Answered step by step

Verified Expert Solution

Question

1 Approved Answer

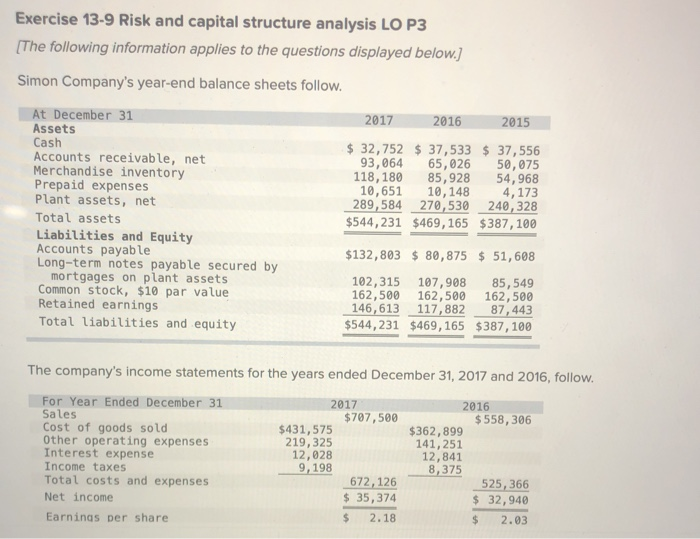

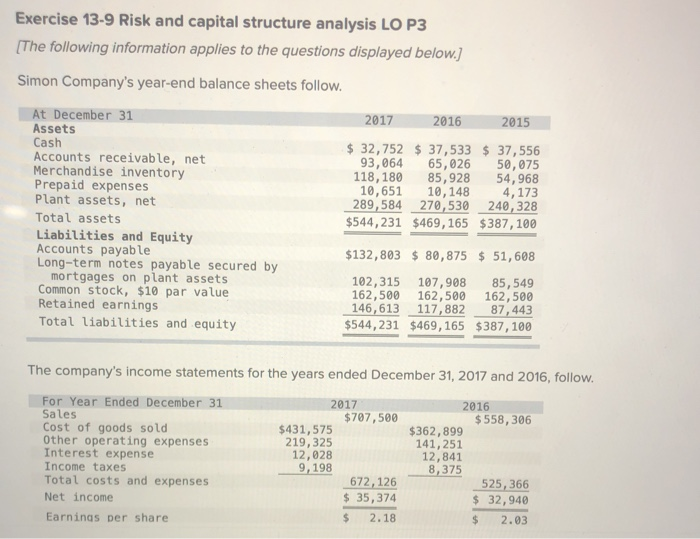

Exercise 13-9 Risk and capital structure analysis LO P3 (The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. 2017

