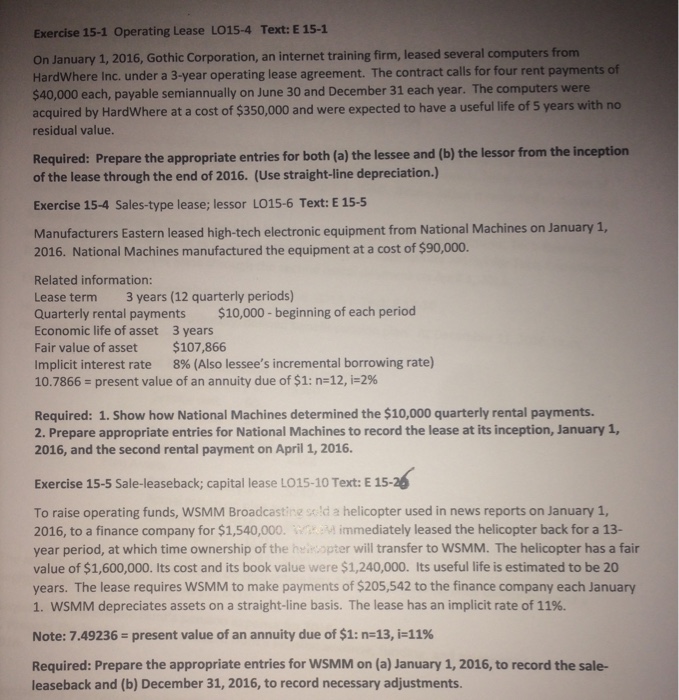

Exercise 15-1 Operating Lease LO15-4 Text: E 15-1 On January 1, 2016, Gothic Corporation, an internet training firm, leased several computers HardWhere Inc. under a 3-year operating lease agreement. The contract calls for four rent payments of $40,000 each, payable semiannually on June 30 and December 31 each year. The computers were acquired by HardWhere at a cost of $350,000 and were expected to have a useful life of 5 years with no residual value. rom Required: Prepare the appropriate entries for both (a) the lessee and (b) the lessor from the inception of the lease through the end of 2016. (Use straight-line depreciation.) Exercise 15-4 Sales-type lease; lessor L015-6 Text: E 15-5 Manufacturers Eastern leased high-tech electronic equipment from National Machines on January 1 2016. National Machines manufactured the equipment at a cost of $90,000 Related information: Lease term 3 years (12 quarterly periods) Quarterly rental payments $10,000- beginning of each period Economic life of asset 3 years Fair value of asset $107,866 Implicit interest rate 8% (Also lessee's incremental borrowing rate) 10.7866 = present value of an annuity due of $1: n=12, i-2% Required: 1. Show how National Machines determined the $10,000 quarterly rental payments. 2. Prepare appropriate entries for National Machines to record the lease at its inception, January 1, 2016, and the second rental payment on April 1, 2016. Exercise 15-5 Sale-leaseback; capital lease LO15-10 Text: E 15- To raise operating funds, WSMM Broadcasting seld a helicopter used in news reports on January 1, 2016, to a finance company for $1,540,000. immediately leased the helicopter back for a 13- year period, at which time ownership of the heiropter will transfer to WSMM. The helicopter has a fair value of $1,600,000. Its cost and its book value were $1,240,000. Its useful life is estimated to be 20 years. The lease requires WSMM to make payments of $205,542 to the finance company each January 1. wsMM depreciates assets on a straight-line basis. The lease has an implicit rate of 11%. Note: 7.49236-present value of an annuity due of $1:n:13, i=11% Required: Prepare the appropriate entries for WSMM on (a) January 1, 2016, to record the sale- leaseback and (b) December 31, 2016, to record necessary adjustments