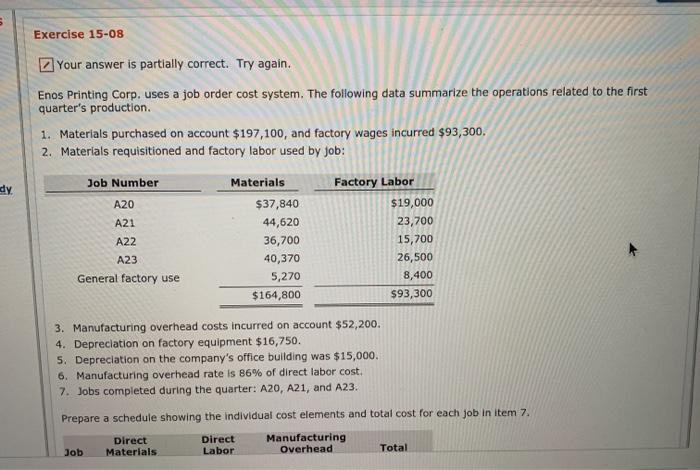

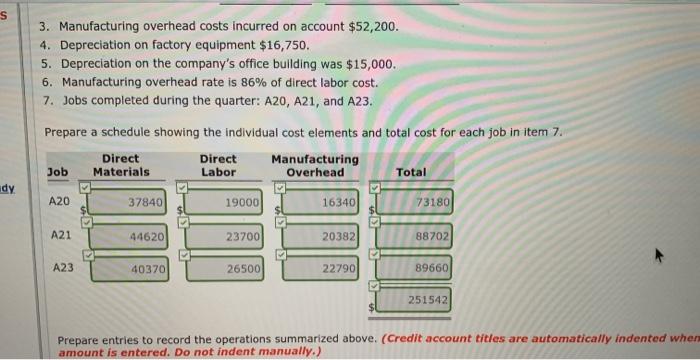

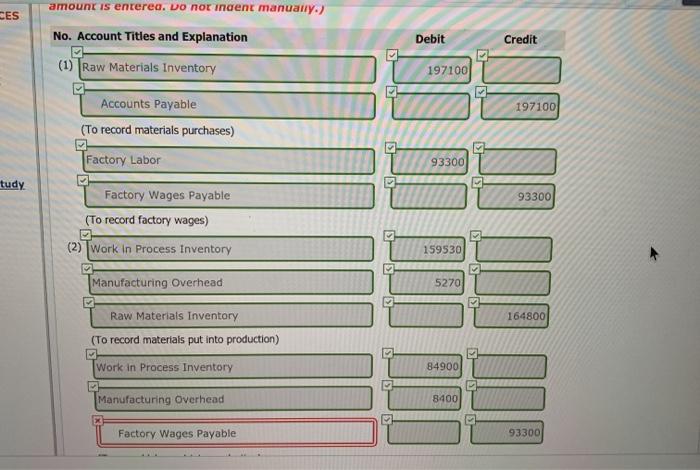

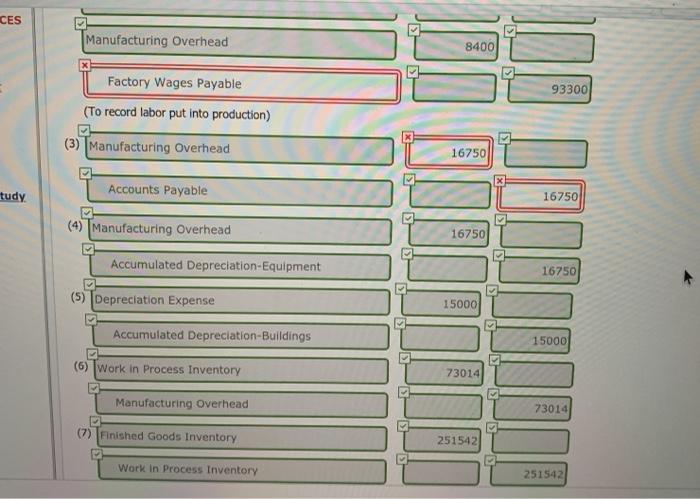

Exercise 15-08 Your answer is partially correct. Try again. Enos Printing Corp. uses a job order cost system. The following data summarize the operations related to the first quarter's production 1. Materials purchased on account $197,100, and factory wages incurred $93,300. 2. Materials requisitioned and factory labor used by job: Job Number dy A20 A21 A22 A23 General factory use Materials $37,840 44,620 36,700 40,370 5,270 $164,800 Factory Labor $19,000 23,700 15,700 26,500 8,400 $93,300 3. Manufacturing overhead costs incurred on account $52,200. 4. Depreciation on factory equipment $16,750. 5. Depreciation on the company's office building was $15,000. 6. Manufacturing overhead rate is 86% of direct labor cost. 7. Jobs completed during the quarter: A20, A21, and A23. Prepare a schedule showing the individual cost elements and total cost for each Job in item 7. Direct Direct Manufacturing Job Materials Labor Overhead Total S 3. Manufacturing overhead costs incurred on account $52,200. 4. Depreciation on factory equipment $16,750. 5. Depreciation on the company's office building was $15,000. 6. Manufacturing overhead rate is 86% of direct labor cost. 7. Jobs completed during the quarter: A20, A21, and A23. Prepare a schedule showing the individual cost elements and total cost for each job in item 7. Direct Direct Manufacturing Job Materials Labor Overhead Total dy A20 37840 19000 16340 73180 A21 44620 23700 20382 88702 A23 40370 26500 22790 89660 251542 Prepare entries to record the operations summarized above. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) CES amount is enrerea. Do not ingent manually.) No. Account Titles and Explanation Debit Credit (1) Raw Materials Inventory 197100 1971001 Accounts Payable (To record materials purchases) Factory Labor 93300 tudy. 93300 Factory Wages Payable (To record factory wages) (2) Work In Process Inventory HO I) III III 10 10 DOI DO! 159530 Manufacturing Overhead 5270 164800 Raw Materials Inventory (To record materials put into production) Work in Process Inventory 84900 Manufacturing Overhead 8400 Factory Wages Payable 93300 CES Manufacturing Overhead 8400 X Factory Wages Payable 93300 (To record labor put into production) (3) Manufacturing Overhead 16750 tudy. Accounts Payable FONI 16750 (4) Manufacturing Overhead 16750 Accumulated Depreciation Equipment 16750 (5) Depreciation Expense 15000 Accumulated Depreciation-Buildings 15000 (6) Work in Process Inventory 73014 V Manufacturing Overhead 73014 (7) Finished Goods Inventory 251542 Work in Process Inventory 251542