Answered step by step

Verified Expert Solution

Question

1 Approved Answer

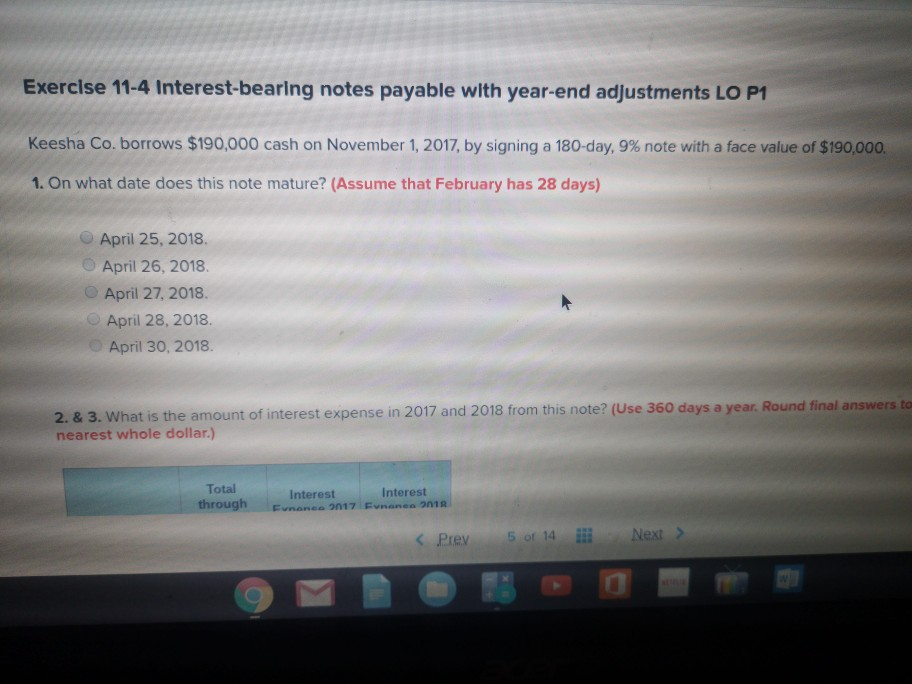

Exercise 11-4 Interest-bearing notes payable with year-end adjustments LO P1 Keesha Co. borrows $190,000 cash on November 1, 2017, by signing a 180-day, 9% note

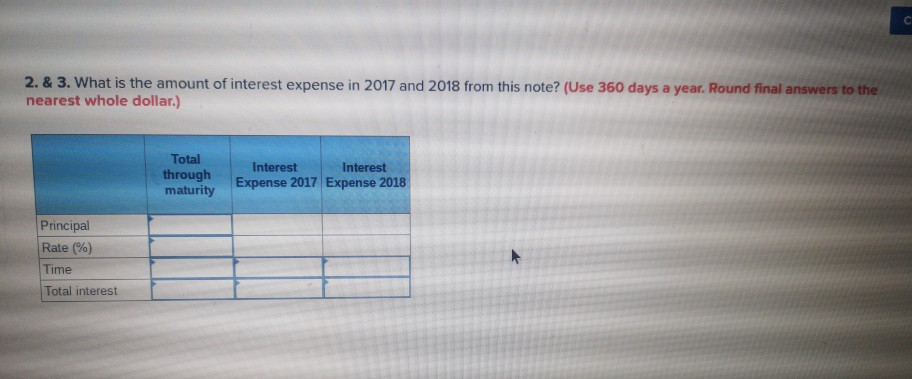

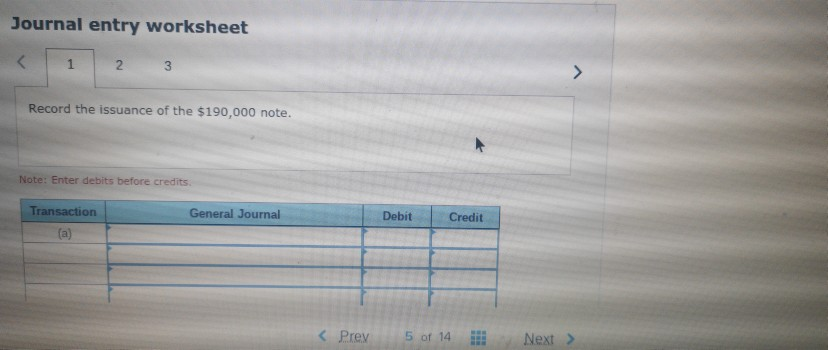

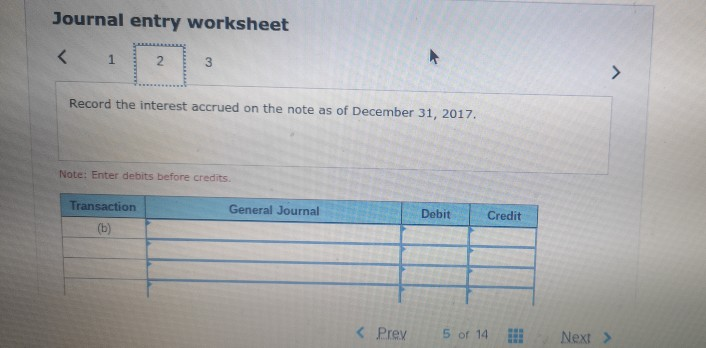

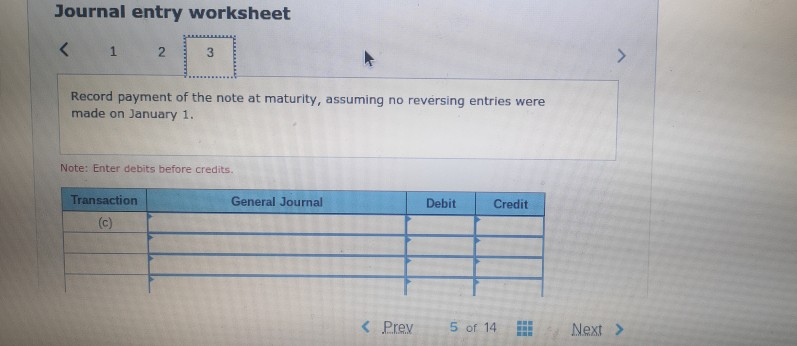

Exercise 11-4 Interest-bearing notes payable with year-end adjustments LO P1 Keesha Co. borrows $190,000 cash on November 1, 2017, by signing a 180-day, 9% note with a face value of $90,000. 1. On what date does this note mature? (Assume that February has 28 days) April 25, 2018 April 26, 2018 April 27, 2018 April 28, 2018. April 30, 2018 2. & 3. What is the amount of interest expense in 2017 and 2018 from this note? (Use 360 days a year. Round final answers to nearest whole dollar.) Total through Interest Interest 5 of 14 . Next > Prev 2. & 3. What is the amount of interest expense in 2017 and 2018 from this note? (Use 360 days a year. Round final answers to the nearest whole dollar.) Total through maturityExpense 2017 Expense 2018 Interest Interest Principal Rate (%) Time Total interest Journal entry worksheet 2 3 Record the issuance of the $190,000 note Note: Enter debits before credits Transaction General Journal Debit Credit Previ.. 5 of 14 Next > Journal entry worksheet 2 3 Record the interest accrued on the note as of December 31, 2017. Note: Enter debits before credits Debit Credit General Journal Transaction Journal entry worksheet 2 Record payment of the note at maturity, assuming no reversing entries were made on January 1. Note: Enter debits before credits. Transaction General Journal Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started