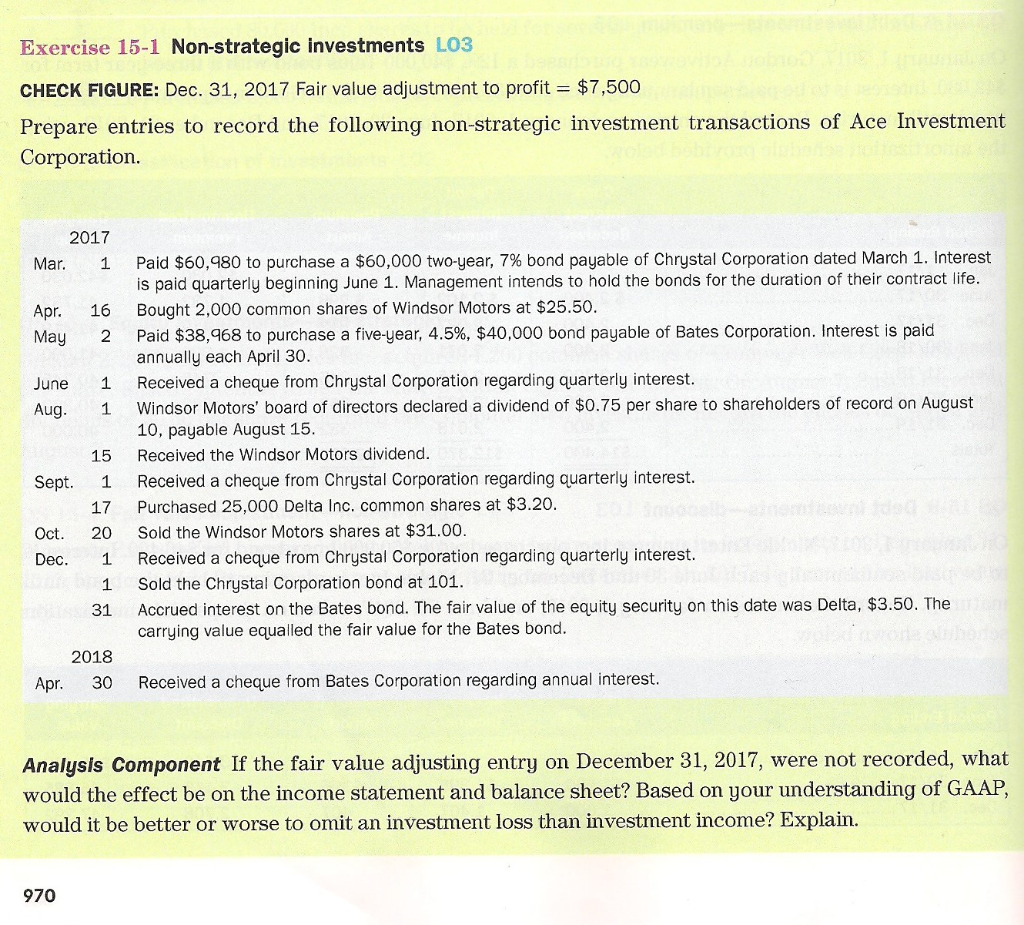

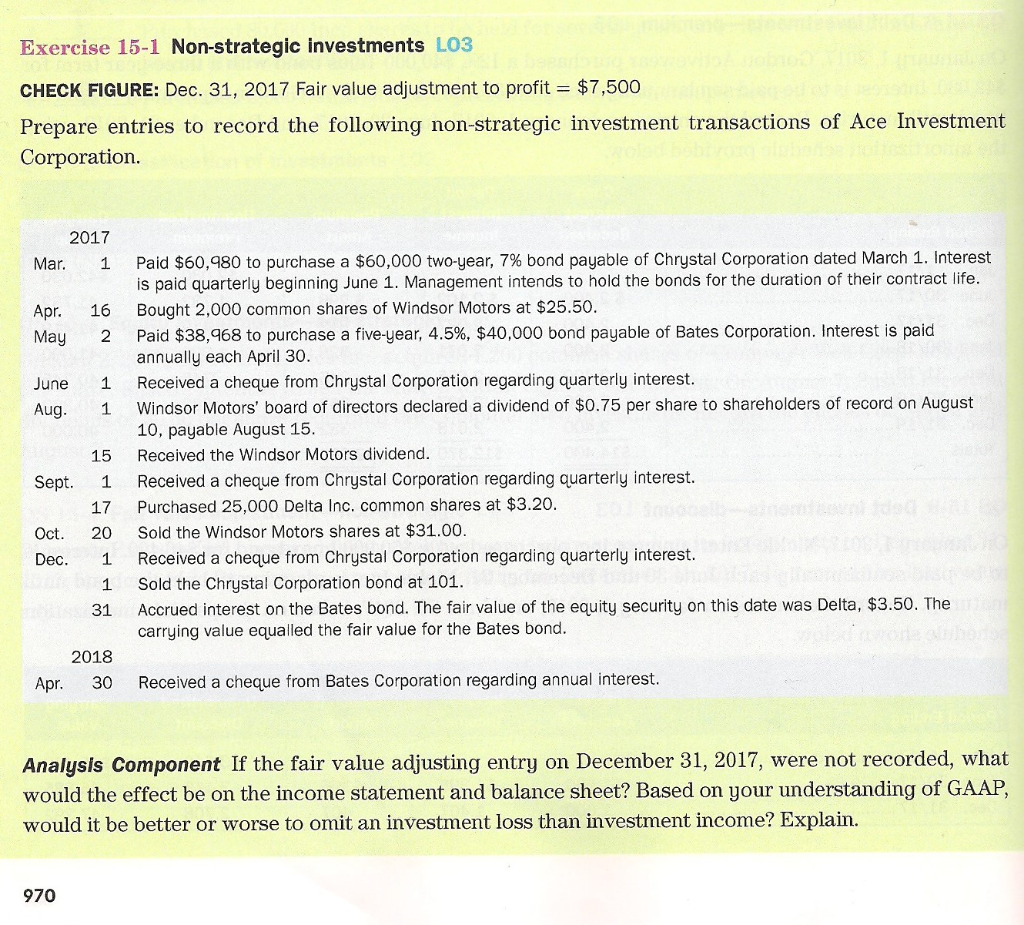

Exercise 15-1 Non-strategic investments LO3 CHECK FIGURE: Dec. 31, 2017 Fair value adjustment to profit - $7,500 Prepare entries to record the following non-strategic investment transactions of Ace Investment Corporation 2017 Paid $60,980 to purchase a $60,000 two-year, 7% bond payable of Chrystal Corporation dated March 1. Interest is paid quarterly beginning June 1. Management intends to hold the bonds for the duration of their contract life. Mar 1 Apr. 16 Bought 2,000 common shares of Windsor Motors at $25.50. Paid $38,968 to purchase a five-year, 4.5%, $40,000 bond payable of Bates Corporation. Interest is paid annually each April 30. May 2 Received a cheque from Chrystal Corporation regarding quarterly interest. Windsor Motors' board of directors declared a dividend of $0.75 per share to shareholders of record on August 10, payable August 15 June 1 1 Aug. Received the Windsor Motors dividend. 15 Received a cheque from Chrystal Corporation regarding quarterly interest Sept 1 Purchased 25,000 Delta Inc. common shares at $3.20 17 Sold the Windsor Motors shares at $31.00. Received a cheque from Chrystal Corporation regarding quarterly interest. Oct 20 1 Dec. Sold the Chrystal Corporation bond at 101. 1 Accrued interest on the Bates bond. The fair value of the equity security on this date was Delta, $3.50. The 31 carrying value equalled the fair value for the Bates bond. 2018 30 Received a cheque from Bates Corporation regarding annual interest. Apr. Analysis Component If the fair value adjusting entry on December 31, 2017, were not recorded, what would the effect be on the income statement and balance sheet? Based on your understanding of GAAP, would it be better or worse to omit an investment loss than investment income? Explain. 