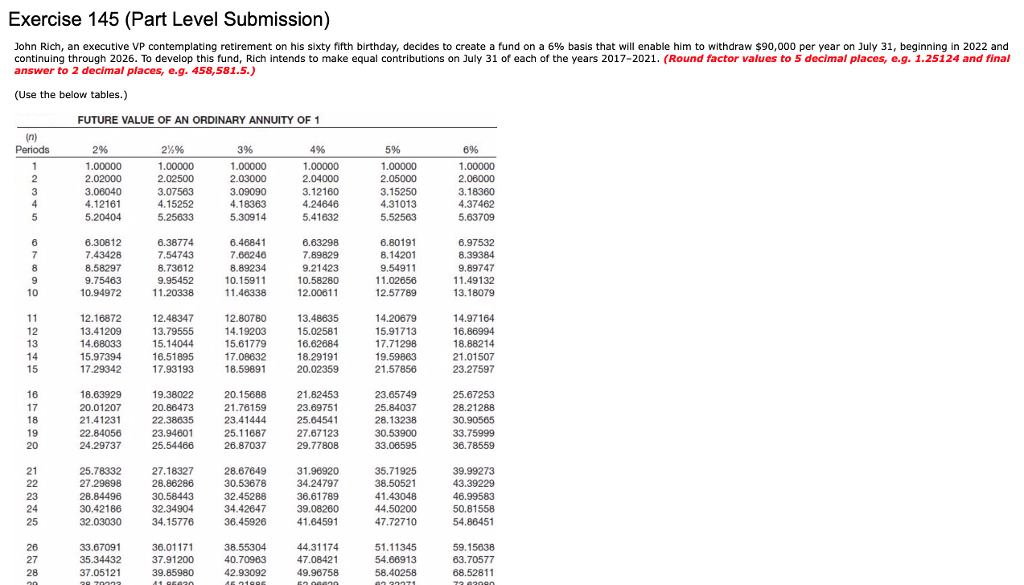

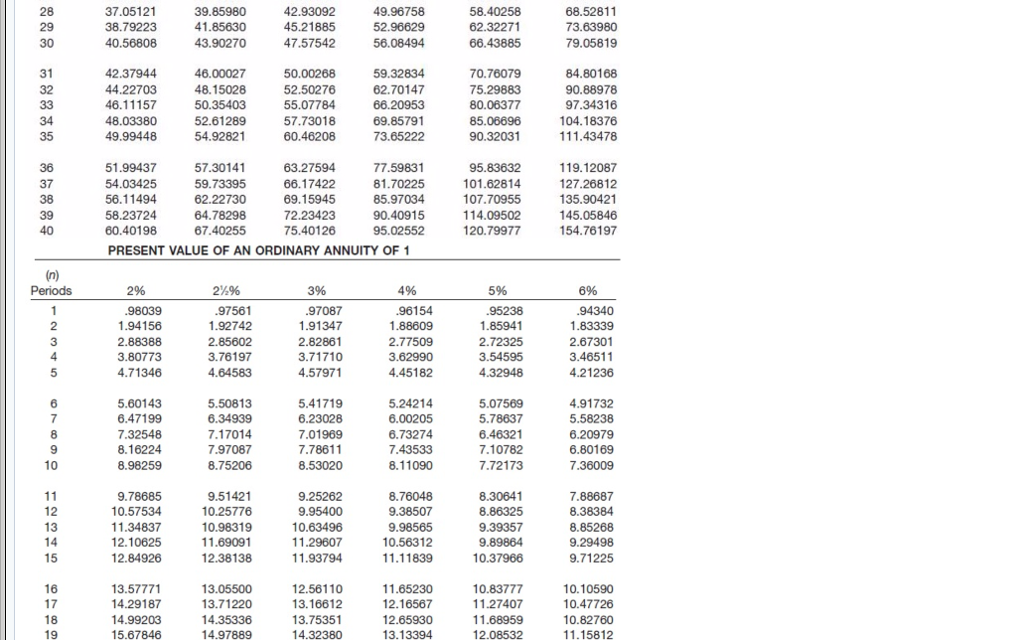

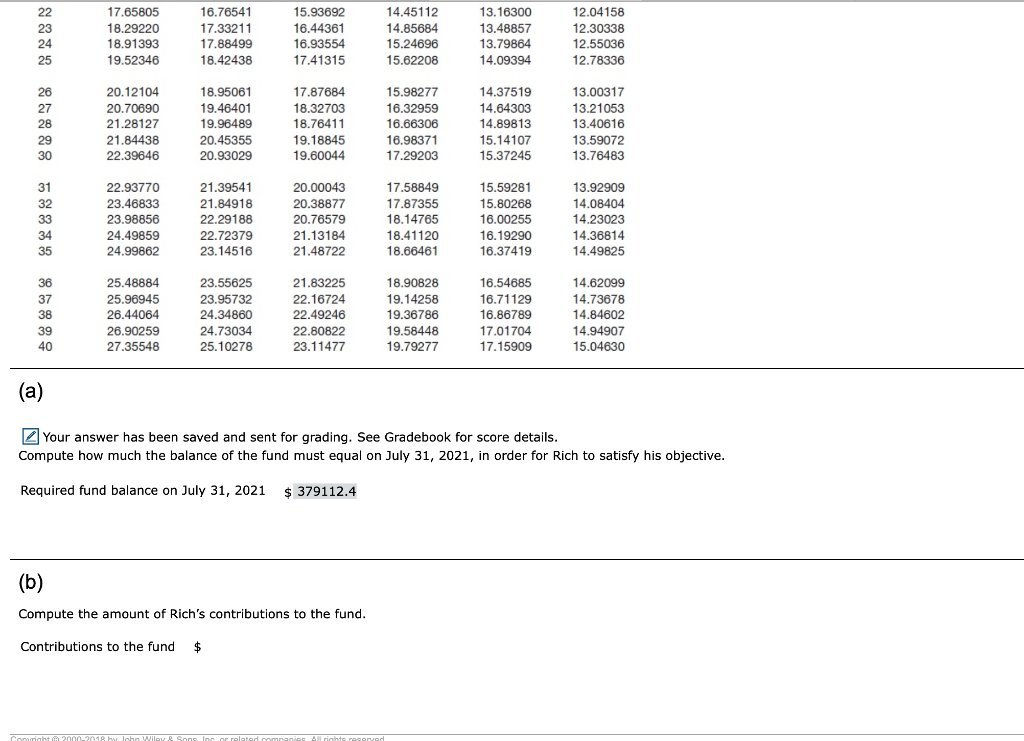

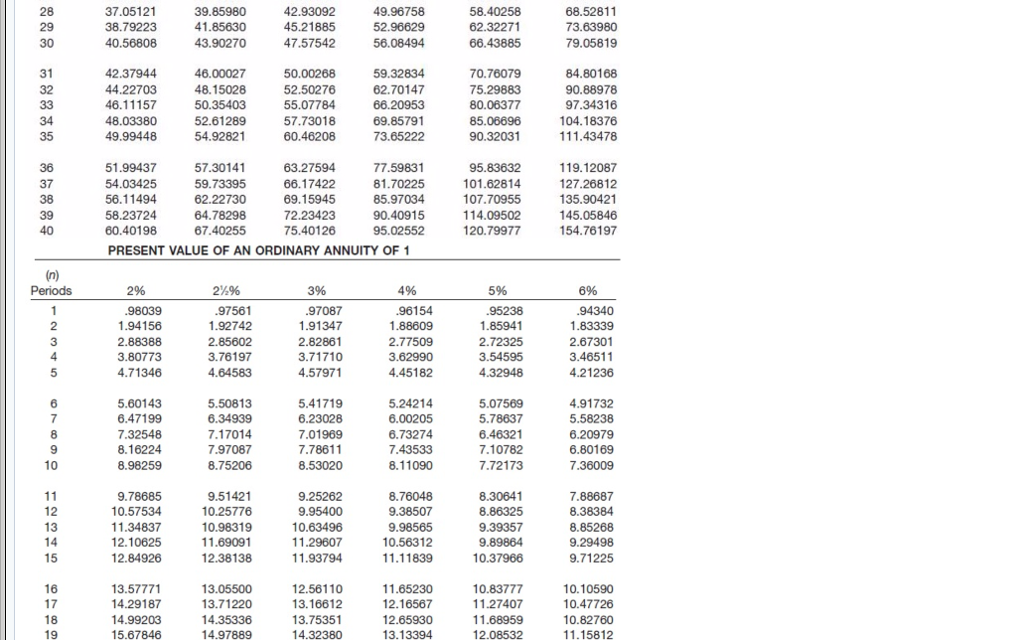

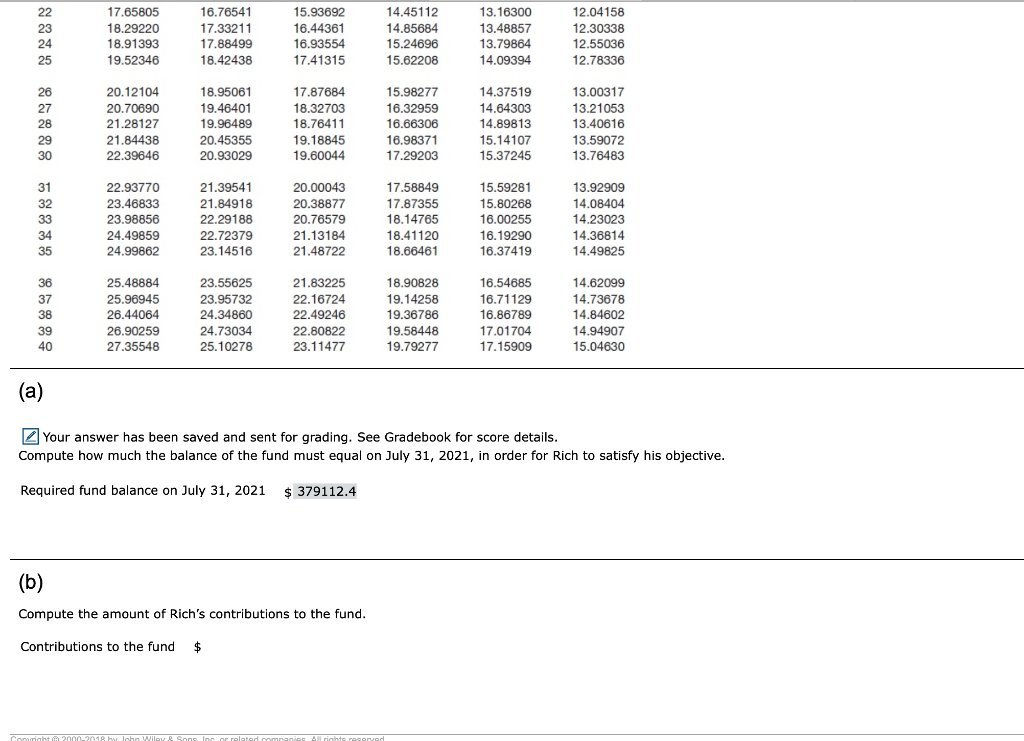

Exercise 145 (Part Level Submission) John Rich, an executive VP contemplating retirement on his sixty fifth birthday, decides to create a fund on a 6% basis that will enable him to withdraw $90,000 per year on July 31, beginning in 2022 and continuing through 2026. To develop this fund, Rich intends to make equal contributions on July 31 of each of the years 2017-2021. (Round factor values to 5 decimal places, e.g. 1.25124 and final answer to 2 decimal places, e.g. 458,581.5.) (Use the below tables.) FUTURE VALUE OF AN ORDINARY ANNUITY OF 1 2%96 6% 00000 .02500 .09090 4.24646 00000 2.04000 3.12160 5.41632 2.06000 3.07563 4.12161 4.18363 4.31013 4.37462 5.63709 6.30812 7.434286.38774 8.58297 6.46841 7.66246 8.89234 10.15911 6.80191 8.14201 9.54911 6.97532 7.54743 8.73612 9.89747 11.49132 13.18079 9.21423 10.94972 2.00811 12.57789 12.16872 12.48347 12.80780 