Answered step by step

Verified Expert Solution

Question

1 Approved Answer

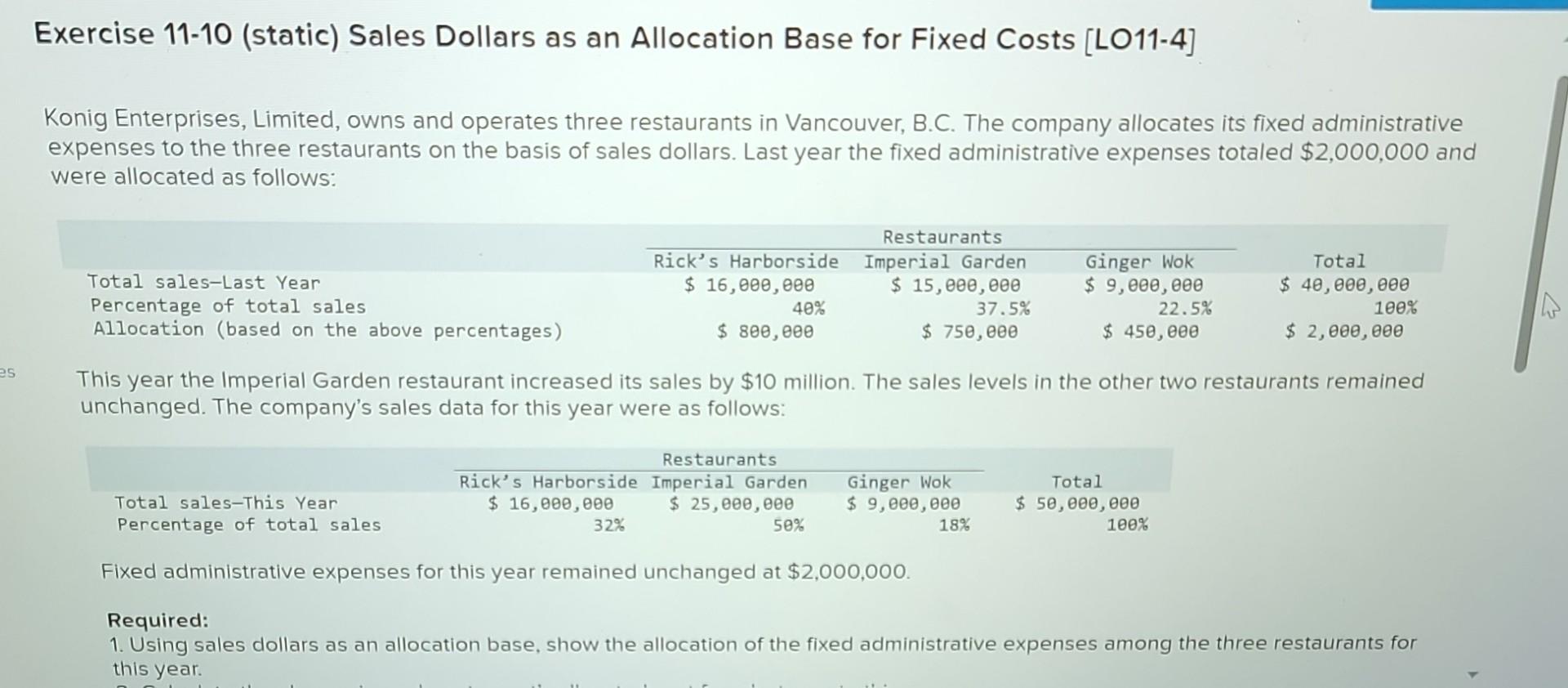

Exercise 11-10 (static) Sales Dollars as an Allocation Base for Fixed Costs [LO11-4] Konig Enterprises, Limited, owns and operates three restaurants in Vancouver, B.C. The

