Question

Mr.ABC claims that he is good at picking underpriced stocks. Over the years, the average return on the portfolio managed by Mr.ABC has been

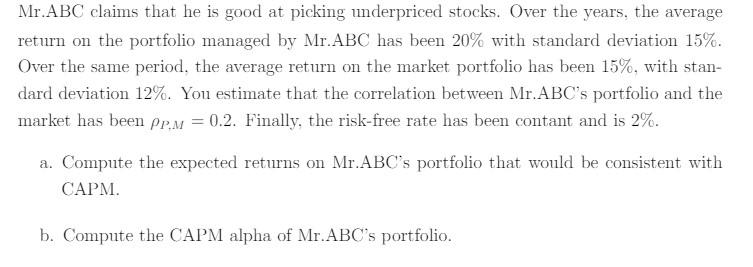

Mr.ABC claims that he is good at picking underpriced stocks. Over the years, the average return on the portfolio managed by Mr.ABC has been 20% with standard deviation 15%. Over the same period, the average return on the market portfolio has been 15%, with stan- dard deviation 12%. You estimate that the correlation between Mr.ABC's portfolio and the market has been pPM = 0.2. Finally, the risk-free rate has been contant and is 2%. a. Compute the expected returns on Mr.ABC's portfolio that would be consistent with CAPM. b. Compute the CAPM alpha of Mr.ABC's portfolio.

Step by Step Solution

3.32 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

To compute the expected returns on Mr ABCs portfolio consistent with the Capital Asset Pricing Model ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial management theory and practice

Authors: Eugene F. Brigham and Michael C. Ehrhardt

12th Edition

978-0030243998, 30243998, 324422695, 978-0324422696

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App