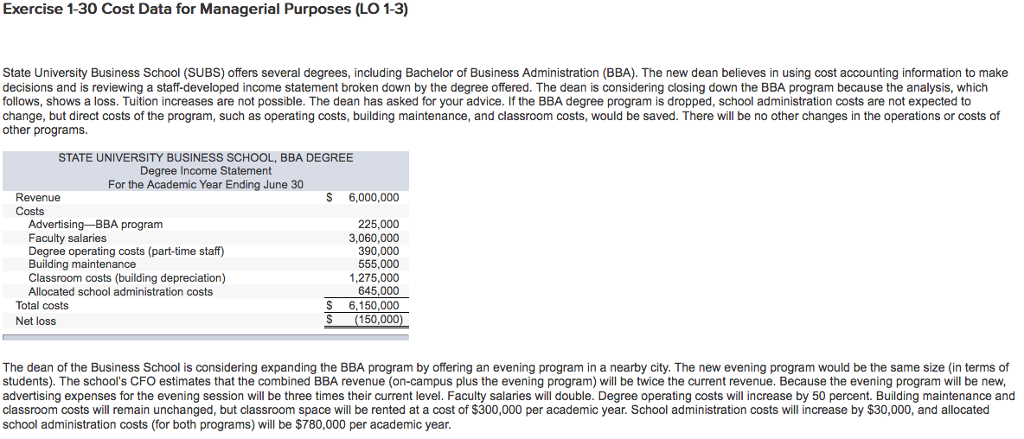

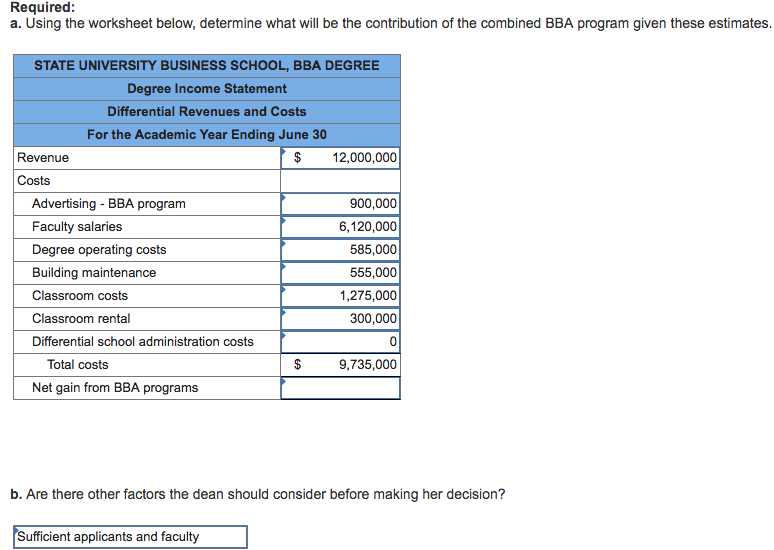

Exercise 1-30 Cost Data for Managerial Purposes (LO 1-3) State University Business School (SUBS) offers several degrees, including Bachelor of Business Administration (BBA). The new dean believes in using cost accounting information to make decisions and is reviewing a staff-developed income statement broken down by the degree offered. The dean is considering closing down the BBA program because the analysis, which follows, shows a loss. Tuition increases are not possible. The dean has asked for your advice. If the BBA degree program is dropped, school administration costs are not expected to change, but direct costs of the program, such as operating costs, building maintenance, and classroom costs, would be saved. There will be no other changes in the operations or costs of other programs. STATE UNIVERSITY BUSINESS SCHOOL, BBA DEGREE Degree Income Statement For the Academic Year Ending June 30 Revenue Costs S 6,000,000 Advertising-BBA program Faculty salaries Degree operating costs (part-time staff) Building maintenance Classroom costs (building depreciation) Allocated school administration costs 225,000 3,060,000 390,000 555,000 1,275,000 645,000 S 6,150,000 S (150,000 Total costs Net loss The dean of the Business School is considering expanding the BBA program by offering an evening program in a nearby city. The new evening program would be the same size (in terms of students). The school's CFO estimates that the combined BBA revenue (on-campus plus the evening program) will be twice the current revenue. Because the evening program will be new advertising expenses for the evening session will be three times their current level. Faculty salaries will double. Degree operating costs will increase by 50 percent. Building maintenance and classroom costs will remain unchanged, but classroom space will be rented at a cost of $300,000 per academic year. School administration costs will increase by $30,000, and allocated school administration costs(for both programs) will be $780,000 per academic year Required a. Using the worksheet below, determine what will be the contribution of the combined BBA program given these estimates STATE UNIVERSITY BUSINESS SCHOOL, BBA DEGREE Degree Income Statement Differential Revenues and Costs For the Academic Year Ending June 30 Revenue $ 12,000,000 Costs Advertising - BBA program Faculty salaries Degree operating costs Building maintenance Classroom costs Classroom rental Differential school administration costs 900,000 6,120,000 585,000 555,000 1,275,000 300,000 0 9,735,000 Total costs Net gain from BBA programs b. Are there other factors the dean should consider before making her decision? ufficient applicants and faculty