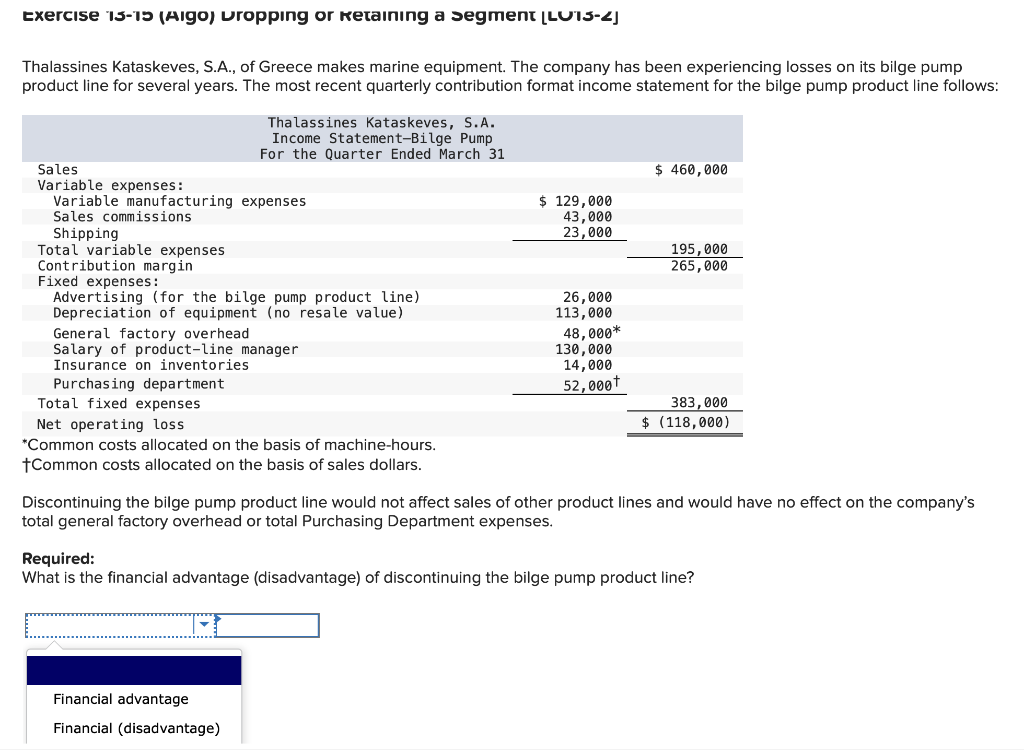

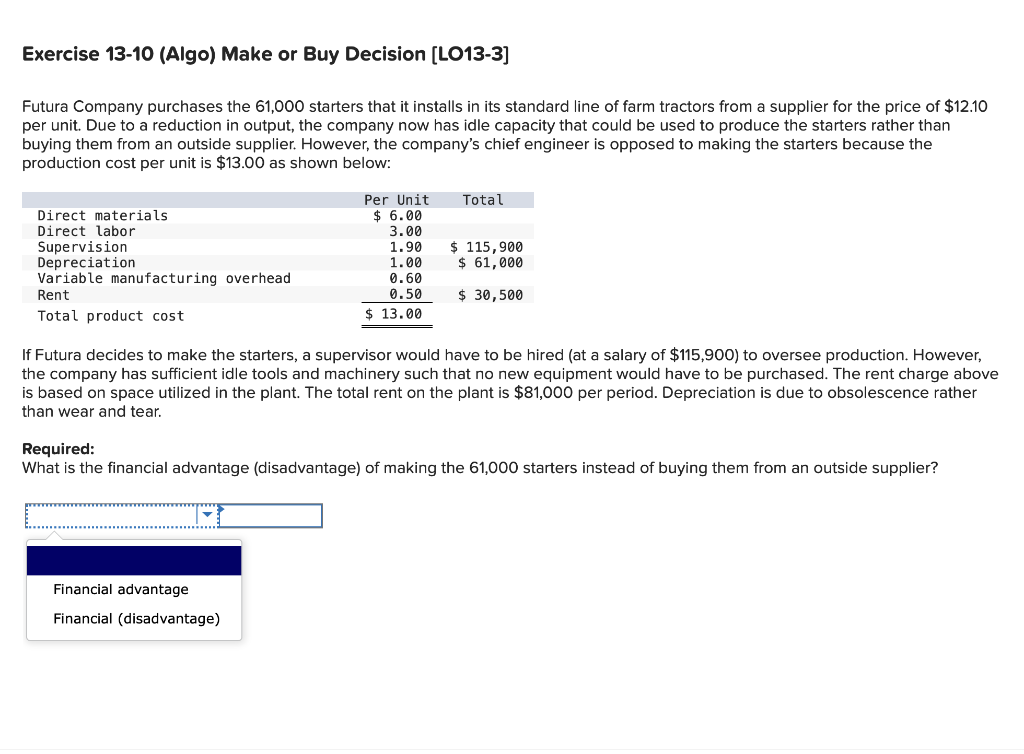

Exercise 13-15 (Aigo) Dropping or retaining a segment [LU15-2] Thalassines Kataskeves, S.A., of Greece makes marine equipment. The company has been experiencing losses on its bilge pump product line for several years. The most recent quarterly contribution format income statement for the bilge pump product line follows: Thalassines Kataskeves, S.A. Income Statement-Bilge Pump For the Quarter Ended March 31 Sales $ 460,000 Variable expenses: Variable manufacturing expenses Sales commissions $ 129,000 43,000 Shipping 23,000 Total variable expenses Contribution margin 195,000 265,000 Fixed expenses: 26,000 Advertising (for the bilge pump product line) Depreciation of equipment (no resale value) 113,000 General factory overhead 48,000* Salary of product-line manager Insurance on inventories 130,000 14,000 52,000+ Purchasing department Total fixed expenses 383,000 Net operating loss $ (118,000) *Common costs allocated on the basis of machine-hours. +Common costs allocated on the basis of sales dollars. Discontinuing the bilge pump product line would not affect sales of other product lines and would have no effect on the company's total general factory overhead or total Purchasing Department expenses. Required: What is the financial advantage (disadvantage) of discontinuing the bilge pump product line? Financial advantage Financial (disadvantage) Exercise 13-10 (Algo) Make or Buy Decision [LO13-3] Futura Company purchases the 61,000 starters that it installs in its standard line of farm tractors from a supplier for the price of $12.10 per unit. Due to a reduction in output, the company now has idle capacity that could be used to produce the starters rather than buying them from an outside supplier. However, the company's chief engineer is opposed to making the starters because the production cost per unit is $13.00 as shown below: Per Unit $ 6.00 Total Direct materials 3.00 Direct labor Supervision Depreciation 1.90 $ 115,900 1.00 $ 61,000 Variable manufacturing overhead 0.60 Rent 0.50 30,500 Total product cost $ 13.00 If Futura decides to make the starters, a supervisor would have to be hired (at a salary of $115,900) to oversee production. However, the company has sufficient idle tools and machinery such that no new equipment would have to be purchased. The rent charge above is based on space utilized in the plant. The total rent on the plant is $81,000 per period. Depreciation is due to obsolescence rather than wear and tear. Required: What is the financial advantage (disadvantage) of making the 61,000 starters instead of buying them from an outside supplier? Financial advantage Financial (disadvantage)