14.19203 15.61779 14.20679 15.91713 17.71298 14.97164 13.41209 15.14044 17.08632 20.02359 15.02581 18.8821 21.01507 23.27597 15.9 16.51895 17.93193 18.29191 18.59891 38035 21.7921.82453 25.64541 27.67123 20.15688 23.65749 20.01207 21.41231 20.86473 23.69751 23.41444 25.11687 26.87037 28.13238 30.53900 33.06595 28.21288 30.90565 33.75999 36.78559 23.94601 25.54466 24.29737 25.78332 27.29698 28.84496 30.42186 32.03030 27.18327 28.67649 30.53678 32.45288 35.71925 38.50521 39.99273 34.24797 36.61789 24 25 32.34904 34.15776 44.50200 47.72710 50.81558 54.86451 36.45926 33.67091 26 27 28 36.01171 37.91200 38.55304 40.70963 44.31174 08421 49.96758 51.11345 54.66913 58.40258 63.70577 68.52811 37.05121 28 29 37.05121 38.79223 68.52811 73.63980 79.05819 39.85980 45.21885 47.57542 49.96758 52.96629 56.08494 58.40258 62.32271 43.90270 46.00027 48.15028 50.35403 52.61289 54.92821 42.37944 44.22703 46.11157 50.00268 52.50276 55.07784 57.73018 60.46208 59.32834 62.70147 70.76079 80.06377 85.06696 90.32031 84.80168 90.88978 97.34316 104.18376 111.43478 34 35 69.85791 57.30141 63.27594 