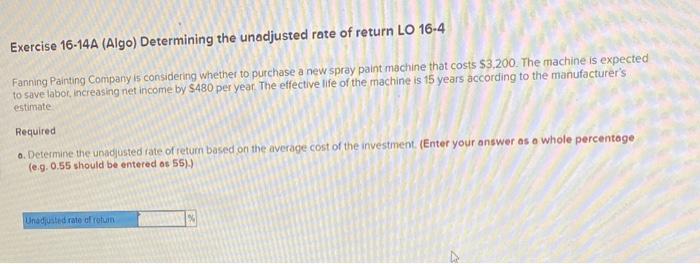

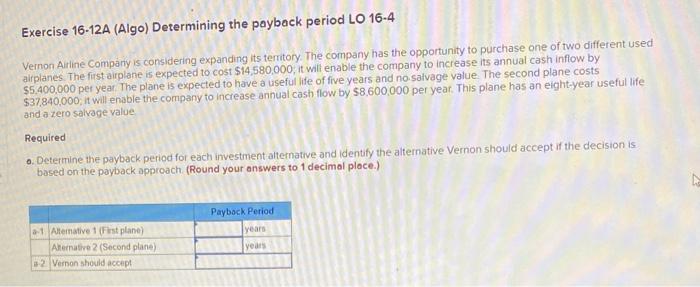

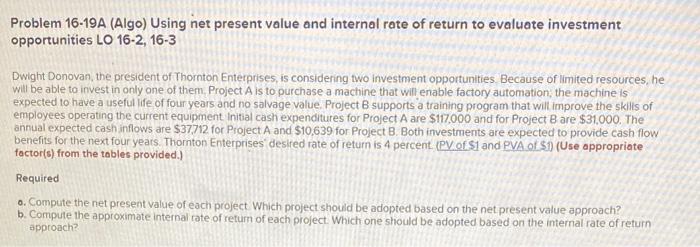

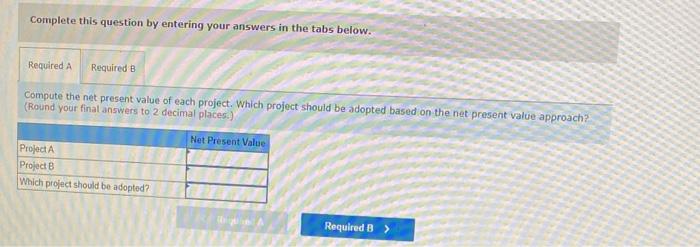

Exercise 16-14A (Algo) Determining the unadjusted rate of return LO 164 Fanning Painting Company is considering whether to purchase a new spray paint machine that costs $3,200. The machine is expected to save labor, increasing net income by $480 per year. The effective life of the machine is 15 years according to the manufacturer's estimate Required a. Determine the unadjusted fate of return based on the average cost of the investment. (Enter your answer as a whole percentage (e.9. 0.55 should be entered os 55) ) Exercise 16-12A (Algo) Determining the payback period LO 16.4 Vernon Airtine Company is considering expanding its temitory. The company has the opportunity to purchase one of two different used airplanes. The first airplane is expected to cost $14,580,000, it wilt enable the company to increase its annual cash inflow by $5,400,000 per year. The plane is expected to have a useful life of five years and no. saivage value. The second plane costs $37,840,000; it will enable the company to increase annual casin flow by $8,600,000 per year. This plane has an eight-year useful life and a zero salvage value Required o. Determine the payback period for each investment alternative and identify the alternative Vernon should accept if the decision is based on the payback approach. (Round your answers to 1 decimal place.) Problem 16-19A (Algo) Using net present value and internal rate of return to evaluate investment opportunities LO 162,163 Dwight Donovan, the president of Thornton Enterprises, is considering two investment opportunities. Because of limited resources, he will be able to invest in only one of them. Project A is to purchase a machine that will enable factory automation; the machine is expected to have a useful life of four years and no salvage value. Project B supports a training program that will improve the skills of employees operating the current equipment Initial cash expenditures for Project A are $117,000 and for Project B are $31,000. The annual expected cash inflows are $37,712 for Project A and $10,639 for Project B. Both investments are expected to provide cash flow benefits for the next four years. Thornton Enterprises desifed rate of return is 4 percent. (PV of S1 and PVA of \$1) (Use appropriate foctor(s) from the tables provided.) Required 0. Compute the net present value of each project Which project should be adopted based on the net present value approach? b. Compute the approximate internal tate of return of each project. Which one should be adopted based on the internal rate of return approach? Complete this question by entering your answers in the tabs below. Compute the net present value of each project. Which project should be adopted based on the net present value approach? (Round your final answers to 2 decimal places.)