal Balance January 1 $350,000 322,173 292,955 Cash Payment $45,327 45,327 45,327 Applied to Interest $17,500 16,109 14,648 Applied to Principal $27,827 29,218 30,679 Required a. Using a financial statements model like the one shown next, record the appropriate amounts for the following two events: (1) January 1, Year 1, Issue of the note payable. (2) December 31, Year 1, payment on the note payable. b. If the company earned $92,000 cash revenue and paid $60,000 in cash expenses in addition to the Interest in Year 1, what is the amount of each of the following? (O) Net income for Year 1 (2) Cash flow from operating activities for Year 1. (3) Cash flow from financing activities for Year 1. c. What is the amount of interest expense on this loan for Year 4? Complete this question by entering your answers in the tabs below. Required A Required 81 Required B2 Required B3 Required C What is the amount of interest expense on this loan for Year 47 (Round your answer to the nearest dollar amount.) Required A Required B1 Required B2 Required B3 Required Using a financial statements model like the one shown next, record the appropriate amounts for the following two events: (1) January 1, Year 1, Issue of the note payable. (2) December 31, Year 1, payment on the note payable. (In the Statement of Cash Flows column, use the initials o to designate operating activity, IA for Investing activity, FA for financing activity and Na to indicate the element is not affected by the event. Enter any decreases to account balances with a minus sign.) Show less Effect of Transactions on Financial Statements Balance Sheet Income Statement Assets Llabilities Equity Revenue Expenses - Net Income Event No. Statement of Cash Flows 2 Required B1 > Required A AIRE Required B1 Required B2 Required B3 Required C If the company earned $92,000 cash revenue and paid $60,000 in cash expenses in addition to the interest in Year 1, what is the amount of Net income for Year 1? Expenses Total expenses 0 $ 0 Complete this question by entering your answers in the tabs below. Required A Required B1 Required B2 Required B3 Required C If the company earned $92,000 cash revenue and paid $60,000 in cash expenses in addition to the interest in Year 1, what is the amount of Cash flow from operating activities for Year 12 (Amounts to be deducted should be indicated with minus sign.) Cash flows from operating activities: Net cash flow from operating activities $ 0 in the tabs below. Required A Required B1 Required B2 Reqaired B3 Required C If the company earned $92,000 cash revenue and paid $60,000 in cash expenses in addition to the Interest in Year 1, what is the amount of cash flow from financing activities for Year 1? (Amounts to be deducted should be indicated with minus sign.) Cash flows from financing activities: Net cash flow from financing activities 0 Required a. Using a financial statements model like the one shown next, record the appr (1) January 1, Year 1, issue of the note payable. (2) December 31, Year 1, payment on the note payable. b. If the company earned $92,000 cash revenue and paid $60,000 in cash exp amount of each of the following? (1) Net income for Year 1. (2) Cash flow from operating activities for Year 1. (3) Cash flow from financing activities for Year 1. c. What is the amount of interest expense on this loan for Year 4? Complete this question by entering your answers in the tabs below. Required A Required B1 Required B2 Required B3 Required C What is the amount of interest expense on this loan for Year 4? (Round your answe Interest expense