66.17422 69.15945 77.59831 95 54.03425 56.11494 58.23724 60.40198 PRESENT VALUE OF AN ORDINARY ANNUITY OF 1 127.26812 135.90421 145.05846 154.76197 62.22730 107.70955 90.40915 95.02552 40 7-40255 72.2342385970344 119.12087 75.40126 120.79977 2% 1.94156 3.80773 2 % 3% 97087 1.91347 2.82861 3.71710 4.57971 97561 96154 95238 1.8594 94340 3.76197 4.64583 2.67301 3.46511 4.21236 3.62990 272325 5.41719 6.23028 7.01969 7.78611 4.45182 5.24214 6.73274 8.11090 5.07569 5.78637 6.46321 7.10782 7.72173 4.91732 5.58238 6.20979 6.80169 6.47199 6.34939 7.17014 7.97087 8.75206 8.16224 8.98259 9.78685 10.57534 1.34837 9.51421 10.25776 10.98319 11.69091 12.38138 8.30641 8.86325 9.39357 88687 10.63496 11.29607 10.56312 9.29498 9.71225 14 12.84926 10.37966 4,3238012659301127407 10. 10590 1.15812 13.57771 14.29187 12.56110 13.16612 13.75351 13.71220 12.16567 10.82760 15.67846 14.97889 12.08532 17.65805 18.29220 18.91393 19.52346 16.76541 17.33211 17.88499 18.42438 15.93692 16.44361 16.93554 17.41315 14.45112 13.16300 13.48857 13.79864 14.09394 12.04158 12.30338 12.55036 12.78336 23 