Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Exercise 14-11A (Algo) Determining cash flows from financing activities LO 14-4 On January 1, Year 1, Perez Company had a balance of ( $ 599,000

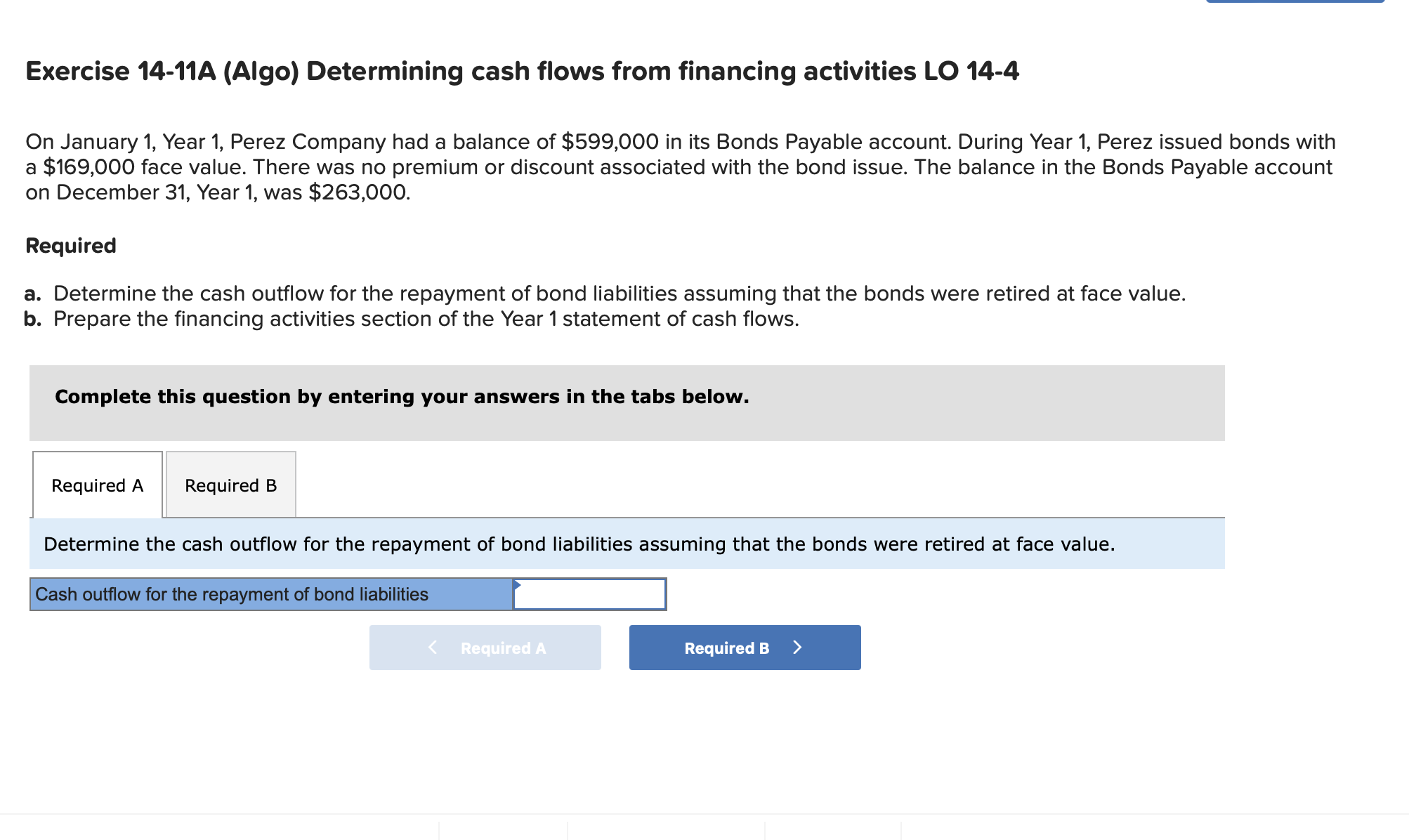

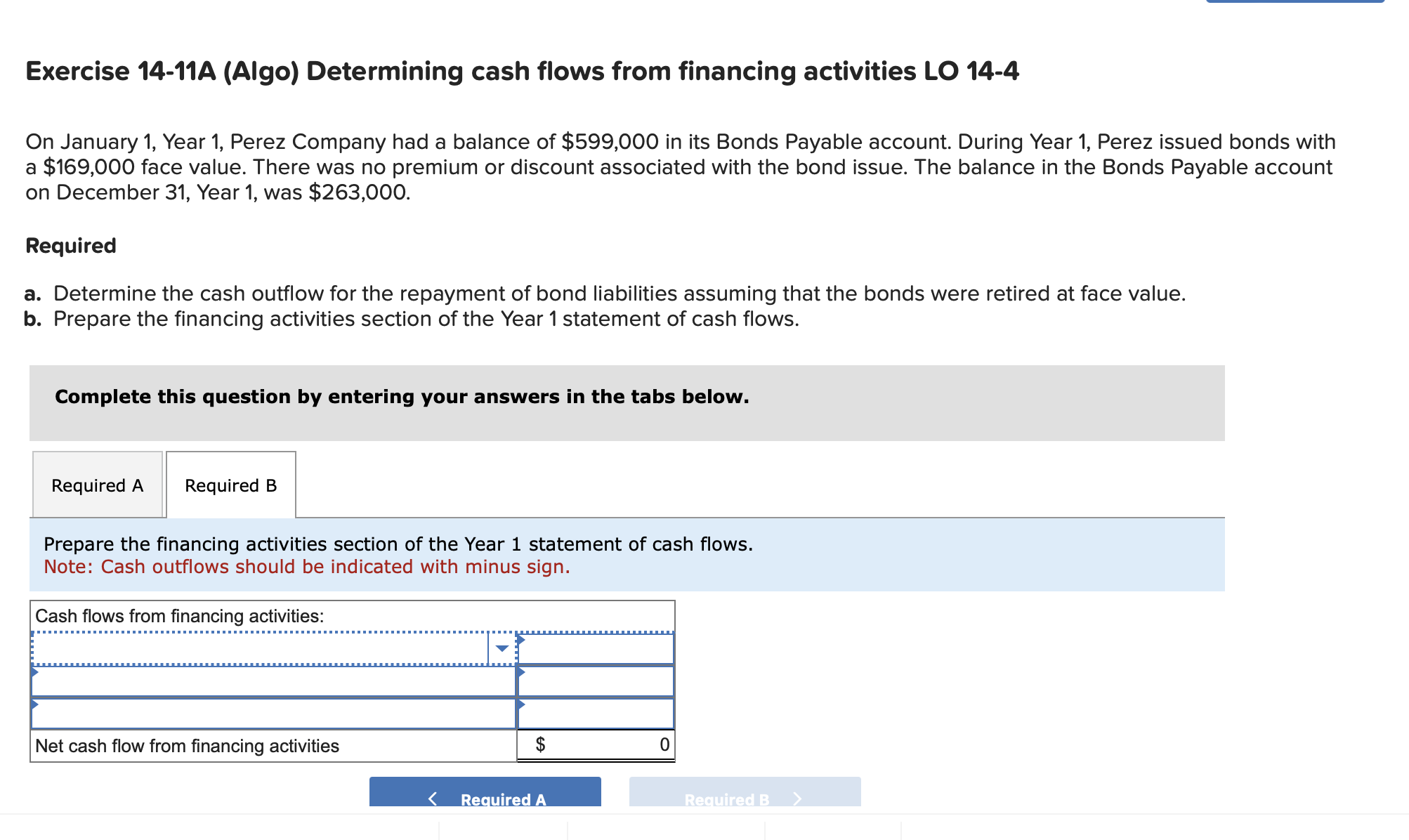

Exercise 14-11A (Algo) Determining cash flows from financing activities LO 14-4 On January 1, Year 1, Perez Company had a balance of \\( \\$ 599,000 \\) in its Bonds Payable account. During Year 1, Perez issued bonds with a \\( \\$ 169,000 \\) face value. There was no premium or discount associated with the bond issue. The balance in the Bonds Payable account on December 31, Year 1, was \\( \\$ 263,000 \\). Required a. Determine the cash outflow for the repayment of bond liabilities assuming that the bonds were retired at face value. b. Prepare the financing activities section of the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Determine the cash outflow for the repayment of bond liabilities assuming that the bonds were retired at face value. Exercise 14-11A (Algo) Determining cash flows from financing activities LO 14-4 On January 1, Year 1, Perez Company had a balance of \\( \\$ 599,000 \\) in its Bonds Payable account. During Year 1, Perez issued bonds with a \\( \\$ 169,000 \\) face value. There was no premium or discount associated with the bond issue. The balance in the Bonds Payable account on December 31, Year 1, was \\( \\$ 263,000 \\). Required a. Determine the cash outflow for the repayment of bond liabilities assuming that the bonds were retired at face value. b. Prepare the financing activities section of the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Prepare the financing activities section of the Year 1 statement of cash flows. Note: Cash outflows should be indicated with minus sign

