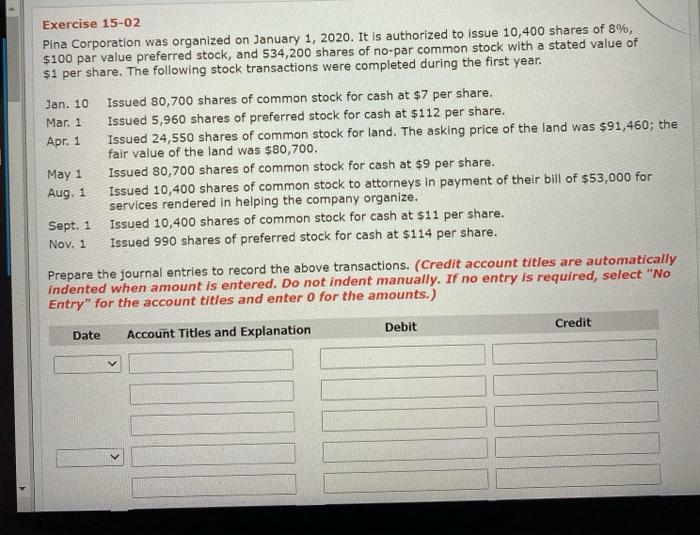

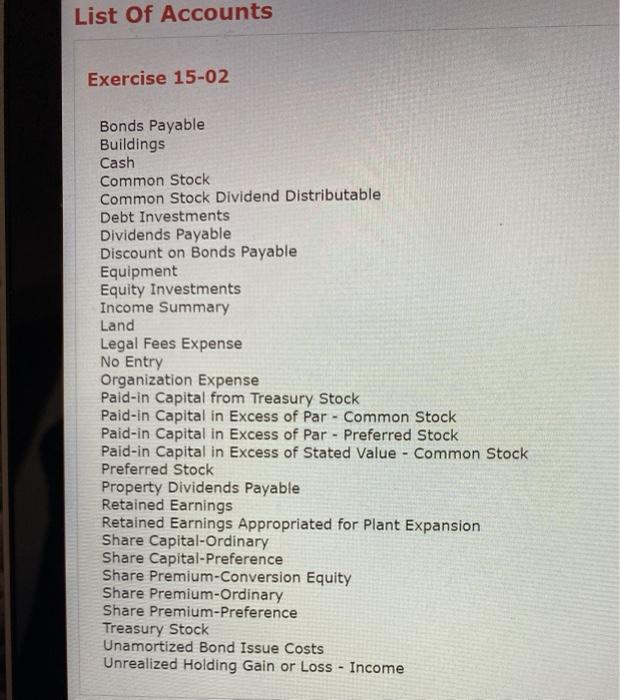

Exercise 15-02 Pina Corporation was organized on January 1, 2020. It is authorized to issue 10,400 shares of 8%, $100 par value preferred stock, and 534,200 shares of no-par common stock with a stated value of $1 per share. The following stock transactions were completed during the first year. Jan. 10 Issued 80,700 shares of common stock for cash at $7 per share. Mar. 1 Issued 5,960 shares of preferred stock for cash at $112 per share. Apr. 1 Issued 24,550 shares of common stock for land. The asking price of the land was $91,460; the fair value of the land was $80,700. May 1 Issued 80,700 shares of common stock for cash at $9 per share. Aug. 1 Issued 10,400 shares of common stock to attorneys in payment of their bill of $53,000 for services rendered in helping the company organize. Sept. 1 Issued 10,400 shares of common stock for cash at $11 per share. Nov. 1 Issued 990 shares of preferred stock for cash at $114 per share. Prepare the journal entries to record the above transactions. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Debit Credit Date Account Titles and Explanation v Prepare the journal entries to record the above transactions. (Credit account titles are automatically Indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter o for the amounts.) Credit Debit Date Account Titles and Explanation Jul SHOW LIST OF ACCOUNTS List Of Accounts Exercise 15-02 Bonds Payable Buildings Cash Common Stock Common Stock Dividend Distributable Debt Investments Dividends Payable Discount on Bonds Payable Equipment Equity Investments Income Summary Land Legal Fees Expense No Entry Organization Expense Paid-in Capital from Treasury Stock Paid-in Capital in Excess of Par - Common Stock Paid-in Capital in Excess of Par - Preferred Stock Paid-in Capital in Excess of Stated Value - Common Stock Preferred Stock Property Dividends Payable Retained Earnings Retained Earnings Appropriated for Plant Expansion Share Capital-Ordinary Share Capital-Preference Share Premium-Conversion Equity Share Premium-Ordinary Share Premium-Preference Treasury Stock Unamortized Bond Issue Costs Unrealized Holding Gain or Loss - Income