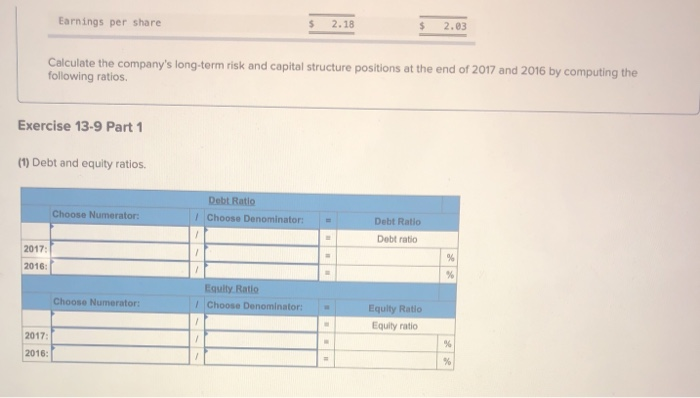

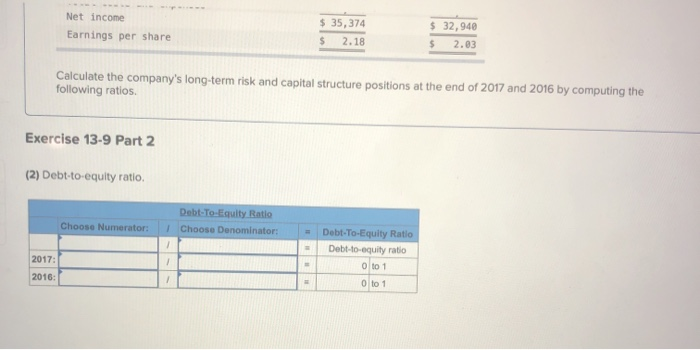

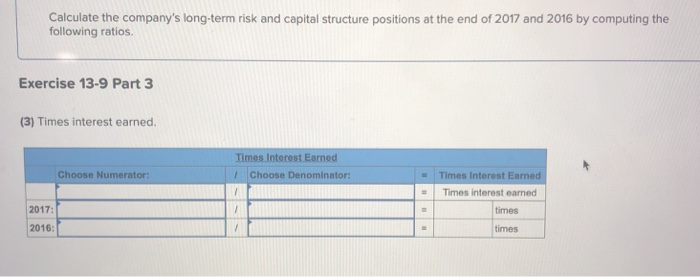

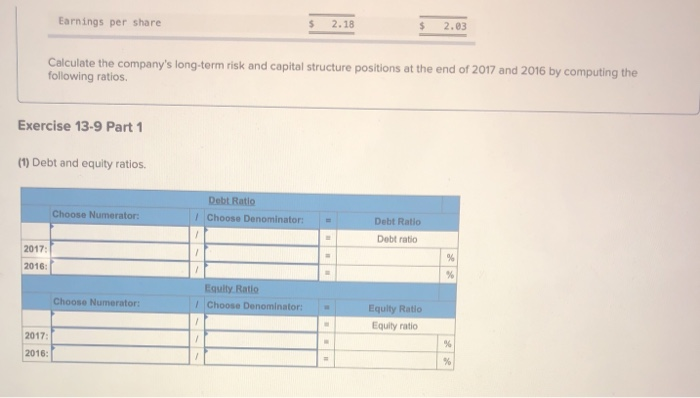

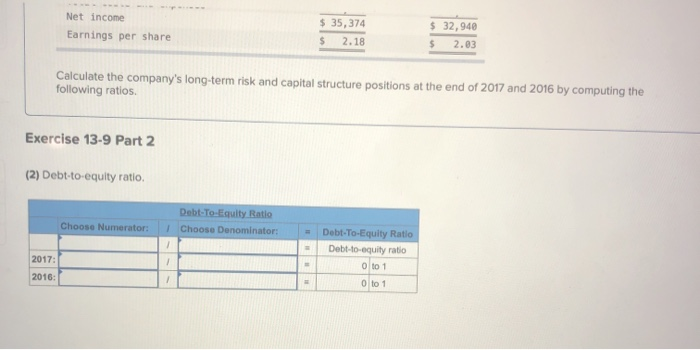

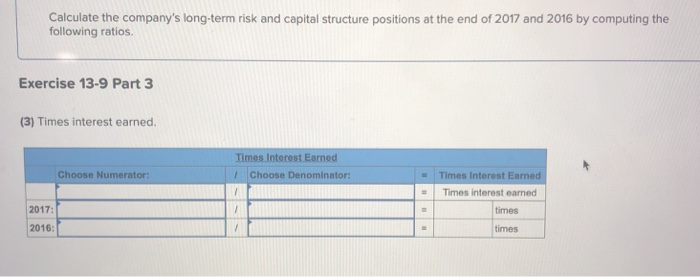

Exercise 13-9 Risk and capital structure analysis LO P3 (The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. 2017 2016 2015 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 32,752 $ 37,533 $ 37,556 93,064 65,026 50,075 118,180 85,928 54,968 10,651 10,148 4,173 289,584 270,530 240, 328 $544,231 $469,165 $387,100 $132,803 $ 80,875 $ 51,608 102,315 107,908 85,549 162,500 162,500 162,500 146,613 117,882 87,443 $544,231 $469,165 $387,100 The company's income statements for the years ended December 31, 2017 and 2016, follow. For Year Ended December 31 2017 2016 Sales $ 707,500 $ 558, 306 Cost of goods sold $431,575 $362,899 Other operating expenses 219,325 141,251 Interest expense 12,028 12,841 Income taxes 9,198 8,375 Total costs and expenses 672, 126 525, 366 Net income $ 35,374 $ 32,940 Earnings per share $ 2.18 $ 2.03 Earnings per share $ 2.18 2.03 Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios. Exercise 13-9 Part 1 (1) Debt and equity ratios Choose Numerator: Debt Ratio 1 Choose Denominator: Debt Ratio Debt ratio 2017: % 2016: % Choose Numerator: Equity Ratio Choose Denominator: Equity Ratio Equity ratio 2017 % 2016: % Net income Earnings per share $ 35, 374 2.18 $ 32,940 $ 2.03 Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios. Exercise 13-9 Part 2 (2) Debt-to-equity ratio Choose Numerator: Debt-To-Equity Ratio Choose Denominator: 1 2017: Debt-To-Equity Ratio Debt-to-equity ratio O to 1 O to 1 2016: Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios. Exercise 13-9 Part 3 (3) Times interest earned. Times Interest Eamed Choose Numerator: Choose Denominator: 1 Times Interest Earned Times interest earned times 2017: 2016: times

Exercise 13-9 Risk and capital structure analysis LO P3 (The following information applies to the questions displayed below.) Simon Company's year-end balance sheets follow. 2017 2016 2015 At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable secured by mortgages on plant assets Common stock, $10 par value Retained earnings Total liabilities and equity $ 32,752 $ 37,533 $ 37,556 93,064 65,026 50,075 118,180 85,928 54,968 10,651 10,148 4,173 289,584 270,530 240, 328 $544,231 $469,165 $387,100 $132,803 $ 80,875 $ 51,608 102,315 107,908 85,549 162,500 162,500 162,500 146,613 117,882 87,443 $544,231 $469,165 $387,100 The company's income statements for the years ended December 31, 2017 and 2016, follow. For Year Ended December 31 2017 2016 Sales $ 707,500 $ 558, 306 Cost of goods sold $431,575 $362,899 Other operating expenses 219,325 141,251 Interest expense 12,028 12,841 Income taxes 9,198 8,375 Total costs and expenses 672, 126 525, 366 Net income $ 35,374 $ 32,940 Earnings per share $ 2.18 $ 2.03 Earnings per share $ 2.18 2.03 Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios. Exercise 13-9 Part 1 (1) Debt and equity ratios Choose Numerator: Debt Ratio 1 Choose Denominator: Debt Ratio Debt ratio 2017: % 2016: % Choose Numerator: Equity Ratio Choose Denominator: Equity Ratio Equity ratio 2017 % 2016: % Net income Earnings per share $ 35, 374 2.18 $ 32,940 $ 2.03 Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios. Exercise 13-9 Part 2 (2) Debt-to-equity ratio Choose Numerator: Debt-To-Equity Ratio Choose Denominator: 1 2017: Debt-To-Equity Ratio Debt-to-equity ratio O to 1 O to 1 2016: Calculate the company's long-term risk and capital structure positions at the end of 2017 and 2016 by computing the following ratios. Exercise 13-9 Part 3 (3) Times interest earned. Times Interest Eamed Choose Numerator: Choose Denominator: 1 Times Interest Earned Times interest earned times 2017: 2016: times

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started