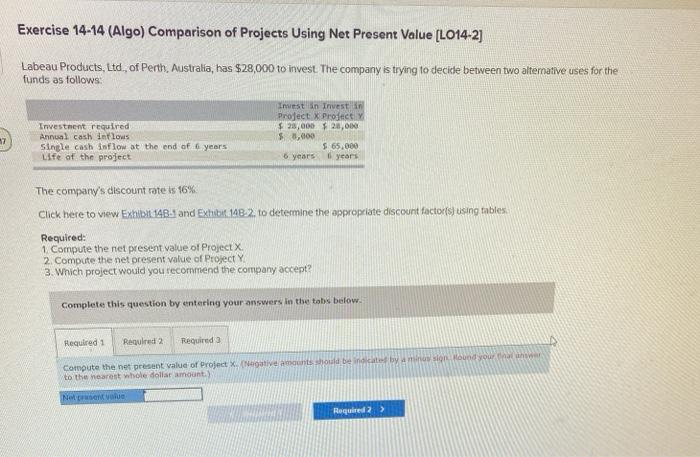

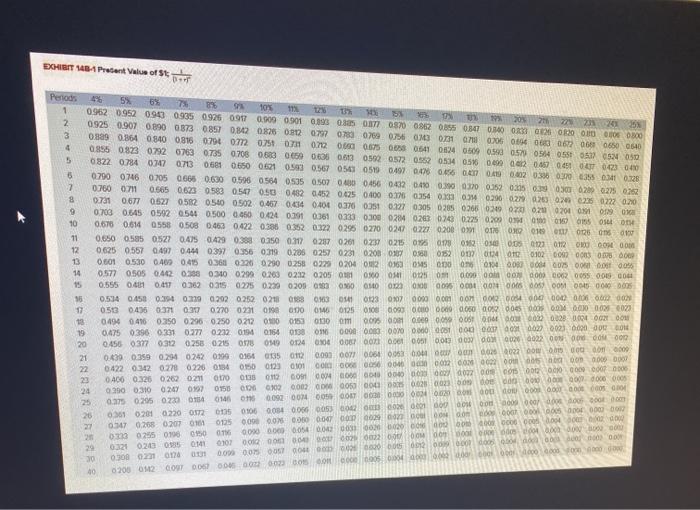

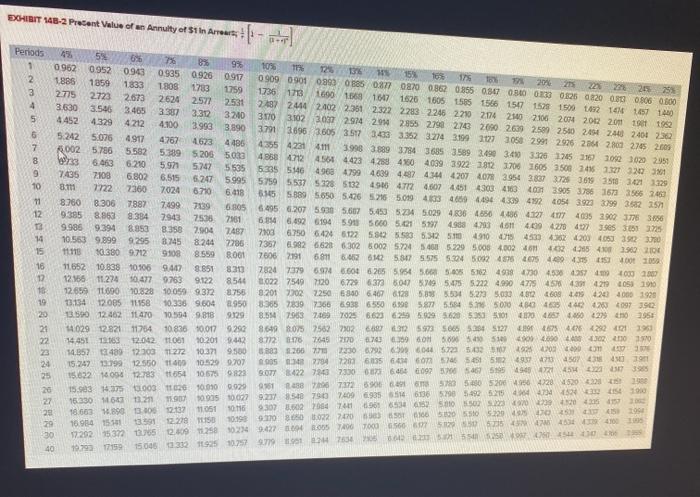

Exercise 14-14 (Algo) Comparison of Projects Using Net Present Value [LO14-2] Labeau Products, Ltd., of Perth, Australia, has $28,000 to invest. The company is trying to decide between two alternative uses for the funds as follows: Invest in Invest in Project Product $ 28,000 $20,000 $3,000 $ 65,000 6 years 6 years Investment required Annual cash inflows Single Cash inflow at the end of 6 year's Life of the project 7 The company's discount rate is 16% Click here to view Exhibit 14B-S and Exhibit 14B-2. to determine the appropriate discount factor(s) using tables Required: 1 Compute the net present value of Project X 2. Compute the net present value of Project Y 3. Which project would you recommend the company accept? Complete this question by entering your answers in the tabs below. Required: Required 2 Required Compute the net present value of project X. (Negative amounts should be nice by mission Hound your to the nearest whole dollar amount.) Network Required) BOHIBIT MBA Prtant Value of St DF SOL NM Periods 5% 8% 1 0962 0952 0943 0935 0926 096 0900 6901 QS 00S ONT 0.870 0852 055 0547 0700 OK EXO ONDOO 000 9 11% 0925 0.907 0890 0373 0857 0342 026 0102 079 078 0769 0756 0313 031 0305 096 03 067060650 0640 21 03090.364 0.840 08160794 07207510070200 0.57 08 0641 0904 0509 0.5 0.5 054 055 054 050 0.855 0.873 07920763 0735 07080603 0659 0.635 000 0532 0.572 052 0534 0.5 0.2 0.657 0 0 0 0 5 0822 0.784 0747 073 0.681 650 0621 0.50 0.567 050 05190497 0.06 0.56 0.0002 0.35 000 5 07900746 0705 0665 0.690 0.596 0.564 0535 0.507 0.400 0.456 0432 6450 0.30 0.30 0.52 0.375 0.9 002000225 0252 7 0760 07 0.565 0.623 0583 0.547 0.50 0.482 0.452 0.025 0.000 0.76 0.54 0.33 0.4 0.290 029 026 022 023 0222 0.20 8 0731 0.677 0527 0.582 0510 0502 0.467 0.34 0.400 0.70 0351 0.227 03050285 030 029 020 021 0201 00 OK 9 0.703 0.645 0502 0544 0.500 0.450 0.21 0391 0361 0333 0300 0284 02 6743 0.225 0.209 010 016 95 OSLO 10 0.670 0.6140558 0.508 0.463 0422 0.386 0.352 0.322 0295 0770 6242 0227 0208 01 01 ONO 119 0126 01-01 0.650 055 0522 0.475 0.429 0.38 0.250 0.17 0237 0.21 0.237 02 05 01 02 05 2012 OGOS 0000 12 0.625 0,557 0.497 0.44 0.397 0.356 0.319 0206 0257 0231 020000000152 097 