Exercise 14-11A (Algo) Determining cash flows from financing activities LO 14-4 On January 1, Year 1, Perez Company had a balance of \\( \\$ 599,000 \\) in its Bonds Payable account. During Year 1, Perez issued bonds with a \\( \\$ 169,000 \\) face value. There was no premium or discount associated with the bond issue. The balance in the Bonds Payable account on December 31, Year 1, was \\( \\$ 263,000 \\). Required a. Determine the cash outflow for the repayment of bond liabilities assuming that the bonds were retired at face value. b. Prepare the financing activities section of the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Determine the cash outflow for the repayment of bond liabilities assuming that the bonds were retired at face value. Exercise 14-11A (Algo) Determining cash flows from financing activities LO 14-4 On January 1, Year 1, Perez Company had a balance of \\( \\$ 599,000 \\) in its Bonds Payable account. During Year 1, Perez issued bonds with a \\( \\$ 169,000 \\) face value. There was no premium or discount associated with the bond issue. The balance in the Bonds Payable account on December 31, Year 1, was \\( \\$ 263,000 \\). Required a. Determine the cash outflow for the repayment of bond liabilities assuming that the bonds were retired at face value. b. Prepare the financing activities section of the Year 1 statement of cash flows. Complete this question by entering your answers in the tabs below. Prepare the financing activities section of the Year 1 statement of cash flows. Note: Cash outflows should be indicated with minus sign Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started