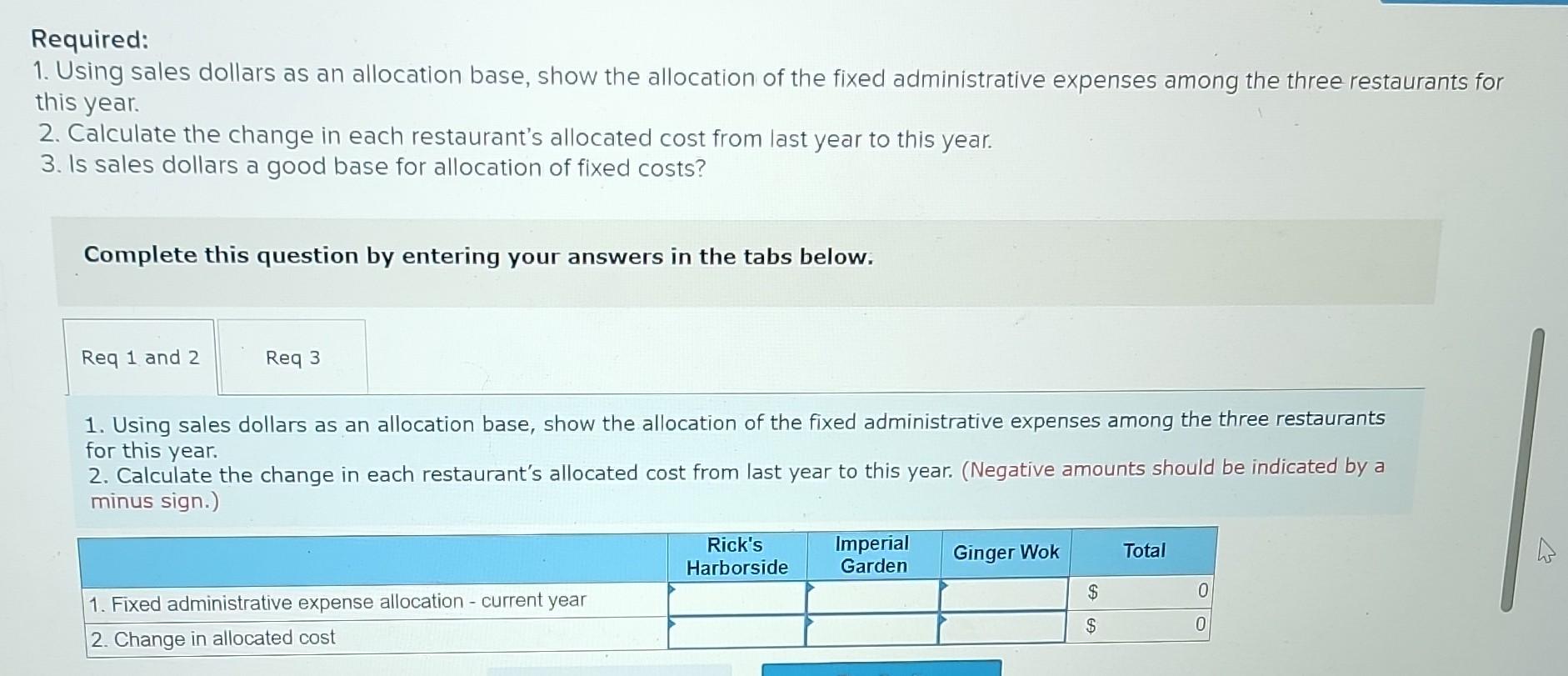

Exercise 11-10 (static) Sales Dollars as an Allocation Base for Fixed Costs [LO11-4] Konig Enterprises, Limited, owns and operates three restaurants in Vancouver, B.C. The company allocates its fixed administrative expenses to the three restaurants on the basis of sales dollars. Last year the fixed administrative expenses totaled $2,000,000 and were allocated as follows: This year the Imperial Garden restaurant increased its sales by $10 million. The sales levels in the other two restaurants remained unchanged. The company's sales data for this year were as follows: Fixed administrative expenses for this year remained unchanged at $2,000,000. Required: 1. Using sales dollars as an allocation base, show the allocation of the fixed administrative expenses among the three restaurants for this year. Required: Using sales dollars as an allocation base, show the allocation of the fixed administrative expenses among the three restaurants fo his year. 2. Calculate the change in each restaurant's allocated cost from last year to this year. 3. Is sales dollars a good base for allocation of fixed costs? Complete this question by entering your answers in the tabs below. 1. Using sales dollars as an allocation base, show the allocation of the fixed administrative expenses among the three restaurants for this year. 2. Calculate the change in each restaurant's allocated cost from last year to this year. (Negative amounts should be indicated by a minus sign.) Complete this question by entering your answers in the tabs below. Is sales dollars a good base for allocation of fixed costs? Yes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started