Question

Exercise 11-23 (Algo) Dividend yield computation and interpretation LO A1 Annual Cash Company Dividend per Share Market Value per Share Etihad United Lingus Allied

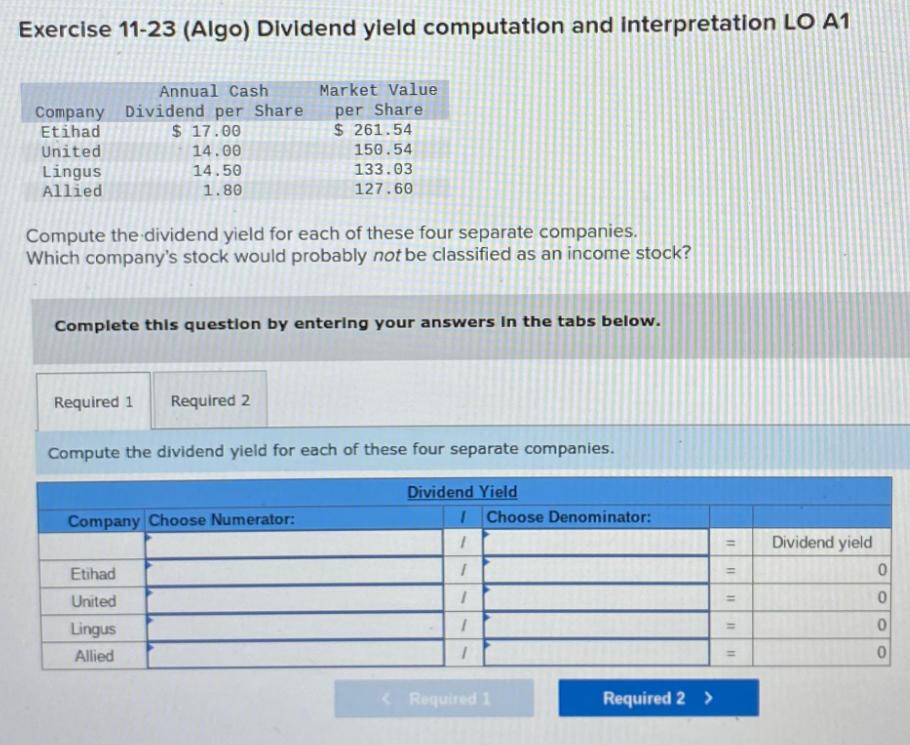

Exercise 11-23 (Algo) Dividend yield computation and interpretation LO A1 Annual Cash Company Dividend per Share Market Value per Share Etihad United Lingus Allied $ 17.00 14.00 14.50 1.80 $ 261.54 150.54 133.03 127.60 Compute the dividend yield for each of these four separate companies. Which company's stock would probably not be classified as an income stock? Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the dividend yield for each of these four separate companies. Company Choose Numerator: Etihad United Lingus Allied Dividend Yield I Choose Denominator: I " = = Dividend yield 0 0 = = 0 " 0

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental accounting principle

Authors: John J. Wild, Ken W. Shaw, Barbara Chiappetta

21st edition

1259119831, 9781259311703, 978-1259119835, 1259311708, 978-0078025587

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App