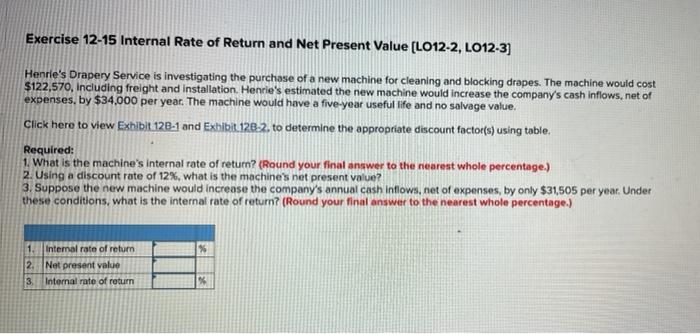

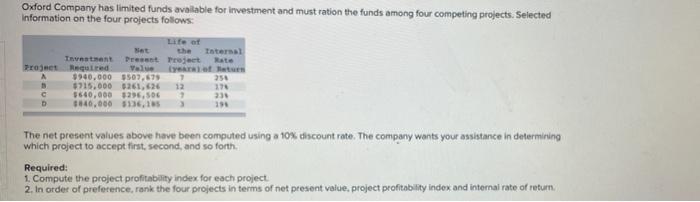

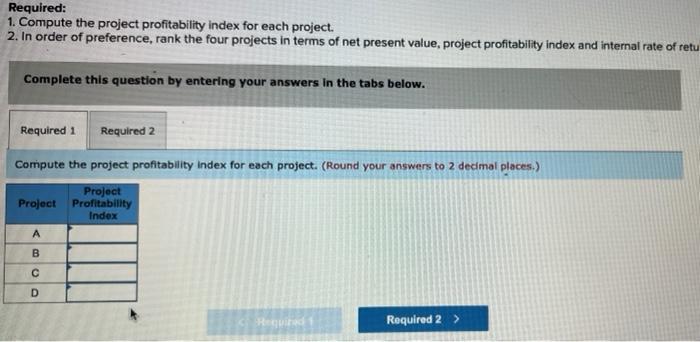

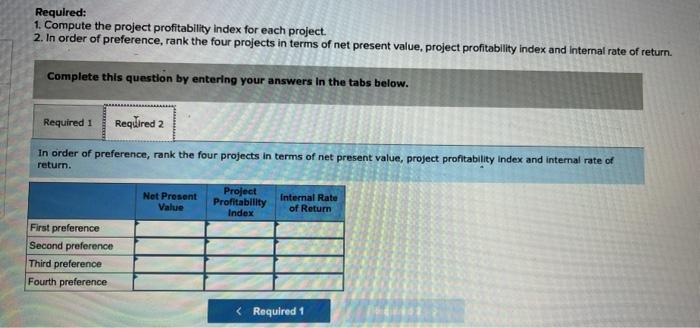

Exercise 12-15 Internal Rate of Return and Net Present Value (L012-2, LO12-3] Henrle's Drapery Service is investigating the purchase of a new machine for cleaning and blocking drapes. The machine would cost $122.570, including freight and installation. Henrie's estimated the new machine would increase the company's cash inflows, net of expenses, by $34.000 per year. The machine would have a five-year useful life and no salvage value. Click here to view Exhibit 12B-1 and Exhibit 128-2. to determine the appropriate discount factor(s) using table. Required: 1. What is the machine's internal rate of return? (Round your final answer to the nearest whole percentage.) 2. Using a discount rate of 12%, what is the machine's net present value? 3. Suppose the new machine would increase the company's annual cash inflows, net of expenses, by only $31,505 per year. Under these conditions, what is the internal rate of return? (Round your final answer to the nearest whole percentage.) % 1. Internal rate of retum 2. Net present value 3 Internal rate of return % Oxford Company has limited funds available for investment and mustration the funds among four competing projects. Selected Information on the four projects follows: Life of the Internal Tavestent Present Project Rate Project Red Velvet $940,000 $507,679 7 250 715.000 261,626 12 170 C 1640,000 3236,506 1335 $140,000 $136.15 191 The net present values above have been computed using a 10% discount rate. The company wants your assistance in determining which project to accept first second, and so forth Required: 1. Compute the project profitability index for each project 2. In order of preference, rank the four projects in terms of net present value, project profitability index and internal rate of return, Required: 1. Compute the project profitability index for each project. 2. In order of preference, rank the four projects in terms of net present value, project profitability index and internal rate of retu Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the project profitability Index for each project. (Round your answers to 2 decimal places.) Project Project Profitability Index A B C D Required Required 2 > Required: 1. Compute the project profitability index for each project. 2. In order of preference, rank the four projects in terms of net present value, project profitability index and internal rate of return. Complete this question by entering your answers in the tabs below. Required 1 Required 2 In order of preference, rank the four projects in terms of net present value, project profitability Index and internal rate of return. Net Present Value Project Profitability Index Internal Rate of Return First preference Second preference Third preference Fourth preference