970 Exercise 15-1 Non-strategic investments LO3 CHECK FIGURE: Dec. 31, 2017 Fair value adjustment to profit - $7,500 Prepare entries to record the following non-strategic investment transactions of Ace Investment Corporation 2017 Paid $60,980 to purchase a $60,000 two-year, 7% bond payable of Chrystal Corporation dated March 1. Interest is paid quarterly beginning June 1. Management intends to hold the bonds for the duration of their contract life. Mar 1 Apr. 16 Bought 2,000 common shares of Windsor Motors at $25.50. Paid $38,968 to purchase a five-year, 4.5%, $40,000 bond payable of Bates Corporation. Interest is paid annually each April 30. May 2 Received a cheque from Chrystal Corporation regarding quarterly interest. Windsor Motors' board of directors declared a dividend of $0.75 per share to shareholders of record on August 10, payable August 15 June 1 1 Aug. Received the Windsor Motors dividend. 15 Received a cheque from Chrystal Corporation regarding quarterly interest Sept 1 Purchased 25,000 Delta Inc. common shares at $3.20 17 Sold the Windsor Motors shares at $31.00. Received a cheque from Chrystal Corporation regarding quarterly interest. Oct 20 1 Dec. Sold the Chrystal Corporation bond at 101. 1 Accrued interest on the Bates bond. The fair value of the equity security on this date was Delta, $3.50. The 31 carrying value equalled the fair value for the Bates bond. 2018 30 Received a cheque from Bates Corporation regarding annual interest. Apr. Analysis Component If the fair value adjusting entry on December 31, 2017, were not recorded, what would the effect be on the income statement and balance sheet? Based on your understanding of GAAP, would it be better or worse to omit an investment loss than investment income? Explain. 970