15.24696 25 20.12104 20.70690 21.28127 18.95061 19.46401 19.96489 20.45355 20.93029 17.87684 18.32703 18.76411 19.18845 19.60044 15.98277 16.32959 14.37519 13.00317 13.21053 13.40616 13.59072 13.76483 27 28 16.98371 17.29203 14.89813 15.14107 15.37245 22.93770 23.46833 23.98856 24.49859 21.39541 21.84918 22.29188 20.00043 20.38877 17.58849 32 21.13184 21.48722 18.14765 18.41120 18.66461 16.00255 16.19290 6.37419 14.23023 14.36814 14.49825 34 99862 22237920.765791787355 15.59281 23.14516 25.48884 25.96945 26.44064 26.90259 27.35548 23.55625 23.95732 24.34860 24.73034 25.10278 21.83225 22.16724 22.49246 22.80822 23.11477 18.90828 19.14258 19.36786 19.58448 19.79277 16.54685 16.71129 16.86789 17.01704 17.15909 14.73678 14.84602 14.94907 15.04630 38 40 Your answer has been saved and sent for grading. See Gradebook for score details Compute how much the balance of the fund must equal on July 31, 2021, in order for Rich to satisfy his objective. Required fund balance on July 31, 2021 $379112.4 Compute the amount of Rich's contributions to the fund Contributions to the fund$