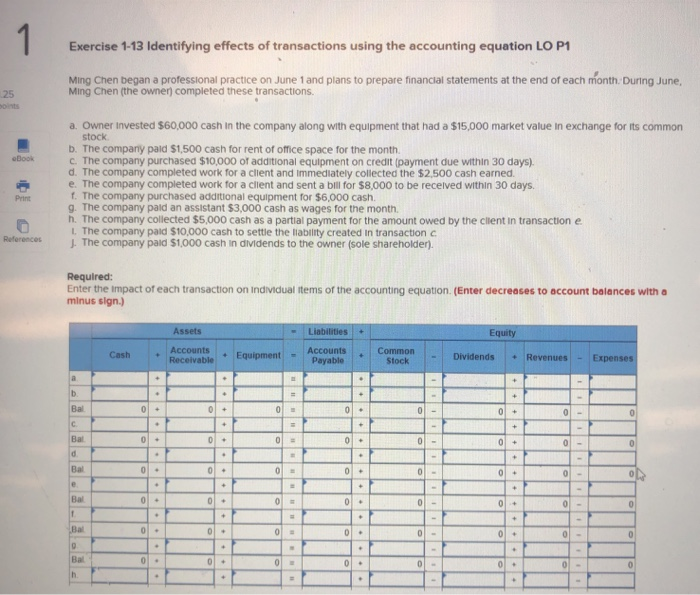

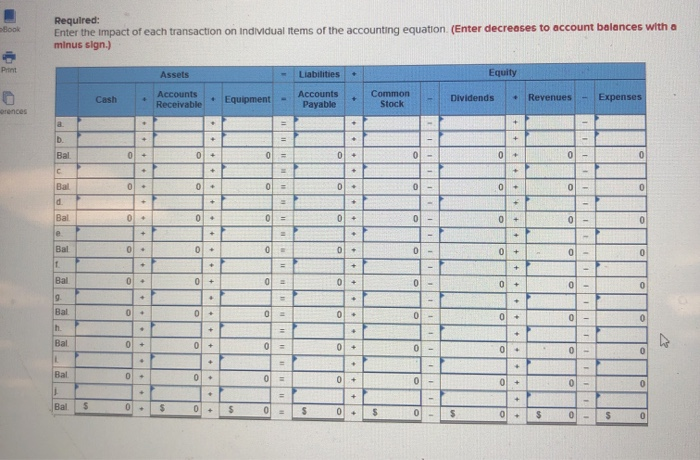

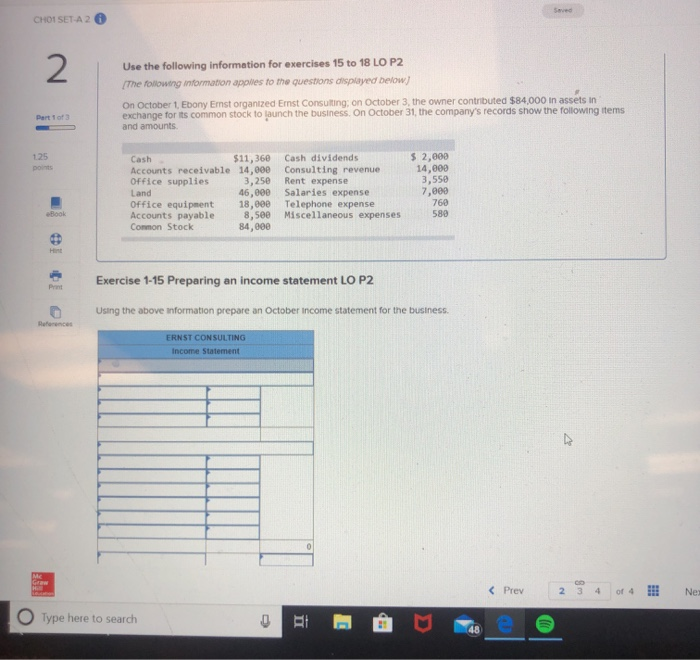

- Exercise 1-13 Identifying effects of transactions using the accounting equation LO P1 Ming Chen began a professional practice on June 1 and plans to prepare financial statements at the end of each month. During June, Ming Chen (the owner completed these transactions 25 Joint a. Owner invested $60,000 cash in the company along with equipment that had a $15,000 market value in exchange for its common stock b. The company paid $1,500 cash for rent of office space for the month c. The company purchased $10,000 of additional equipment on credit (payment due within 30 days) d. The company completed work for a client and immediately collected the $2,500 cash earned. e. The company completed work for a client and sent a bill for $8,000 to be received within 30 days. 1. The company purchased additional equipment for $6,000 cash. g. The company paid an assistant $3,000 cash as wages for the month n. The company collected $5,000 cash as a partial payment for the amount owed by the client in transaction e L The company paid $10,000 cash to settle the liability created in transactionc The company paid $1000 cash in dividends to the owner (sole shareholder). Required: Enter the impact of each transaction on individual items of the accounting equation (Enter decreases to account balances with a minus sign.) Assets - Liabilities Equity Cash Accounts Receivable Equipment Accounts Payable Common Stock - Dividends Revenues - Expenses HP: Book Required: Enter the impact of each transaction on Individual items of the accounting equation (Enter decreases to account balances with a minus sign.) Pent Assets Liabilities + Equity Accounts Cash Equipment Accounts Payable Common Stock Dividends Revenues - Expenses Receivable rences 0 + 0 + 0 0 0 = 0 - - 0 + 0 0 = 0 + 0 - Bal 0 0 + 0 = 1 0 Bal 0 0 + + + = = = Bal 0 + 0 0 Bal 0 + 0 + 0 0 = = = = = 0 0 + 0 $ 0 CHOISETA 2 Use the following information for exercises 15 to 18 LO P2 The following information applies to the questions displayed below) On October 1 Ebony Ernst organized Emst Consulting, on October 3, the owner contributed $84,000 in assets in exchange for its common stock to launch the business. On October 31, the company's records show the following items and amounts Cash $11,360 Accounts receivable 14,000 Office supplies 3,250 Land 46,000 Office equipment 18,000 Accounts payable 8. see Common Stock 84,000 Cash dividends Consulting revenue Rent expense Salaries expense Telephone expense Miscellaneous expenses $ 2,000 14,000 3,550 7,000 760 580 Exercise 1-15 Preparing an income statement LO P2 Using the above information prepare an October Income statement for the business. ERNST CONSULTING Income Statement