004 010 0102 00 00 00 00 13 0.601 0.530 0.4 0.415 036 0320 0200 0.258 0225 0204 20360 05 00 0 000000000500056 14 0.577 0.505 0.412 0.38 0.30 0.299 0.263 0232 0205 0101 090 01 0125 091 0.0000 DON 0000 0002 0055 000 000 0.555 0.41 0.497 0.382 03 0275 0230 0203030360 0100 000 000 0004 00156051 COM 004 0000000 0.534 0.450 0.00 0.00 0.292 0252 0210188 03 04 03 007 00000001 001 0012 000 000 000 17 053 0435 0.371 0307 0270 02 010 010 016 0125 010 009 0.0 0.0 0.0 002 004 000 200 002 0023 04940416 0.250 0.296 0.250 0.212 00153 000 0 0090 0.000 0.0005 006 002 00 OGM Cou 19 0.475 0396 0231 0.277 0232 019 0.154 013801 0000 0000 0.00 0.00 0.00 000 000 000 000 000 000 20 0.456 0377 0.3120.253 0.215 078 019 0140 000 con 000051 000 000 0000200022 000 000 21 0.439 0.359 0.294 0242 0.1990166 035 0.003 007 0064 063 0.00 0.00 02200 0000 22 0422034202200226 0156 0950 003 0101 000 000 000 000 000 000 0000 2 0 4000326 0262 0211 017008 ti 0 CO CHU CHO H 0 0 0 0 0 0 0E D D1 D200 g b phn qu 24 0.250 0.310 024 0997 0158 000 000 000 00050 000 002 002300 W 0000000000000 25 0.375 0.205 0230 0454 014600092M005 DOT 4 ou do 0.000000 26 0361020102200172 01060064 0056 005 00022 0.01 000 000 000 000 0 0.20 0.20 00 0125 0.00 0.00 0.00 0.007 2006 Noon 000 000 000 000 000 022 0295 0190 0950017 000000000054 000 000 000 000 000 000 000 00000000000 29 0321 02309014 0101001001002002 DI 0.38 021017 30 000 000 000 000 00012 000.COM doo doo) 000 10 200 M2 CON DOS 0000 002 0000000000000000 CHO EGHIBIT 548-2 Prozent Value of an Annulty of $1 In Arrear Periods 1333 49 5% 656 76 99 09620952 1025 0943 0.935 0926 0917 124 15 090909010993 E85 0:37 08200.862 0.855 0.567 0.00 0-333 0826 0820 0.83 0.306 0.500 175 2 To 1886 2015 1859 226 227 2255 1803 1783 1759 3 1736 2775 2723 1713 2673 1690 1668 1607 2624 2577 2531 1626 1505 155 1565 150 3.630 2487 2444 2102 2.351 2322 2283 2246 2210 294 295 2106 2004 2002 2001 1952 4 1528150082 T 1440 3545 3465 3387 3.312 3200 3.70 5 4452 3102 1037 294 294 2955 2790 2113 2090 269 2.500 2500 245 246 2404 230 4.329 4212 4.100 3.993 3890 37913696 3605 3517 3433 3352 3.214 391027 1050 2991 2925 24 23 2765 2009 6 5.242 5.076 4917 4.767 4623 4486 4355 4231 7 4.111 002 5786 3998 3.889 3784 3685 3589 2.490 341 3325 125 2557 10923920 2950 5.582 5.309 5206 5023 49584712 8 2733 454 4423 4258460 40393922-2812 