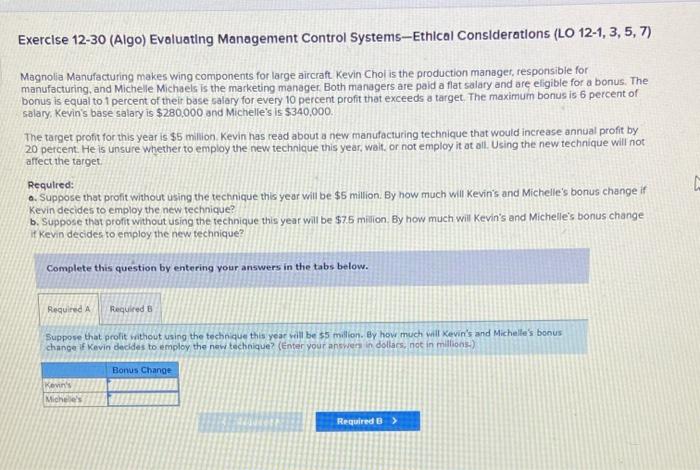

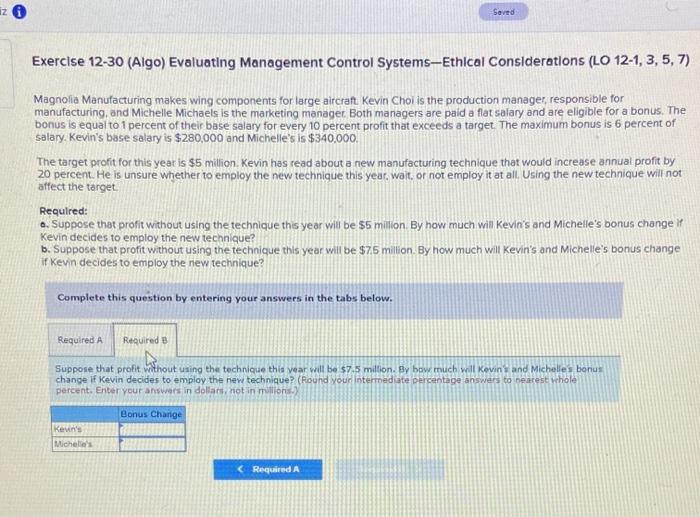

Exercise 12-30 (Algo) Evaluating Management Control Systems-Ethical Considerations (LO 12-1, 3, 5, 7). Magnolia Manufacturing makes wing components for large aircraft Kevin Chol is the production manager, responsible for manufacturing, and Michelle Michaels is the marketing manager Both managers are paid a flat salary and are eligible for a bonus. The bonus is equal to 1 percent of their base salary for every 10 percent profit that exceeds a target. The maximum bonus is 6 percent of salary Kevin's base salary is $280,000 and Michelle's is $340,000 The target profit for this year is $5 million, Kevin has read about a new manufacturing technique that would increase annual profit by 20 percent. He is unsure whether to employ the new technique this year, wolt, or not employ it at all. Using the new technique will not affect the target Required: o. Suppose that profit without using the technique this year will be $5 million. By now much will Kevin's and Michelle's bonus change if Kevin decides to employ the new technique? b. Suppose that profit without using the technique this year will be $7.5 milion. By how much wil Kevin's and Michelle's bonus change it Kevin decides to employ the new technique? Complete this question by entering your answers in the tabs below. Required A Required B Suppose that profit without using the technique this year will be $5 million. By how much will Kevin's and Michelle's bonus change if Kevin decides to employ the new technique? (Enter your answers in dollars, not in millions) Bonus Change Kevin's Michel's Required B > iz Seved Exercise 12-30 (Algo) Evaluating Management Control Systems-Ethical Considerations (LO 12-1,3,5,7) Magnolia Manufacturing makes wing components for large aircraft Kevin Choi is the production manager responsible for manufacturing, and Michelle Michaels is the marketing manager. Both managers are paid a flat salary and are eligible for a bonus. The bonus is equal to 1 percent of their base salary for every 10 percent profit that exceeds a target The maximum bonus is 6 percent of salary. Kevin's base salary is $280,000 and Michelle's is $340,000. The target profit for this year is $5 million, Kevin has read about a new manufacturing technique that would increase annual profit by 20 percent. He is unsure whether to employ the new technique this year, walt. or not employ it at all Using the new technique will not affect the target Required: o. Suppose that profit without using the technique ths year will be 55 million. By how much will Kevin's and Michelle's bonus change if Kevin decides to employ the new technique? b. Suppose that profit without using the technique this year will be $75 million. By how much will Kevin's and Michelle's bonus change if Kevin decides to employ the new technique? Complete this question by entering your answers in the tabs below. Required Required Suppose that profit without using the technique this year will be $7.5 million. By how much will Kevin and Michelles bonus change if Kevin decides to employ the new technique? (Round your intermediate percentage answers to nearest whole percent. Enter your answers in dollars, not in millions. Bonus Change Kevin's Michelle's Required A