Question

Exercise 13-10. Selected hypothetical comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the

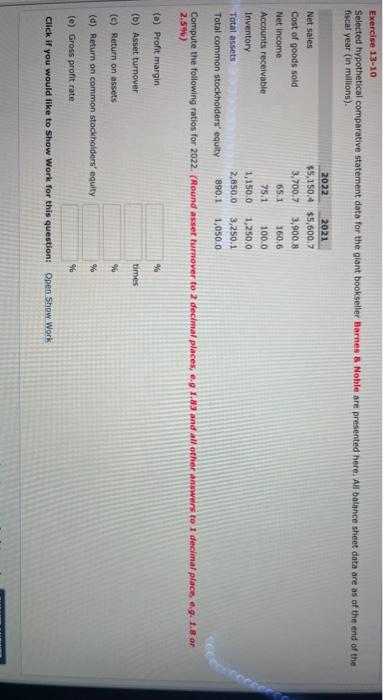

Exercise 13-10. Selected hypothetical comparative statement data for the giant bookseller Barnes & Noble are presented here. All balance sheet data are as of the end of the fiscal year (in millions). Net sales 2022 $5,150.4 $5,600.7 2021 Cost of goods sold 3,700.7 3,900.8 Net income 65.1 160.6 Accounts receivable 75.1 100.0 Inventory 1,150.0 1,250.0 Total assets 2,850.0 3,250.1 Total common stockholders' equity 890.1 1,050.0 Compute the following ratios for 2022. (Round asset turnover to 2 decimal places, eg 1.83 and all other answers to 1 decimal place, e.g. 1.8 or 2.5%) (a) Profit margin % (b) Asset turnover times (c) Return on assets % (d) Return on common stockholders' equity % % (e) Gross profit rate Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started