Question

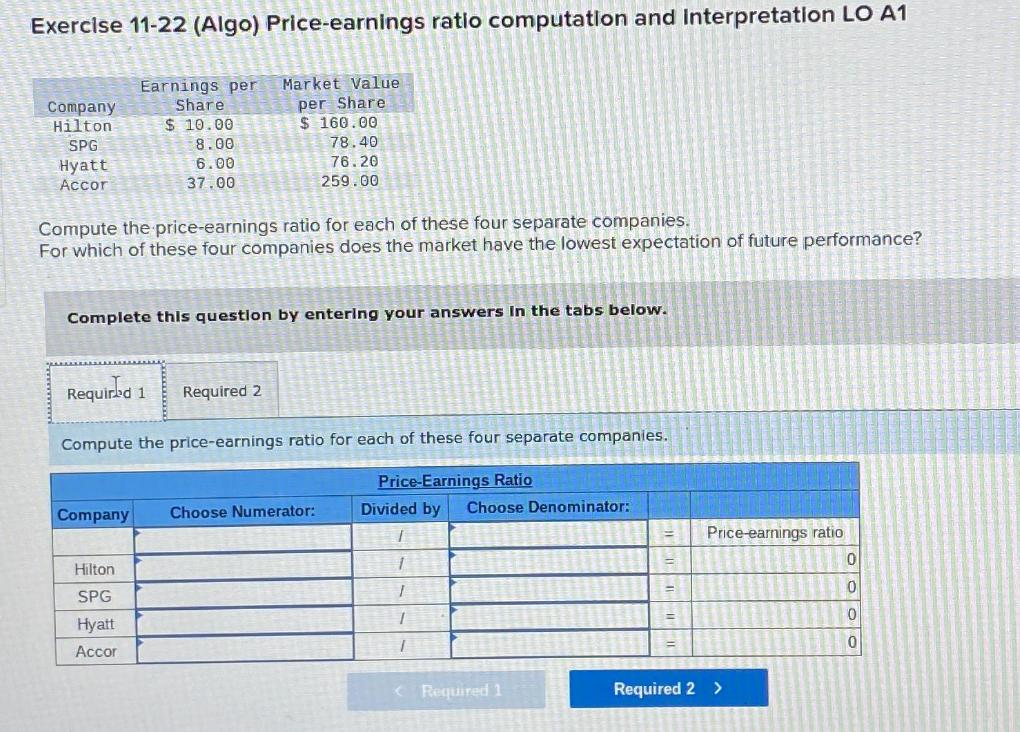

Exercise 11-22 (Algo) Price-earnings ratio computation and interpretation LO A1 Earnings per Market Value Company Hilton Share $ 10.00 per Share $ 160.00 SPG

Exercise 11-22 (Algo) Price-earnings ratio computation and interpretation LO A1 Earnings per Market Value Company Hilton Share $ 10.00 per Share $ 160.00 SPG 8.00 78.40 Hyatt 6.00 37.00 76.20 259.00 Accor Compute the price-earnings ratio for each of these four separate companies. For which of these four companies does the market have the lowest expectation of future performance? Complete this question by entering your answers In the tabs below. Required 1 Required 2 Compute the price-earnings ratio for each of these four separate companies. Price-Earnings Ratio Company Choose Numerator: Divided by Choose Denominator: = Price-earnings ratio Hilton 1 0 SPG =1 0 Hyatt 1 0 Accor 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial And Managerial Accounting

Authors: John J. Wild

9th Edition

1260728773, 9781260728774

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App