Answered step by step

Verified Expert Solution

Question

1 Approved Answer

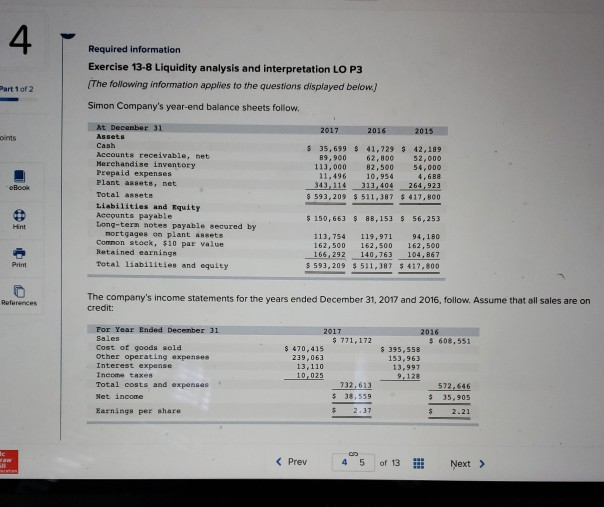

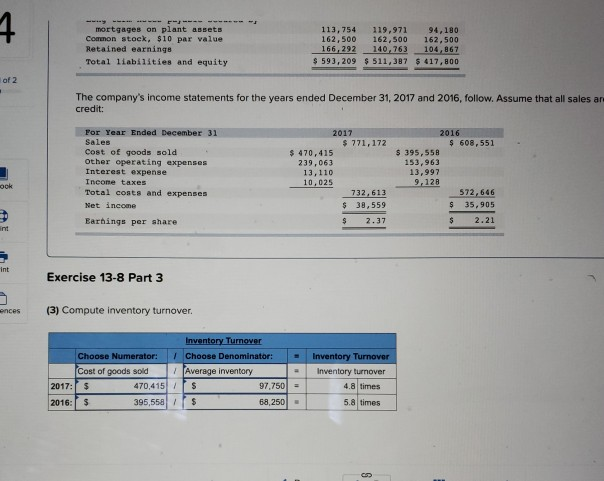

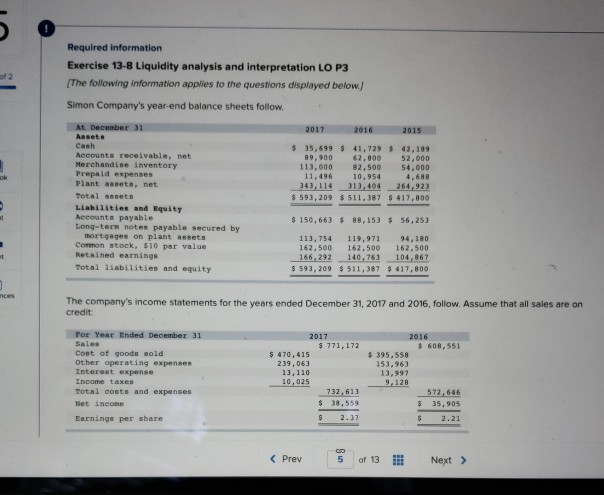

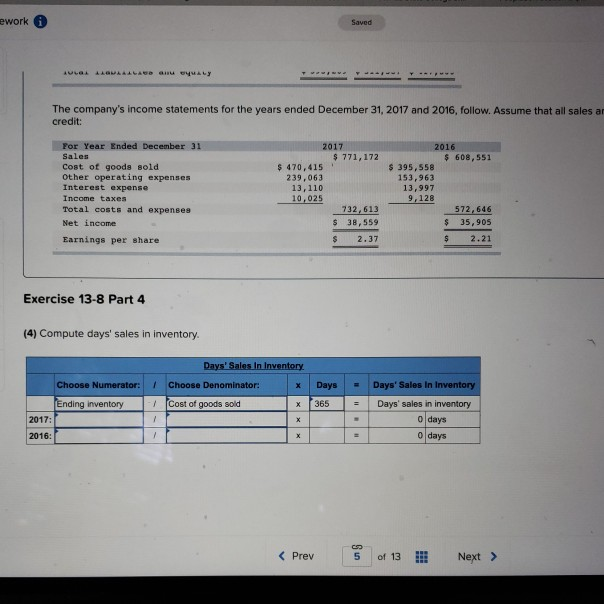

exercise 13-8 liquidity analysis and interpretation lo p3 4 Required information Exercise 13-8 Liquidity analysis and interpretation LO P3 (The following information applies to the

exercise 13-8 liquidity analysis and interpretation lo p3

4 Required information Exercise 13-8 Liquidity analysis and interpretation LO P3 (The following information applies to the questions displayed below Part 1 of 2 Simon Company's year-end balance sheets follow. At December 31 2017 2016 2015 Assets oints Cash S 35,699 $ 41,729 $ 42,189 62,800 82,500 10,954 Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net 52,000 54,000 89,900 113,000 11,496 343,114 4,688 264,923 313,404 eBook Total assets 593,209 $ 511,387 $ 417,800 Liabilities and Equity Aceounts payable Long-tern notes payable secured by nortgages on plant assets Common stoek, $10 par value Retained earnings 88,153 56, 253 150,663 Hnt 113, 754 162,500 166, 292 119,971 162,500 140,763 94,180 162,500 104, 867 Total liabilities and equity Print S 593,209 $ 511,387 $ 417,800 The compamy's income statements for the years ended December 31, 2017 and 2016, follow. Assume that all sales are on credit: References For Year Ended December 31 2017 2016 $608,551 Sales $771,172 Cost of goods sold Other operating expenses Interest expense S 470,415 239,063 S 395,558 153,963 13,997 9,128 13,110 10,025 Income taxes Total costs and expenses 732,613 572,646 $ 38,559 Net incomes 35,905 Earnings per share 2.37 2.21 r aw

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started