370616053501 241732732031 6.463 6.210 5.97 5247 5535 5335546 9 7435 4968 4799 4.609 4.07434442070783954 3.837 3725 389 350 30211329 7.108 6.802 6.515 6 247 5.995 5759 5537 5328 5132 4966 472 4.607 4.651 4303413 10 8.11 7722 2360 70246.710 4001 39053786 15733566 2650 6.418 5.145 5.889 5650 5.426 5216 5.099 433 466 4.494 4399 4192 205439233799362 1571 71 8.750 8.306 7.887 7.499 7139 6.805 6.495 6.207 5.930 5.60 5.453 234 5.029 48364656 4.136 4127 47 46352907 37783656 12 9385 8.9638384 7943 7535 7961 6.4 6.492 6194 591 560 5.01 5737 4958431611 409 4270 40 305 315 325 9.986 9.394 8.853 8.358 2.904 7487 7800 6.750 6.424 6122 5842580 5.31251491043042200 4.050 302 30 14 10.553 9.899 9.295 8745 8.244 2286 735789026621 6.302 8002 5.724 54 52295.000 4.00240142095401 1962 0 15 1113 30.3809712 9108 8.559 8061 7606 2191 6.81 62 612 5817 5.575 5.304 3002 475 405 44 435 15 100 1059 16 11652 10.838 10.106 9417 8.851 8.30 782473796.9746.00 6205 54 55.00 52 4938 40 456 457 4 100 1000 12 12.156 11.224 10.477 9.763 9.122 8544 3.02275497120 6.7296378 50479954755222 4.990 4725 457 43914219053 1910 16 12.659 11.000 10.82810059 9.372 3.755 8.20179022250 6340 6.40781285.89 5.50 5.2735.000 4.912 608 449 4.20 40001928 19 13.134 120857158 10.336 9.604 8950 3.365 78397366 6938 6550 698 5877 5584 5.500 480 435 442 43 4097 3902 20 13.590 12 462 11470 90,594 9818 9129 8.514 7983 7.00 7025 6.603 6.259 5.9095620 500 500 400 405 4460427942955 27:46 22421 1961 21 14.029 1282111784 10836 10.017 9.250 8.649 80757502 702 607 3059735.665 554 5127 22 14.451 13.163 120421061 10 201 442 872170 764517270 70 59 59 50 51000 4000 44000 14.357480 1230311272 10.371 5.383 3200 7 7230 692 696045723 5.02 2800 450743140 1961 24 15.247 13:1912550 11600 10.529 9.707 905 27047203 6035 664 465 451 54937 4514 019 25 15.6321098 12.783 1654 10 675 123 9.077 3.422 723 730006454 097 462 515 94472 991 24887737290 573 5.000 52004720 520 1959 20 15.3 14.375 0.003 102 1010 0.929 M. 27 16.330647 11 21 $0.905 0.027 9.237 8.50 7900 7400 6.93556936 5798542515 44 4456 1910 9307 1.602 704 701 69065306162500909245115210 28 18.663 1.890 306 1137 11051 116 30100 50 5510 5220 04158109 10:1989.10000222470 29 16.954 1551 13891 12.278 1150 560 ST 5515 44100 30 17.292 15372 652.00 253 02349.427364 07200 000 40 1979377190 150063319 1910.757979.01 2765403500